“How Much Life Insurance Do I Need?”: Your guide to expert answers for a protected life

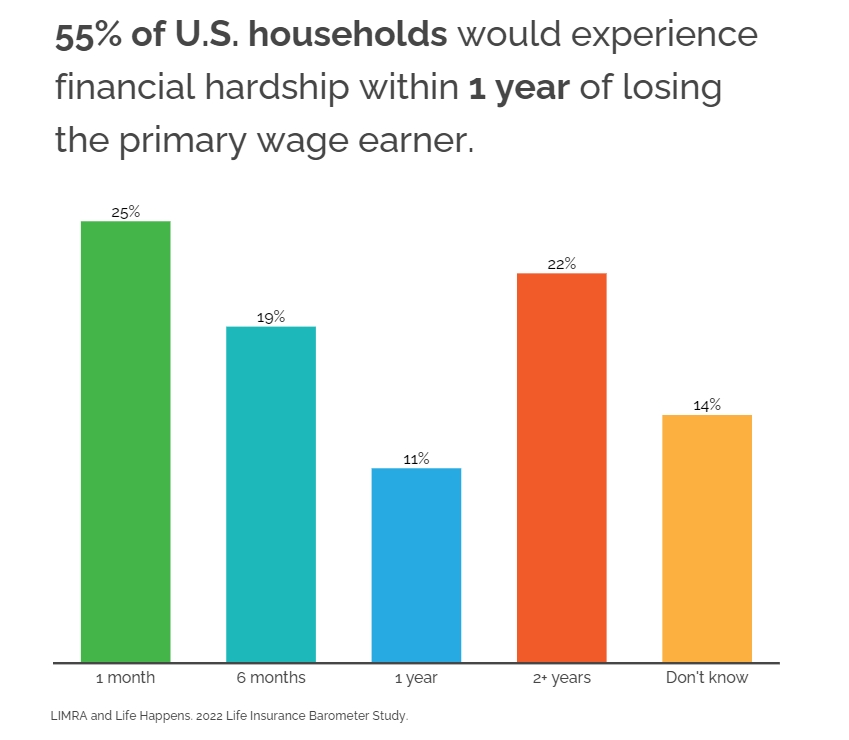

Do you know how long it takes for your loved ones to experience financial hardship if you passed away?

55% of Americans would experience financial insecurity in a year or less after losing a primary wage earner.1

The tragedy of losing a spouse or parent is tremendous, and the fact that 67,980,000 families would be in a financial crisis just one year after such an event reveals a massive threat to our nation’s well-being.†

Life insurance is a key element in feeling—and being—financially secure. Among insureds with financial dependents, 68% feel secure, compared with 47% of non-insureds.1

Consumers with overlapping sources of coverage—employer and individual—have the highest likelihood of feeling secure.1

Given the importance of life insurance but the intricate details surrounding a product many are unfamiliar with, our financial professionals have compiled a list of commonly asked questions and their answers to help you navigate your decision.

†Based on 122,354,219 U.S. households according to U.S. Census Bureau3 data as of 2020, and the LIMRA study1 that 55% of households would face financial hardship in one year of losing the primary wage earner.

Decisions about your family’s future are too important to leave up to a robot.

No amount of online research truly take the place of sitting down with someone who can hear your story and make recommendations based on your family, not a statistic.

If you don’t find the answers you’re looking for below, you may want to connect with a local financial professional for a personal conversation.

Table of contents

- Is life insurance expensive?

- Do I need life insurance as a young adult?

- Do single people need life insurance?

- Does my spouse need life insurance if they are not the primary wage earner?

- Can I just use my life insurance through my employer?

- How much life insurance do I need?

- Is it wise to buy life insurance online?

- What’s the difference between term and permanent life insurance?

- What does the life insurance application process look like?

- What is underwriting?

- How often should I change my life insurance coverage?

Is life insurance expensive?

Life insurance policies come at many price points depending on your age, gender, health, and the type of insurance, yet 50% of people overestimate the cost of term life insurance.2

“Most people can afford some level of life insurance. Young parents on a budget can likely protect their families for less than $10/month.”

–Chris Sitek, CLTC®, CASL®, CLU®, ChFC®, RHU®, REBC®,

Vice President Life and Long-Term Care

There are three ways to secure more affordable life insurance:

- Take out a life insurance policy while you’re young

- Choose a term life insurance policy that covers your needs

- Ask an independent agent to check rates at multiple insurance providers

You can use a variety of online calculators to give you an idea of what your cost might be per month, but ultimately, a conversation with a trusted financial professional is the best way to find coverage that meets the goals you have for your family while managing your budget.

Do I need life insurance as a young adult?

It’s great that you are young and healthy! This means your monthly life insurance premium is likely as low as it will be in your life, and you can lock in protection at a low rate through a suitable term life policy.

Your financial professional can help you explore riders and features on your policy that will lock in future insurability and convertibility to make protection extremely affordable while you are building in your career.

Keep in mind riders and additional features are available at additional costs.

The average 30-year-old can save $450 per year on a $1 million 30-year term life policy compared to waiting until they are 40 to buy life insurance.2

Do single people need life insurance?

Even if you don’t have dependents, life insurance can play a role in your overall financial plan.

First, it can cover funeral expenses or debt payment for your surviving relatives.

Second, securing the policy sooner rather than later helps you lock in an affordable rate that you can keep if or when you add to your family.

Finally, you can utilize life insurance as a tax-favored wealth accumulation tool that could also have asset protection provisions as well.

Financial professionals do not provide tax, mortgage, real estate or legal advice. You should always consult a tax or legal professional for advice regarding your specific tax and/or legal situation.

Does my spouse need a life insurance policy if they are not the primary wage earner?

No matter your income level, life insurance could help prepare you if something happened to your spouse, regardless of if they have an income.

The loss of a stay-at-home parent can have a drastic effect on the overall financial well-being of your family. Childcare and household management are just a few of the main needs that open up if one parent passes away.

Additionally, life insurance can provide a financial cushion for the surviving spouse that allows them to handle the emotional loss and take time off work as needed to mourn and adjust to a new way of life.

Can I just use my life insurance through my employer?

Life insurance is a great benefit if your employer offers it! However, an employer policy is best utilized with an individual policy to supplement your coverage. This is because employer policies do not always cover your entire life insurance need, and they are not always portable if you were to leave that employer.

As you are evaluating how your employer’s life insurance option fits into your overall plan, be sure to ask the following questions:

- What amount of coverage can you get without an exam?

- With an exam, what is your max amount of supplemental coverage?

- Do you know the portability privileges of the of this life insurance coverage?

- Does the policy have inflation protection?

- Will they give you more as you get promoted?

If you are looking to get supplemental coverage with your employer, you may only get standard rates or be subject to underwriting.

A financial professional can help you evaluate your life insurance benefit and coordinate it within your overall risk management and financial strategy.

RELATED: Why you should look at your employer’s disability benefits more seriously

How much life insurance do I need?

Your life insurance face amount—or death benefit—should fill the economic gap you’d leave in your family.

Face amount is what is paid out to your beneficiaries if you pass away.

The amount of life insurance you’ll potentially need will depend completely on your individual situation. You can begin with calculating human life value, performing a needs-based analysis, or following general rules such as 5-7 times your income or $1 million in coverage for every $40,000 of annual income family.

Ultimately, though, you’ll want to consider a number of these factors and a candid conversation with your financial professional when making this decision.

Human life value is calculated by how much income the individual brings in to the household and what gap would need to be filled if that income went away.

The factors that affect life insurance needs are:

- Your age

- Your annual income

- Your loved ones’ needs (childcare expenses and living expenses)

- Your outstanding debt

- Long-term goals for your family

- Other investments and assets

Your financial professional can help you discern how different life insurance policies fit into your overall financial picture.

TOOL: Calculate your life insurance needs

Is it wise to buy life insurance online?

We have come to expect a seamless process when purchasing a product or service, and using an online service for your life insurance may seem like a convenient alternative to the traditional insurance sales process.

These tools promise fast, convenient service, and you can do it all on your phone!

However, if you have health issues that may make it hard for you to find affordable coverage, you may consider talking with an insurance expert who can help you navigate those challenges.

A financial professional can also guide you through the underwriting process, keeping the insurance provider on track to ensure your policy is approved in a timely manner.

Likewise, if you are looking for a whole life or universal life policy, you likely won’t be able to secure one online, and you will want to work with a financial professional or life insurance expert to determine the best solution for you.

How to avoid bad actors in the life insurance business

Some people are drawn to an online life insurance quote because it helps them avoid becoming the next victim of an agent who cares more about a big sale than financial wellness.

However, relying solely on online insurance platforms may mean you lose the benefit of human-centric advice and support.

Rather than eliminating a financial professional entirely, do your research to find one you trust. Ask a friend for a recommendation, meet with them for an initial consultation, and check their compliance records. If something feels off, move on. There are thousands of great financial professionals out there with the right intentions!

What’s the difference between term and permanent life insurance?

Term insurance is like renting—a temporary solution for a temporary issue with an affordable premium.

Common term life insurance plans last 10, 20, or 30 years at which point they expire. Most people outlive the term but had the use of the policy along the way.

Permanent insurance is like owning. You build equity and the owner has more control. If structured correctly, permanent insurance will result in money being paid to the beneficiaries 100% of the time, due to the inevitable fact that everyone dies.

RELATED: Think you know everything about permanent life insurance and taxes? The rules just changed.

Policy loans and withdrawals may create an adverse tax result in the event of lapse or policy surrender and will reduce both the surrender value and death benefit. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods. Please keep in mind that primary reason to purchase life insurance is the death benefit.

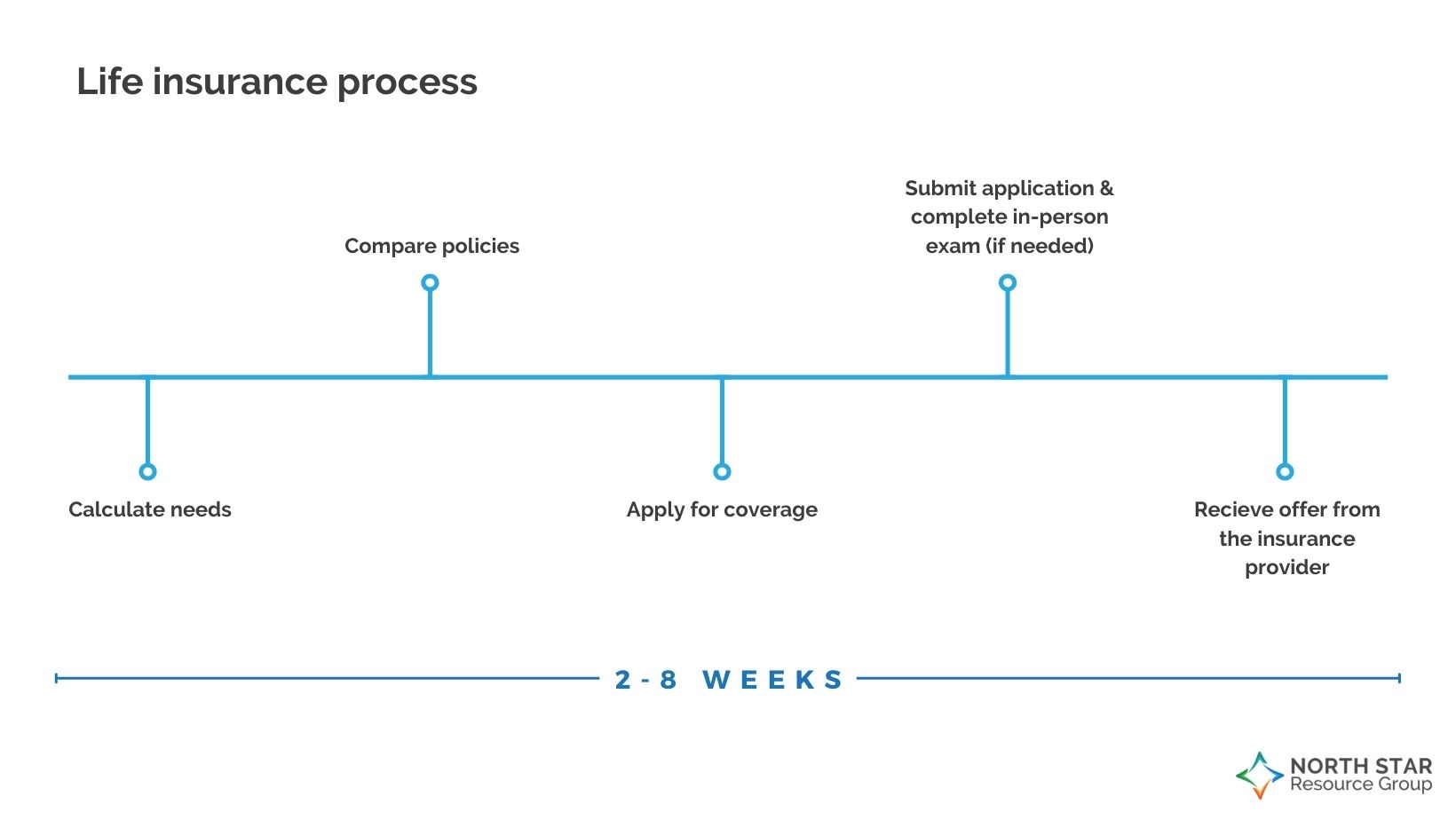

What does the life insurance application process look like?

The application process will depend upon where you’re purchasing your policy.

For those offered a life insurance policy through their employer, the process could be quick, with little to be done on the part of the employee.

For those applying for life insurance coverage elsewhere (either to supplement your coverage through work or just on your own), the process can require a few extra steps.

First, a financial professional can help you sort through your options and select the life insurance company and policy most appropriate for you.

Then, you’ll apply for coverage, giving basic personal and health information. Next, you may be asked to answer some questions about your medical history and perhaps complete an in-person physical exam at your convenience.

Lastly, the insurance company will review all these parts and let you know if they can offer you a policy.

The entire process can take anywhere from two to eight weeks depending on the underwriting process.

What is underwriting?

Underwriting is the process that insurance companies use to determine whether they can ensure the applicant by researching and assessing the risk they present. The process determines how much coverage they will issue and at what cost to the applicant.

What is simplified underwriting?

Some life insurance policies, usually offering more limited coverage, allow for a simplified underwriting process, sometimes called “no exam life insurance.”

With simplified underwriting, you provide your medical information but are not required to do a medical exam—some don’t even require a blood test!

When deciding if a simplified underwriting process may be right for you, discuss the following pros and cons with your financial advisor and how they apply to your situation:

| Pros | Cons |

|---|---|

| No medical exam and a limited number of application questions | Might have a graded death benefit, meaning if the insured dies within the waiting period, the beneficiaries receive a portion of the policy’s full death benefit—that portion increases over time |

| Higher coverage amounts available compared to guaranteed issue insurance | Typically higher premiums than fully underwritten policies |

| Faster way to get coverage | Lower coverage amounts than traditional life insurance policies, such as regular term life insurance |

How often should I change my life insurance coverage?

Some insurance providers recommend you reevaluate your life insurance annually, especially when you fit it into your end-of-year financial check-in.

However, you will also want to check in with your policies to adjust the death benefit or beneficiaries during some key life changes:

Marriage

If you didn’t have a life insurance policy while you were single, now is a great time to get one. If you did have a policy, review whether you still have enough coverage and consider adding your spouse as a beneficiary.

RELATED: Financial considerations for getting married

Your family is growing

Kids add a whole new level of responsibility to your life, especially when you think about how they will be cared for if you aren’t around. You will want to make sure you are comfortable with the amount of life insurance to support each child and ensure each one is added to your beneficiaries.

RELATED: Financial considerations for growing your family

You got a raise

In most cases, when your pay increases, your lifestyle costs increase as well.

Evaluating your life insurance and potentially increasing your coverage ensures your loved ones won’t need to scale back this lifestyle—sell the house, switch out of private school, or any other major shift due to finances—should something happen to you and your income.

You took a new job

If you had any amount of life insurance through your employer, changing organizations may affect this coverage. Consider if you need to add to your supplemental individual life policy.

You’re retiring

In most cases, life insurance is meant to provide financially for your family if your income goes away. If your spouse can comfortably live off your retirement savings and you no longer have any dependents at home, you may have outgrown the need for term life insurance.

If you are using permanent life insurance or hybrid life and long-term-care insurance as an investment strategy, it is best to talk to your financial professional if any shifts are needed as you enter retirement years.

RELATED: Financial considerations for retirement

What if I have more questions about life insurance?

Your life insurance policy should fit seamlessly into your financial strategy, supporting and aligning with your life and goals. Hitting this target requires asking the right questions and getting researched, impartial answers.

No amount of Googling can replace the clarity that comes from sitting down with a goals-based financial professional. You can book a meeting with one today!

Get more financial wellness tips in your inbox!

1LIMRA and Life Happens. 2022 Life Insurance Barometer Study.

2Gusner, P. (2022, August 16). Average life insurance rates of 2022. Forbes.

3U.S. Census Bureau quickfacts: United States. (n.d.). Retrieved August 26, 2022, from https://www.census.gov/quickfacts/fact/table/US/HSD410220

**Please keep in mind that the primary reason to purchase a life insurance product is the death benefit.

Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.

Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.