How to calculate net worth and why it matters

How do you measure financial success?

Often, we look to income to measure financial stability. However, while annual income often indicates one’s financial potential, it doesn’t always show the whole picture.

This has been especially evident in recent years when record inflation took its toll and reports showed that as many as one-third of the nation’s top earners were living paycheck to paycheck.1

RELATED: The impact of inflation on your financial goals

Even among high earners, income never gives the full picture. After all, no one gets to keep every dollar they make. Likewise, as we invest, the value of our assets can increase or decrease depending on the markets and the risk-to-reward balance in our portfolio.

Net worth provides a more complete picture of where you stand financially.

Your net worth accounts for your complete financial life—all your assets minus all your liabilities—allowing you to track wealth over time.

In this guide, we’ll explore what net worth is, how to calculate it, why it’s essential, and how to protect it.

What is net worth?

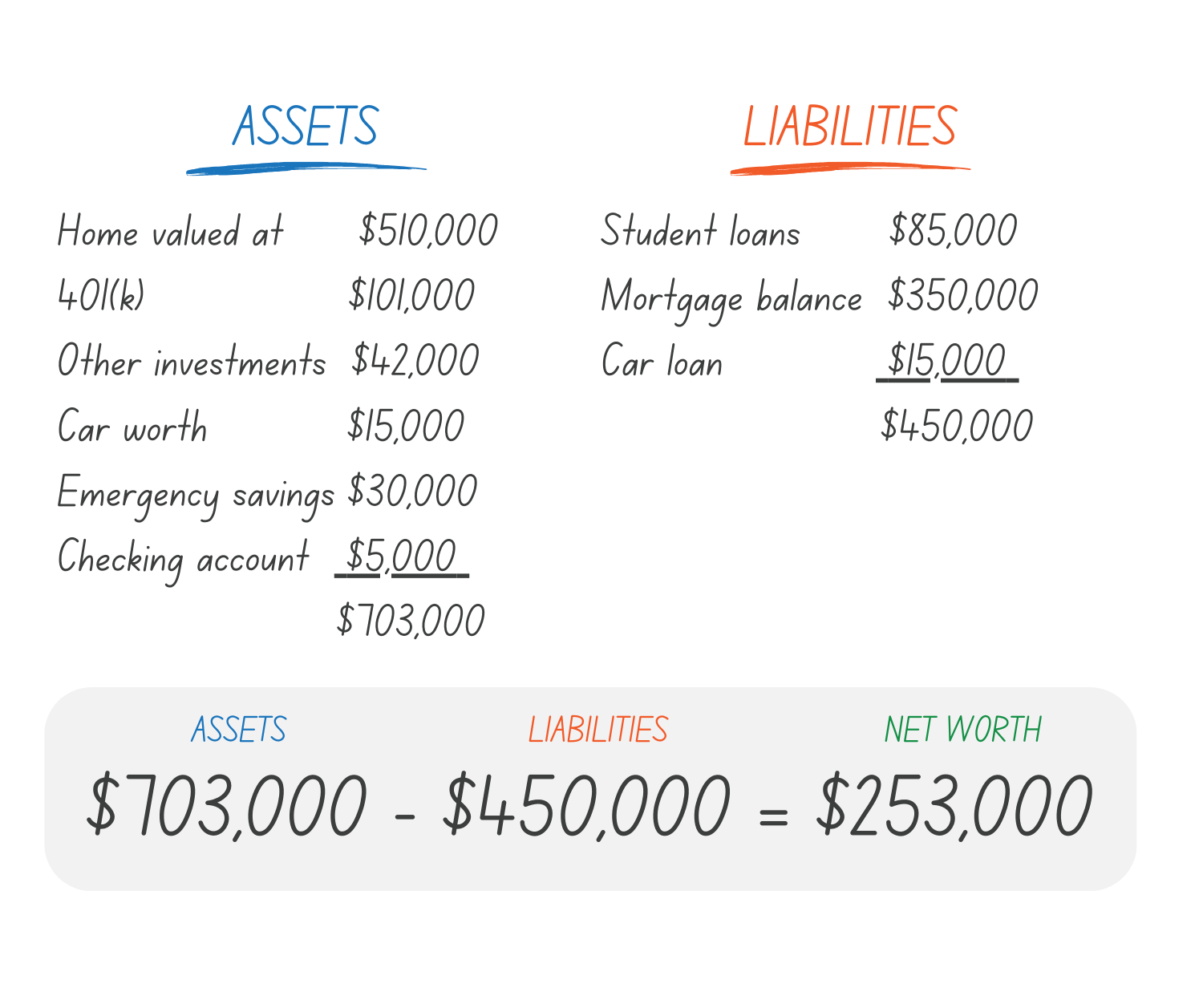

Net worth is the essence of your financial standing—it’s the difference between what you own versus was you owe, or your assets minus your liabilities.

Assets include everything you own that has monetary value, such as cash, investments, real estate, and personal property. Liabilities, on the other hand, are your financial obligations, such as loans, mortgages, credit card balances, and other debts.

Calculating your net worth

To calculate your net worth, start by listing all your assets and their corresponding values. This can include:

- Cash in savings and checking accounts

- Investments such as stocks, bonds, and retirement accounts (401(k), IRA, etc.)

- Real estate properties (primary residence, rental properties, etc.)

- Personal property (vehicles, jewelry, artwork, etc.)

Next, list all your liabilities, including:

- Mortgage(s)

- Auto loans

- Student loans

- Credit card debt

- Other loans or financial obligations

Once you have your list of assets and liabilities, subtract the total liabilities from the total assets. The resulting number is your net worth.

How to calculate net worth

Net worth = assets – liabilities

RELATED: Net worth calculator

Why net worth matters

Whether you’re a high earner looking to build wealth or someone who has already accumulated assets, knowing your net worth provides valuable insight for your continued financial journey:

Financial awareness

Calculating your net worth provides a clear snapshot of your current financial situation. For some, it can provide a sense of security to know that their financial picture is more than just one balance in one investment account.

For others, especially those with high incomes yet high debt, this exercise can remind them to prioritize long-term goals over comparison or lifestyle creep.

Having the information on your current financial standing then allows you to identify areas for improvement.

Goal setting

By assessing your current financial position, you can begin to see where you want to make changes to affect either side of the net worth equation—either increasing total assets through investing or decreasing your liabilities by paying down debt.

Then, knowing your net worth helps you track how each of these actions influences the bottom line of your financial life.

Debt management

As you look at the liability side of your net worth equation, it will become clear which debts are having the highest impact on your overall finances. This can help you prioritize debt repayment and develop a strategy to reduce your loan balances over time and move into a positive net worth and wealth building phase of your life.

Cash flow management

Many high-income earners express frustration that they make too much to feel as financially unorganized and strained as they do. Often, this is because they do not truly understand how their debt and assets balance in their net worth.

By analyzing your assets and liabilities, you can identify areas where cash outflows exceed inflows, pinpointing payments that are draining your account. This awareness allows you to prioritize expenses, cut unnecessary costs, and reallocate funds towards savings or investments.

Asset allocation

The key to successful investing is balancing risk and reward by diversifying where you hold your assets.

When you list out all your asset holdings to calculate your net worth, you may discover some areas are weightier than others. Your financial advisor could recommend reallocating some of your wealth to mitigate against market risks or tax liabilities down the road, both of which can erode your net returns or impact distribution in retirement or estate planning.

Estate planning

Knowing your net worth is the crucial first step for estate planning purposes.

Even for those who don’t think they own enough to warrant a proper estate plan, a net worth summary can reveal notable assets that should be accounted for in your passing.

Additionally, if you do have a more sizeable estate, understanding the full picture of both the assets and liabilities in your finances can help you parse out the complexity of your situation. Then, you and your financial advisor, in coordination with your estate planning attorney, can determine how your assets will be distributed upon your death and ensure your beneficiaries are taken care of according to your wishes.

RELATED: 5 considerations for values-based estate planning

Protecting your net worth with insurance

As you list your primary assets and your largest liabilities, you should also consider if you have the insurance needed to keep your net worth intact. Without the proper protections in place, the progress you’ve made could be unraveled in a single emergency or disaster situation.

Every risk management strategy should include a few primary pieces:

Income protection

While income is not the indicator of financial health, it is the fuel that powers your financial goals and ambitions, making it your number one priority for insuring against death or disability.

Disability insurance helps you protect your income for you, in the case of a disability event or illness. While many employers offer this as a benefit, you should also consider a supplemental policy, especially if you have a high debt balance or monthly expenses you can’t cover on only a portion of your salary.

RELATED: Understanding disability insurance: types, benefits, and options

Life insurance helps protect your loved ones if anything happens to you. The death benefit is paid to your beneficiaries—spouse, partner, children, or parents—to help cover your liabilities (private student loans, credit card debt, mortgage, etc.) as well as any current lifestyle needs or long-term goals (education, retirement, etc.) that will be harder to cover without your income.

Physical asset protection

Proper home and auto insurance—and in some cases umbrella insurance—are essential components of protecting your net worth. These insurance policies provide financial safeguards against unexpected events such as accidents, natural disasters, or liability claims.

Without adequate coverage, a single incident could potentially devastate your financial stability and eat away the wealth you’ve worked hard to build.

Tracking your net worth over time

From knowing your financial standing and setting goals to passing down a financial legacy, a financial advisor can help guide and encourage you through this process. They will even help you prioritize which actions you should take and in what order to propel and protect your net worth in the most efficient way possible.

What’s more, a financial advisor will reevaluate your net worth over time and deliver reports on your progress. This accountability becomes essential for wealth builders with a long-term perspective. It allows you to see the big picture, rather than getting caught up in the snapshots of your life.

Whether it’s a market dip or life circumstances causing spending to increase, even financial upswings that could derail your balanced long-term strategy—a financial advisor can provide the outside perspective to help you stay the course.

Understanding your net worth is a fundamental aspect of personal finance, regardless of your current financial status.

Early in your financial journey, calculating net worth provides a roadmap for financial success, helping you set goals, manage debt, and build wealth over time.

For established wealth builders, tracking net worth ensures proper asset management, estate planning, and the preservation of your financial legacy.

By taking the time to calculate and monitor your net worth regularly, you can achieve greater financial clarity and confidence for yourself and your loved ones.

Get more financial wellness tips in your inbox!

1PYMNTS Intelligence. (February 2024). New Reality Check: The Paycheck-to-Paycheck Report.