The complete guide to preparing for retirement for every stage of life

Retirement is continually the top financial concern for Americans.1 Unfortunately, this worry doesn’t always translate to action.

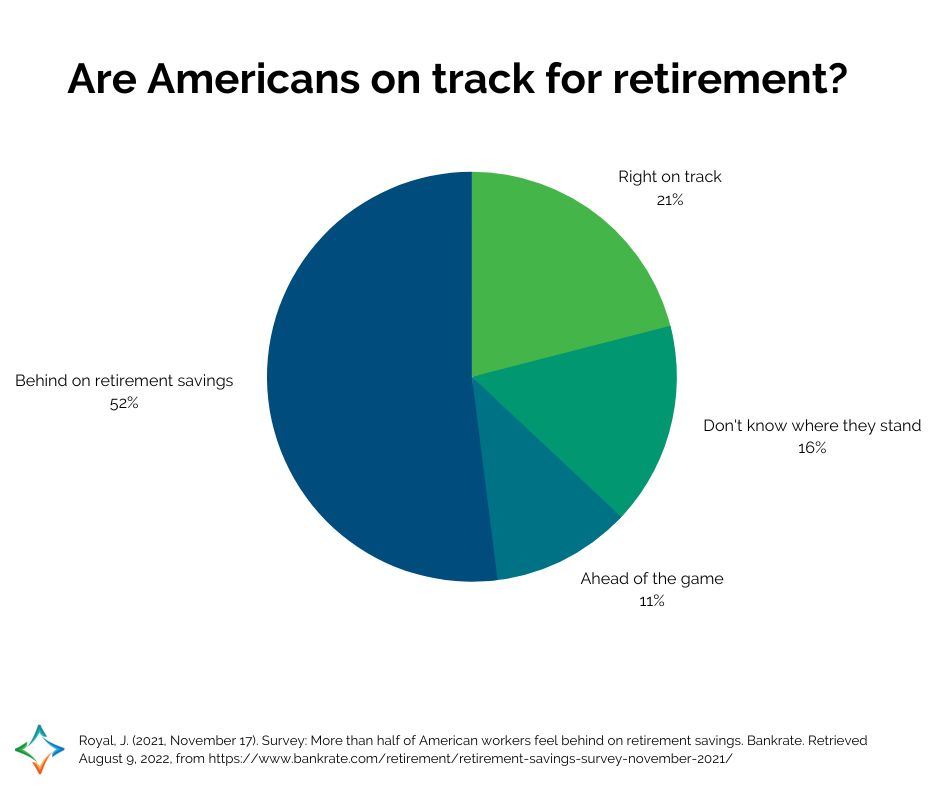

A full 52% of American workers say their retirement savings are not where they need to be, and a further 16% are not sure whether they’re on track.2

This data can be discouraging, but it shouldn’t be terribly surprising. Human brains simply aren’t designed for long-term thinking.

MRIs have shown that our brains think of our future selves as entirely different people, and only 35% of people say they think about the future at all once a week.3

of Americans name not having enough money for retirement as their top financial concern.

Source: Saad, L. (2022, May 16). Americans’ financial worries tick up in past year. Gallup.com.

The future is abstract to us. We don’t relate to that future self, and it is easy to rationalize that we’ll solve that problem when we get to it.

To succeed with retirement savings, you need to make it immediate and tangible for your current self. You need actionable goals at each stage of the financial journey to keep you motivated and on track for the future you desire.

With the help of a smart financial professional and solid cash flow management, you can make moves toward confidence in your retirement strategy at any stage of life:

Table of contents

- Retirement savings in your 20s

- Retirement savings in your 30s

- Retirement savings in your 40s

- Retirement savings in your 50s

- Retirement savings in your 60s and beyond

Types of Retirement Plans

Before diving into saving strategies for different life stages, let’s look at the different types of accounts you could invest in:

- IRA (Individual Retirement Account): A tax-advantaged investing tool that individuals use to earmark funds for retirement savings

- 401(k): Employer-sponsored retirement account offered by corporations

- SEP IRA (Simplified Employee Pension): For self-employed individuals or small business owners

- SIMPLE IRA (Savings Incentive Match Plan for Employees): May be set up by employers with less than 100 employees

- 403(b): Employer-sponsored retirement account offered by public schools, certain tax-exempt organizations, nonprofits and hospitals

- 457: Employer-sponsored retirement accounts offered by state or local governments and certain non-governmental employers

And next, how that money goes in and out of the account:

Traditional: Contributions are made before tax but withdraws in the future are subject to ordinary income taxes. Examples include Traditional IRAs and most types of employer-sponsored plans.

Roth: This account feature means you make contributions after tax, and then future withdrawals are tax free on the conditions the account is held for at least five years and you are age 59 ½ or older. Examples include Roth IRAs and Roth 401(k)s.

TOOLS: Compare a Roth 401(k) to a Traditional 401(k)

Your financial professional may recommend a different retirement account based on life stage, current tax bracket and estimated retirement tax rate, employer match options, and other factors unique to you.

Regardless of the account you choose, what matters most is getting started, with dedicated savers being the most likely to be on target for retirement.4

Retirement savings in your 20s

While retirement may be far off in your 20s, saving for it shouldn’t be.

As soon as you graduate and start earning a regular income, you should consider working with a financial advisor to organize your investments and retirement savings.

Create a budget and stick to it

Managing, prioritizing, and spending below your means are key habits to establish now before lifestyle creep takes over.

Lifestyle creep occurs when an individual’s standard of living improves as their discretionary income rises and former luxuries become new necessities.

Uncontrolled, lifestyle creep can lead to a low net worth, even with a high income because your cash flow management is off kilter.

Start by making a budget and disciplining yourself to stick to it. Remember, a budget doesn’t need to feel restrictive, as it’s only a strategy for being intentional with your money. Even the ultra-wealthy “budget” in the form of cash flow management.

RELATED: What NOT to do when creating a budget

Start saving to take advantage of compound interest

Making savings a habit now means you’ll benefit from compound interest and make more for your money over time.

With the recommendation of your financial professional, get started by saving for retirement in a 401(k), IRA or another investment account. Your financial professional can also explain and educate you on different types of accounts and their characteristics and help you align your investing strategy with your other financial goals.

Gen Z (born 1997 to 2012) is putting away more than previous generations for retirement and has a greater understanding of things such as target date funds. This focus on starting early will serve the generation most interest in retiring early and most likely to experience a long lifespan.

Source: The 2022 BlackRock Read on Retirement. BlackRock. (n.d.).

If your employer offers an employee benefits package, understand your options and make the most of what is available to you. Many employers offer a matching program up to a set percentage of contributions. Even a small monthly contribution from your paycheck will build on interest in the years between now and retirement.

RELATED: Compound Interest: What It Is and How It Works

Work with a financial professional to help balance your financial priorities

Bringing professional guidance into your retirement strategy can provide insight, expertise, and accountability when you need it most.

Your financial professional can help you identify whether the options offered through your employer are sufficient for you or if an additional product is recommended.

Retirement savings in your 30s

As your income increases or you start paying off some loans and debt, resist the temptation to channel all those new available funds into lifestyle changes. Instead, consider if you would be better off bolstering your retirement funds.

Give your savings a raise when you get one

The typical pay raise in America is 3% annually.5 What would happen if you a portion of that increase toward your retirement every year?

Many employer retirement plans allow you to opt-in to a 1% increase to your retirement contribution annually, and this is a highly effective solution for the long term.

While 1% doesn’t seem like an impactful increase, that is exactly what can make it so effective. Upping your contributing 1% will not significantly impact your lifestyle, especially when paired with a cost-of-living or performance-based raise; however, over the course of your career, those small changes will add up into large results.

Consider diversifying your investments

Your 30s are also a good time to start exploring investing beyond your employer plan.

When a financial professional says you need a balanced investing strategy, they are usually referring to balance in account types and investment products.

Investment accounts are where you invest (IRA, 401(k), 403(b), Health Savings Account, etc.), and a product is how you invest within those accounts (stocks, bonds, CDs, mutual funds, ETFs, etc.). Typically, you will have several options of products within a specific account.

Diversifying your investing portfolio can help you spread risk and maximize growth across accounts. With a diverse product mix of stocks, mutual funds, ETFs, and more, those dips and peaks should balance out and result in an overall upward motion of your investment total.

Keep in mind, neither asset allocation nor diversification guarantee against loss. They are methods used to manage risk.

Look into your insurance policies

Retirement isn’t only about investing for potential; a solid strategy should include insuring for adversity.

As your finances become more complex—whether through a growing family or building a business—protecting your income and assets through insurance solutions becomes an essential element to retirement planning.

Life insurance 🡢 |

Business insurance solutions 🡢 |

Disability insurance 🡢 |

Property and casualty insurance 🡢 |

How much should I contribute to my retirement annually?

Typically, financial experts will tell you to contribute 15% of your annual income to retirement.

However, typical advice isn’t always helpful. Your specific path to retirement should account for when you started saving, your income throughout your career, other assets such as real estate and other alternative investments, and your expectations for retirement.

We recommend starting with a retirement calculator to determine if you are on track, then sitting down with a financial professional to talk through the results based on your current lifestyle and your future goals.

Retirement savings in your 40s

At the height of your earning years, you may find yourself with a cash influx in your 40s, possibly for the first time since they were born!

This is a good opportunity to increase the amount you send to your retirement fund as that retirement date is getting closer.

Increase your savings commitment

Your 40s mark the start of your peak earning years, which is a good time to strengthen your commitment to saving by setting more aside.

If you are not yet maxing out your retirement contributions, you may consider increasing the percentage automatically invested to make the most of your tax-advantaged accounts.

Beyond the annual limit in retirement accounts, you can also discuss alternative investment methods with your financial professional to supplement income from your 401(k) and IRA.

Update your life insurance policy

If you purchased a term life insurance policy earlier in adulthood, you may be nearing the end of that term.

Consider converting term life insurance to permanent if other solutions are in place and cash flow allows. While deeply complex, permanent life insurance can have a place in a retirement and estate planning strategy when carefully designed, especially if you are maxing out your contributions to other accounts and still have additional cash flow.

Please keep in mind that the primary reason to purchase a life insurance product is the death benefit. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.

What is the max I can contribute to my retirement in 2022?

Each year, the IRS publishes limits on what can be contributed to each type of retirement account.

| Plan | Normal Limit | “Age 50” Catch-up Limit | “Pre-Retirement” Catch-up Limit |

|---|---|---|---|

| 457 | $20,500 | $6,500 | $20,500 |

| 401(a) | $61,000 | n/a | n/a |

| 401(k) | $20,500 | $6,500 | n/a |

| 403(b) | $20,500 | $6,500 | $15,500 lifetime cap |

| IRA | $6,000 | $1,000 | n/a |

Source: IRS. (2022). 2022 Limitations Adjusted as Provided in Section 415(d), etc.

If you find yourself with the cash flow to invest beyond these limits, a financial professional can help you determine alternative investment strategies that are tax- and growth-minded.

Retirement savings in your 50s

Now is the time to really consider retirement.

Consider scheduling a meeting with your financial professional to review what type of retirement you’re hoping for, how much you have in your retirement fund, and what your social security benefits will look like, and then determine when you will be able to retire based on these factors.

Check that your retirement contributions are on track

Review your retirement accounts on a regular basis to determine if your savings are on track and if your contributions could be increased. Keep in mind the annual limitations on contributions to 401(k)s—in 2022, employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000.(IRS)

If you have 401(k) plans with past employers, discuss with your financial professional how to best deal with these. Your options include leaving the account where it is, rolling over to your new employer, rolling over to an IRA or taking a cash distribution.

Consider decreasing your risk in investments

In your 50s, you are entering the second phase of saving: preservation.

Financial professionals typically recommend decreasing the amount of risk in your investments at this point. The clock to retirement is winding down so this is the time to consider decreasing the amount of risk you take with your investments.

Look into retirement living arrangements

If you have kids moving out, you may consider downsizing your living arrangements at this point and investing proceeds or paying cash for a smaller home.

Additionally, you’ll want to look into to your long-term care needs, potentially securing long-term care insurance or a hybrid life insurance policy to keep in-home care or other nursing services from cutting too deeply into your nest egg.

Retirement savings in your 60s and beyond

Now is the time to really solidify your retirement plans and expectations.

Maybe you choose to keep working or take on a different or less demanding role at work. You may want to spend more time at home with family or devote time volunteering.

Reflecting on your options help you more accurately prepare your financial strategy.

Determine if your savings are on track for retirement

By this point you will have either achieved a critical mass for retirement, or you won’t, requiring part-time income.

Consult with your financial professional to map out where your income will stream from throughout retirement.

Develop a spending strategy for retired living

Throughout the process, work with your financial professional to arrive at a spending strategy fit for you. Within that strategy, include any upcoming larger items, such as contributing to a grandchild’s college education, as well as increased monthly costs, such as health care and insurance before Medicare kicks in.

Regularly assessing your cash flow is necessary whether you’re still several years out from retirement, about to retire or well settled into retirement.

Talk to your financial professional about tax-efficient decumulation

Planning out the retirement decumulation strategy to be tax efficient is crucial. An IRA to Roth rollover strategy could be important to consider if appropriate for your situation.

Careful social security consideration with your financial professional is also essential; delaying withdrawals to age 70 may mean significantly more income.

What if I start saving late?

If you feel like you’re behind, you’re not alone. Rather than feeling discouraged, remember that the sooner you do start, the better you’ll be.

You may also consider these tips for making the most of your investments:

- Consider opening a Roth IRA to invest above the amount allowed in your retirement plan.

- Make sure you have adequate insurance (disability and life) protection to avoid setbacks.

- Pay attention to the amount of debt you take on and pay off before retirement.

- Consider the help of a financial professional to help make up for lost time.

Conclusion

You want to enjoy your retirement and get the most out of this phase in life.

A financial professional can help you get there with a retirement strategy personalized to you. North Star Resource Group’s 160 financial professionals are helping clients reach their retirement goals every year.

Get more financial wellness tips in your inbox!

1Saad, L. (2022, May 16). Americans’ financial worries tick up in past year. Gallup.com. Retrieved August 9, 2022, from https://news.gallup.com/poll/392432/americans-financial-worries-tick-past-year.aspx

2Royal, J. (2021, November 17). Survey: More than half of American workers feel behind on retirement savings. Bankrate. Retrieved August 9, 2022, from https://www.bankrate.com/retirement/retirement-savings-survey-november-2021/

3Ariane Resnick, C. N. C. (2022, April 21). Why are people bad at long-term planning? Verywell Mind. Retrieved August 9, 2022, from https://www.verywellmind.com/why-are-people-bad-at-long-term-planning-5225017

4Six habits of successful investors. Fidelity. (2022, April 27). Retrieved August 9, 2022, from https://www.fidelity.com/viewpoints/investing-ideas/six-habits-successful-investors

5WorldatWork Salary Budget Survey 2021-2022: Top Level Results.

6Transamerica Center for Retirement Studies. (2022, June). Emerging From the COVID-19 Pandemic: The Retirement Outlook of the Workforce.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.