How to save for a down payment on a home

Saving up for a down payment on a house can be one of the most difficult parts of the home-buying process—learn how to save up and resources to help you.

The decision to buy a home is not an easy one. Calculations and considerations all go into just the decision to purchase, rather than continue renting.

There are the financial questions: How does this fit into my overall financial outlook?

And the personal questions: Do I want the responsibility of home ownership? Where do I truly want to live?

Once you decide that, yes, you’re ready to take the leap and become a homeowner, it’s time to figure out how and precisely when you can realize that financial goal. Once you determine the size mortgage payment you can afford on a monthly basis, you will need to calculate and save for the down payment.

A down payment is the sum of money you pay upfront for your home. Usually, the down payment combined with your home loan makes up the total cost of purchasing your home.

According to studies, saving for a down payment is one of the most difficult parts of the home-buying process, increasing in difficulty for younger buyers.1

While some down payments are funded by the sale of the previous home, 61% of all down payments come from the buyer’s savings, meaning first-time buyers and those upsizing their homes are still needing to pile up cash for their purchase.

A down payment is the amount of money spent upfront to purchase a home.

The typical recommended down payment amount is 20% of the total home cost to avoid Private Mortgage Insurance (PMI).

However, 20% isn’t required, it isn’t even the norm. The median down payment amount for all home buyers, regardless of age, is 13%.1

Why put down 20%?

A down payment is not required, and each buyer’s situation will be different. However, putting as much as you are able to down upfront can carry some fairly substantial benefits:

Avoiding Private Mortgage Insurance (PMI)

PMI is required on all home purchases with a down payment under 20%, in which monthly payments, or premiums, must be paid until the borrower reaches 20% equity in the home.

Private mortgage insurance (PMI) is a type of insurance that conventional mortgage lenders require when homebuyers put down less than 20% of the home’s purchase price. PMI is designed to protect the lender in the event that the homeowner defaults on the loan.

Reducing interest costs on your loan

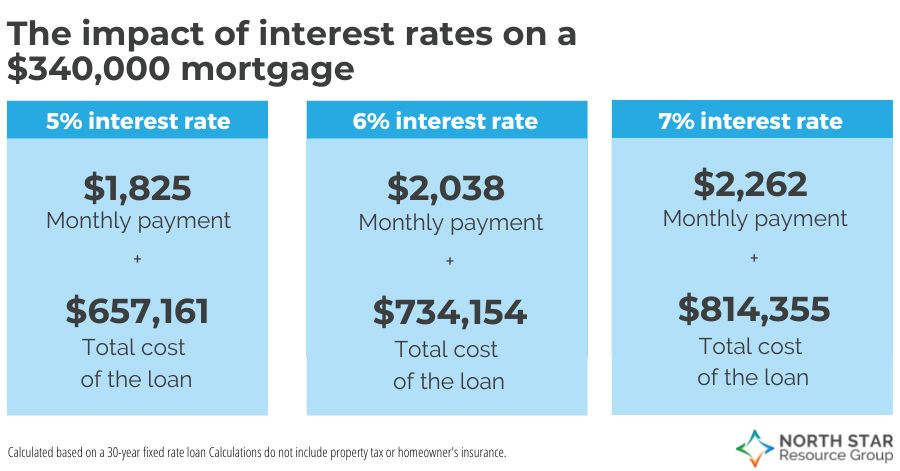

Interest rates on mortgages are affected by many factors—credit score, home location, home value, interest rate type (fixed or variable), and down payment.

In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk with a smaller loan size. Therefore, they don’t need to make up the cost of their risk through payments on interest.

On long-term loans such as mortgages, interest rates can make thousands-of-dollar differences in what paying off the loan completely will cost.

However, this doesn’t necessarily mean you should draw out your down payment savings far beyond 20%. A financial professional can help you weigh the difference between mortgage interest rates and investment rates to determine a course of action for your financial health overall.

Additionally, they can help you refinance your mortgage if interest rates change in the future.

Variable interest rate loan: The interest rate can change based on an underlying benchmark or index that periodically changes.

Fixed interest rate loan: The interest rate on the loan remains the same for the life of the loan.

Refinancing: The process of taking out a new loan with a different term or interest rate to pay off an outstanding loan.

Reducing monthly mortgage payments

The more you put down initially, the smaller the amount you will borrow from the mortgage lender and the less you will pay each month.

This comes into play as you consider how much home you can afford based on your monthly cash flow—what’s coming in and what’s going out.

is what you could save by putting down 20% on a home versus the median 13%.

Calculations based on a 30-year fixed-rate mortgage at 6.78%, including the cost of property taxes, homeowner’s insurance, and PMI (if applicable). Calculated on the North Star Mortgage Calculator.

What if you can’t get to 20%?

If 20% is not a feasible option for you, there are plenty of alternatives to help you pay a little less upfront:

- FHA loans. FHA (Federal Housing Administration) loans help to make the home-buying process more affordable for consumers. Dating back to 1934, FHA loans require as little as 3.5% down and can be a great fit for a wide variety of consumers, including first-time home buyers and/or buyers ages 62+.2 These loans do, however, require buyers to pay mortgage insurance premiums for the entire duration of the loan.

- VA loans. VA (Veterans Affairs) loans help to make purchasing a home more affordable for military buyers, from current service members to veterans to surviving spouses of deceased veterans and more. One of the only home loans available with no down payment required, a VA loan also does not require PMI, can still help you qualify for competitive interest rates, and limits certain closing costs.3

- Conventional loans. For those who may not align with the requirements of either FHA or VA loans, there are still options available to purchase a home with a smaller down payment. It is certainly possible to qualify for a conventional (meaning not government-funded) home loan with a down payment between 3% and 15%, depending on the lender.

Depending on your specific situation, another loan or program may be right for you. Talk to both your financial professional and your realtor about any other options that may be worth considering.

How can you save up for a down payment?

Saving for a large amount of money can be daunting. While it certainly requires some hard work, it’s absolutely attainable with the right mindset and time frame.

Step 1: Determine your home-buying budget

Use a mortgage calculator to determine what your dream home would cost on a monthly basis, including the variables of down payment size. Check your current housing expenses to determine if you can afford an increase and what may need to be cut from other expenses to make that possible.

Some recommend a housing budget of 30% of your total take-home pay, but the specifics vary from person to person. Having a financial professional in your corner at this stage can help you from biting off too big a mortgage or settling for something less than what you truly want and can afford.

Calculate your potential mortgage payment

Step 2: Set a goal for a down payment amount

Now, evaluate your current down payment savings and calculate the gap between where you are now and what you will need for your desired down payment.

A financial professional can help you consider which of your existing savings can be used for the home purchase while keeping your emergency account funded.

Step 3: Break down your down payment goal into monthly savings

Once you know how much you need to save, map out how long it will take you to accumulate that amount. How much do you need to save each month for your desired purchase date? Are you able to create that buffer in your budget? Do you need to extend your timeframe?

Savings for a down payment means juggling dozens of other financial priorities, including student loan repayment and retirement savings. Often, talking with a financial professional who handles all aspects of a financial life can help you decide how to allocate actual dollars toward different goals without getting tunnel vision.

Remember: Every financial goal and journey should be personalized.

While there are hundreds of millions of homeowners in the U.S.4, there is no one-size-fits-all approach to this milestone purchase.

From the type of home you buy to the amount you put down at closing, the experience should be based on you and your priorities. While a financial professional can’t provide mortgage or real estate advice, they can help provide perspective and relief through the financial aspects of the process.

Connecting with someone who knows you and your financial situation and who has your long-term financial wellness in mind is can be imperative in making this process as stress-free as possible.

Connect with one of North Star’s people-first financial professionals for financial guidance along your home-buying path.

Get more financial wellness tips in your inbox!

12022 Home Buyers and Sellers Generational Trends Report. National Association of REALTORS®.

2Let FHA Loans Help You. U.S. Department of Housing and Urban Development. Accessed November 23, 2022.

3VA Home Loan Fact Sheet. (September 2021). U.S. Department of Veterans Affairs.

4El, Sa. How Many Homeowners Are There In The U.S.? (April 11, 2022). Simply Insurance.

Financial Advisors do not provide mortgage/real estate advice and this information should not be considered as such. You should always consult your mortgage/real estate advisor regarding your own specific situation.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.