How your money mindset can affect your wealth building potential

What does it take to be successful with money? Is it something you’re born into or something you earn?

While there is no denying that your upbringing influences your likelihood of financial success—whether it’s your ability to go to college or a leg-up when buying a first home—the reality is that true potential is not dependent on outside factors alone, but on your mindset.

The overwhelming majority (79%) of millionaires in the U.S. did not receive any inheritance at all from their parents or other family members, and only 3% received an inheritance of $1 million or more.1

Even for those who do inherit their wealth, without the right financial habits and healthy mindset, they will end up wasting opportunities to grow wealth, and 70% of wealthy families lose their wealth by the next generation, with 90% losing it the generation after that.2

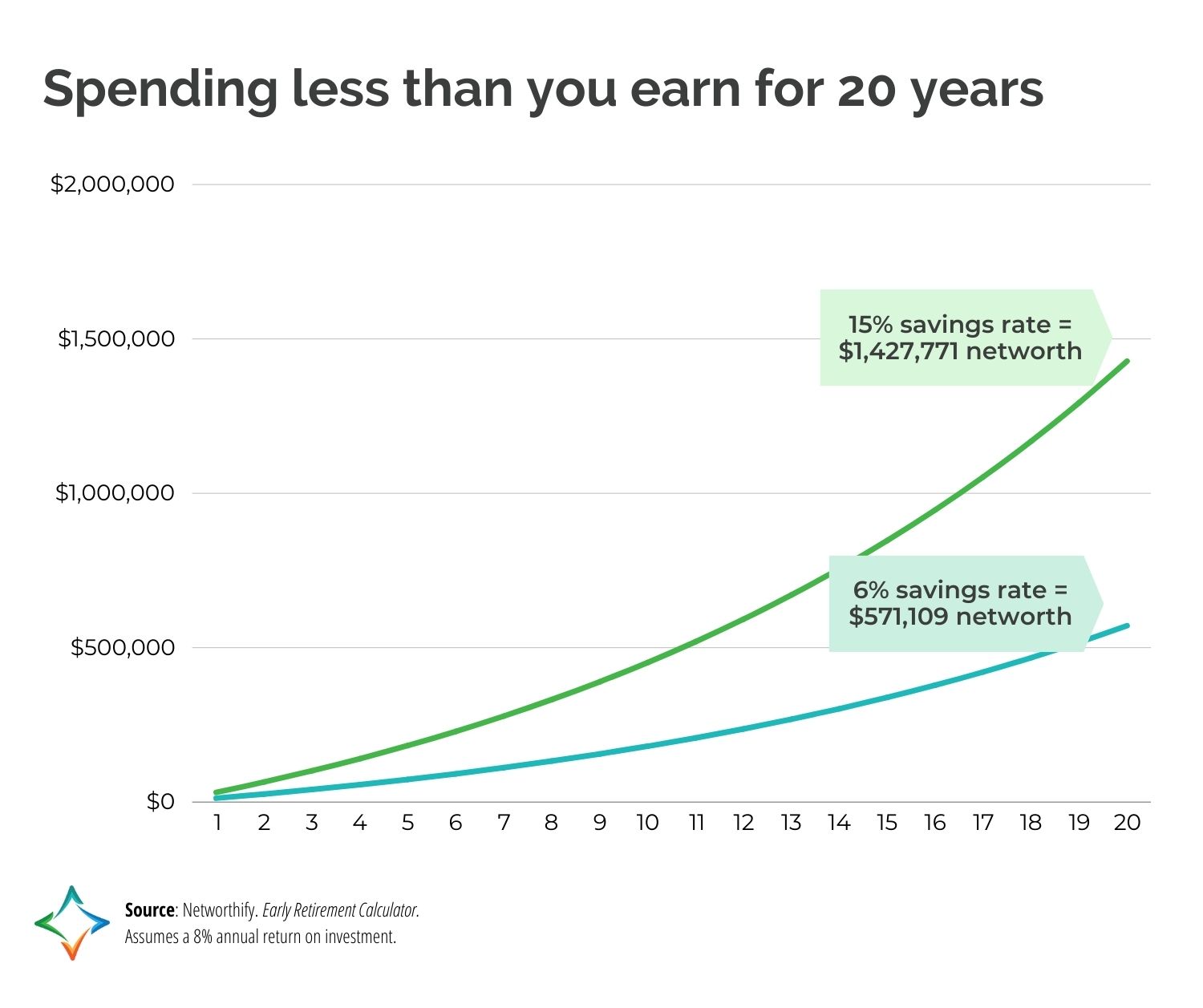

Building wealth, no matter what your income, is about spending less than you make, and then using that margin in the most efficient way possible to grow or protect your wealth.

But how do you achieve this? Altering these habits requires a belief in the possibility of change and the motivation to pursue it.

What is a money mindset?

Your money mindset is the unique amalgamation of beliefs and attitudes you hold toward money. It shapes your decisions regarding saving, spending, and managing your finances.

Like most patterns of thinking, your money mindset is a product of your experiences, both in childhood and adulthood. From subtle influences to significant events, these shape what psychologists term your “money story.”

As children, we start crafting our money stories, influenced by various factors.

For instance, a grandmother who lived through the Great Depression might instill frugality due to memories of not having enough. Or, growing up with entrepreneurial parents may have led to exhilarating financial successes and gut-wrenching setbacks with feast or famine thinking.

To uncover your money mindset, introspection is key. Reflect on what you heard and saw about money growing up. Consider what financial habits of your parents you want to emulate or change.

Some aspects of your money beliefs may seem harmless, like opting for generic products over more expensive name brands. Yet, others can be detrimental, fostering fear, anxiety, or a sense of defeatism. Recognizing these beliefs is crucial for reshaping your money mindset.

In many cases, your upbringing likely brought some positives and negatives to your money mindset. Using the examples above, living through a historical recession may teach you frugality but also may lead to scarcity thinking, and growing up in an entrepreneurial household could impart a value of hard work but also a fear of never being safe with money.

You can go through an exercise of uncovering your money mindset on your own, with a spouse or close friend, or even your financial advisor.

Changing your money mindset

Transforming your money mindset is a journey that requires introspection, education, and action. Here’s a comprehensive guide to help you navigate this transformation:

1. Get a clear picture of your financial situation.

As you think about what your money mindset is currently, you may discover that your thinking about money is influenced by what was not said or taught. More than half of Americans (51%) say their family rarely or never spoke about finances.3

Unfortunately, ignoring your financial situation does not lead to financial peace or progress. To begin making a difference in your financial life, you must get a clear understanding of your complete financial picture—from income to debt to insurance coverage.

This step is so important it is a requirement in the financial planning process.

2. Remind yourself you’re in control of change.

We all have factors outside of our control that affect our financial wellness, for better or worse.

Still, an important step for building wealth is to identify what is in your control and own it.

How you spend, save, and protect your assets all fall into the category of what you can manage. Taking control of these factors will help you manage situations beyond your control.

3. Educate yourself on financial principles and practices.

The main reason people make financial mistakes is because they are misinformed or unaware of their options. The fastest way to feel empowered about money is to feel informed about it.

A great place to start is to engage with a financial advisor who never talks down to you or ignores your questions, but who can simplify complex concepts so you feel confident making decisions with your money.

Connect with a financial advisor

4. Think about what you want your future to look like.

Visualizing your financial goals is a powerful motivator for change. Consider your aspirations for retirement, desired lifestyle, and legacy. Define tangible objectives, whether it’s owning a home, traveling the world, or supporting charitable causes. By envisioning your ideal future, you cultivate clarity and purpose in your financial endeavors.

“If you can see your dream in every detail—if you can fix your eyes on it—then I know you can muster the effort you need to hit your numbers.”

—Chris Hogan, author and business coach

5. Take action to reach your goals.

Transforming your financial life requires deliberate action aligned with your goals. Regardless of income, you can cultivate habits that promote wealth, such as:

Live within your means and monitor cash flow.

Building wealth, in its simplest form, is spending less than you make, while spending more than you make is the fastest road to nothing. Even exceptionally wealthy people track their overall income and expenses diligently to ensure positive cash flow and create the foundation for wealth accumulation.

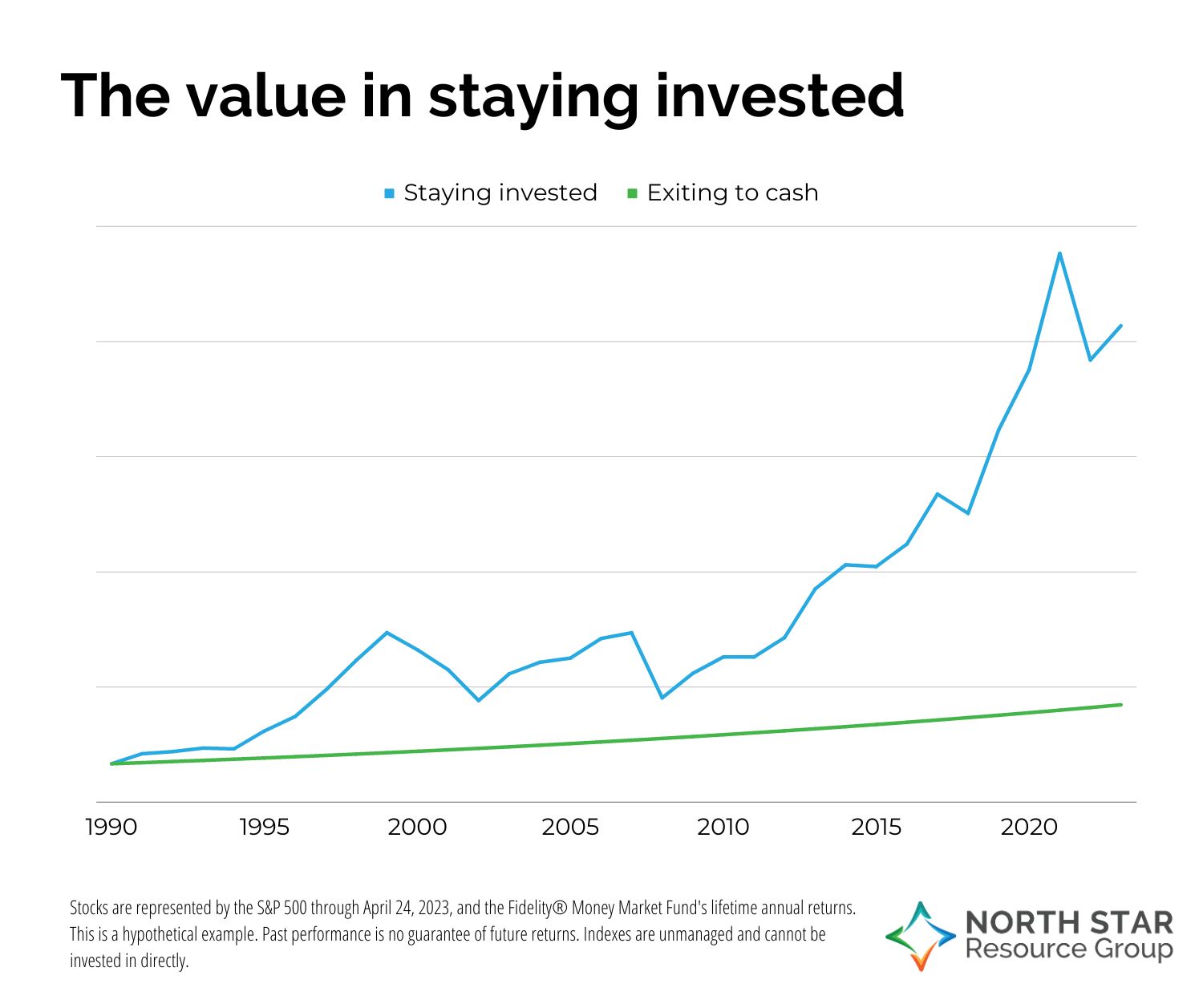

Invest consistently and wisely.

Once you find the margin between income and spending, you can put that money to work through investing. Whether this is just a few dollars a week or a larger sum, the time in the market will work for you. The key is to quiet the noise of short-term volatility and invest in assets strategically based on risk tolerance and time horizon.

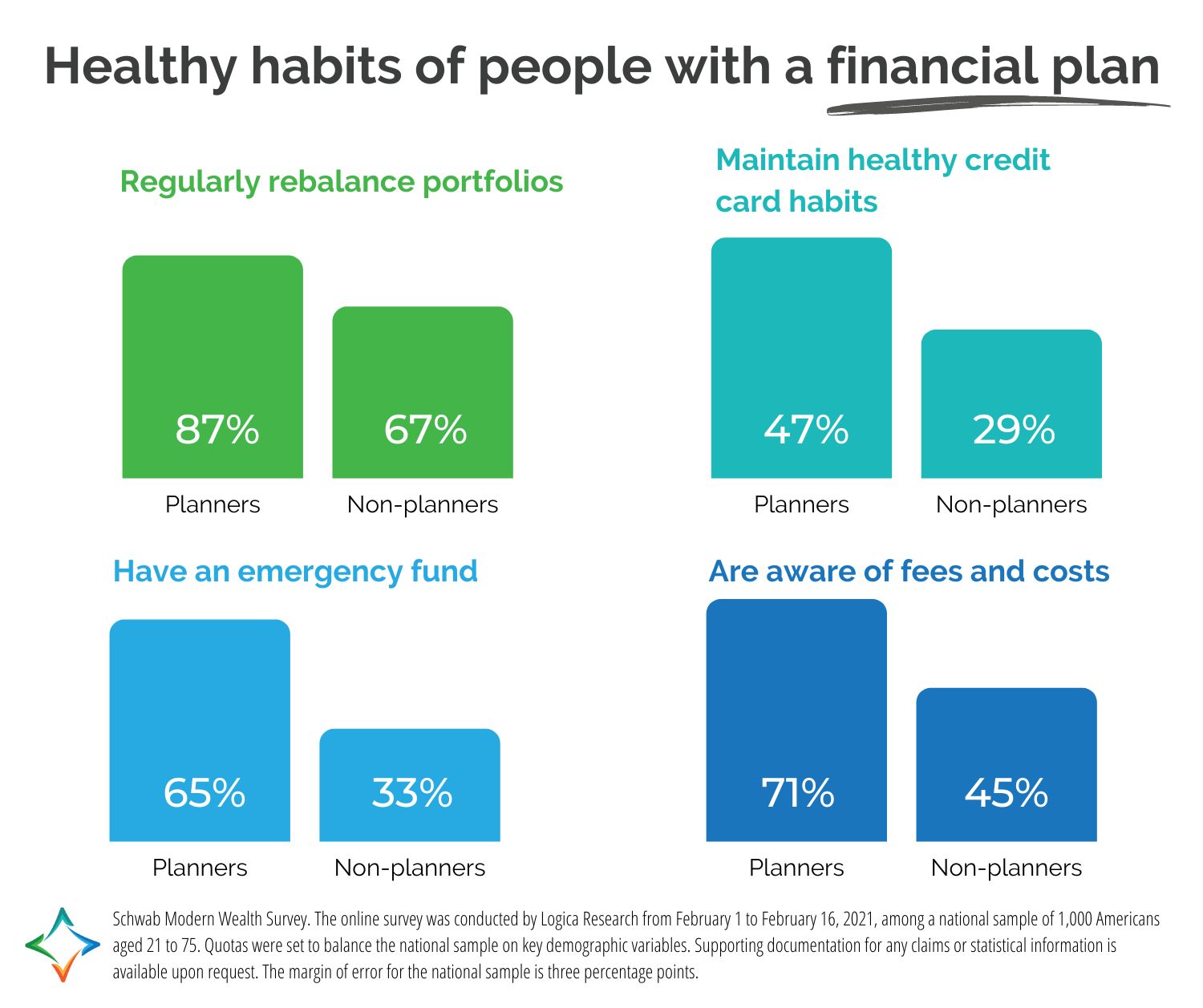

Set goals and develop a financial plan.

Establish clear financial goals and devise a comprehensive plan to achieve them. Monitor your progress regularly and adjust as needed to stay on track toward financial success.

Celebrate progress and express gratitude.

Don’t forget to acknowledge and celebrate milestones along your financial journey, no matter how small. Paying off even a small debt or contributing to your employer-sponsored retirement plan are accomplishments, and they should be acknowledged. Cultivate an attitude of gratitude for the progress you’ve made and the opportunities ahead.

By following these steps, you can begin a transformative journey to reshape your money mindset and uncover your financial potential.

In the world of finance, growth won’t always be linear, but you can surround yourself with people who share your values and help you maintain perspective to stay encouraged.

A financial professional is a great source of guidance and inspiration.

If it’s been a while since you’ve connected with your financial advocate, why not give them a call just to catch up?

Or, if you’ve been lacking support in this area, it may be time to start working with a financial professional and begin to implement strategies toward the future you desire.

We’re here to help you take the next step in financial security, confidence, and freedom.

Get more financial wellness tips in your inbox!

1Ramsey Solutions. (2023, April 12). The National Study of Millionaires. https://www.ramseysolutions.com/retirement/the-national-study-of-millionaires-research

2Pino, I. (2022, December 12). What experts say you need to know about generational wealth. Fortune. https://fortune.com/recommends/investing/generational-wealth-explained/

3Roman, C. (2023, October 20). Breaking the chains of financial stress: Your path to empowerment. Experian. https://www.experian.com/blogs/news/2023/10/20/breaking-the-chains-of-financial-stress/

The opinions are those of the writer, and not the recommendations or responsibility of Cetera Advisor Networks LLC or its representatives.