Growing a fee-based financial planning practice

by Sean McTeague, Financial Planning Specialist

In the last 30 years of wealth management, high-net-worth individuals have consistently shifted from passive investing to strategies that align their investment goals with life goals (Capgemini, World Wealth Report, 1997-2020).

As this happens, the demand for hyper-personalized planning services has increased, with a focus on a strong connection with the wealth advisor and willingness to pay for value-added services.

Not only is fee-based financial planning highly sought after by our ideal clients, but the advisors who jump aboard are seeing a noticeable acceleration in their own growth.

I recently had the opportunity to interview Damon Lichtenberger. Damon began his career as an advisor in 2004, and after nine years, he decided to start integrating fee-based financial planning into his practice.

After dabbling with planning for a couple of years, his financial planning practice started to grow exponentially. In 2021, he submitted 44 plans for a total of $71,660 in fees (Financial Planning Resource Center, December 2021).

When I asked why he finally decided to implement and grow planning in his practice, he said it was to deepen his client relationships, develop a better service model, and focus on a more efficient and consistent revenue model.

Ultimately, he found that his overall practice grew, and his clients were better served.

Damon’s sentiments are consistent with other advisors I have talked to over the years. The choice to implement financial planning came down to two things:

- It can help their clients.

- It can help their practice.

How does financial planning help the clients?

- A better client experience: Having a defined service model for planning and non-planning clients allows advisors to better organize their time. Additionally, clients know what to expect.

- Comprehensive and integrated advice: Financial planning allows advisors to give advice beyond the products that they provide. Advisors and clients can look at all areas of their financial lives at once instead of individually and see how decisions in one area impact all other areas.

Damon mentioned a recent case in which a survivorship policy was implanted for a 44-year-old couple that he was able to illustrate through a financial plan. He said, “Not often are we looking at survivorship policies on 44-year-old couples, but in this case, it just makes a ton of sense when you look at it inside the plan.”

How does financial planning help an advisor’s practice?

Implementation on more recommendations: Many advisors have reported finding more opportunities to help their clients during the financial planning process. Then, clients can implement more recommendations and experience greater financial wellness.

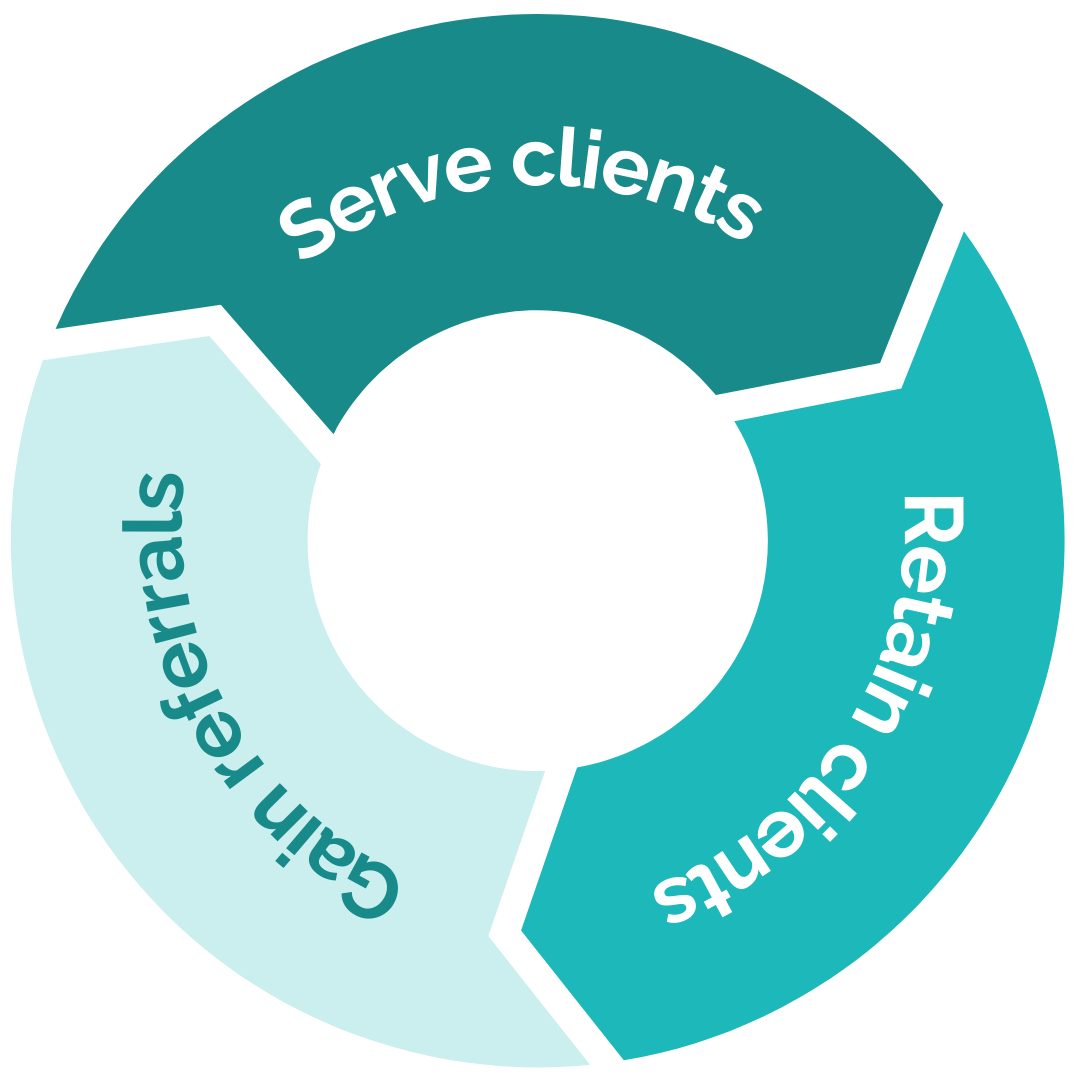

Implementation on more recommendations: Many advisors have reported finding more opportunities to help their clients during the financial planning process. Then, clients can implement more recommendations and experience greater financial wellness.- Better retention: The client experience, clear expectations, and more frequent touches in a financial planning relationship lead to more clients wanting to maintain the relationship.

- More referrals: Happier people tend to share their experiences with others more often. Damon mentioned another recent case in which he was working with a couple that involved a future inheritance. Given the complexity of the case, he was referred to the client’s parents to help them with their own personal financial plan. He is now working on his largest opportunity to date that came as a by-product of financial planning!

of clients consider their advisor’s frequency and style of communication when deciding to retain their services (Michael Kitces, 2020).

How does North Star Resource Group help?

The Financial Planning team at North Star Resource Group works with all advisors in designing presentations for their clients, whether they are simple, need-based analysis or more in-depth comprehensive financial plans for a fee.

We can work with advisors as a formal financial planning resource center that allows all data input, plan production, and recommendations to be outsourced. We also work in a consulting role with advisors to help them position planning and create presentations and recommendations for their clients.

Financial Planning Resource Center (FPRC)

Outsource building client financial plans to North Star Resource Group’s FPRC whose planning specialists are ready to fully support all your financial planning needs.

There are many reasons to outsource plan production to North Star Resource Group:

- It saves you time so you can focus on growing your practice.

- It allows you to focus on your strengths: communicating with clients, listening to their needs, and building relationships.

- It saves you energy. You no longer need to use the technical software to build plans.

Consulting

We can work with you on how to first engage a prospect, introduce planning, and then decide if planning is the right path and how much to charge. We can continue to work with you throughout the planning process to create presentations and identify opportunities and recommendations.

North Star financial planning consulting includes:

- Financial planning best practice strategy consulting

- Marketing, training, and support for eMoney

- Financial planning and needs analysis support

- Help identifying opportunities and recommendations

If you’re interested in incorporating financial planning into your 2022 practice growth, reach out to learn how North Star can help.

Separate from the financial plan and an advisors’ role as financial planner, an advisor may recommend the purchase of specific investment or insurance products or accounts. These product recommendations are not part of the financial plan and clients are under no obligation to follow them.