Market Insights: Your portfolio in light of the 2022 mid-term election

Uncertainty regarding the economy and the direction of the capital markets is always high during election years. Investor doubts increase as campaign ads and speeches highlight everything that is wrong in our world, seeming to suggest the inverse that nothing is right.

Such is the climate of politics—heated and contentious.

Despite the obvious unpleasantries of today’s political climate, the reality is that the markets do not like uncertainty.

Mid-term elections tend to have a short-term effect on the markets that follow a predictable pattern: average stock returns tend to dip in the second and third quarters and then rebound by the end of the year and into the first half of the following year.1

What does mid-term volatility translate into for the long term?

This is where things get interesting, and it can become a trap regardless of our political persuasions. There is no end to the data trying to prove what happens when an incumbent party wins or loses. For every proof statement, there is another interpretation of data to contest it.

However, in the long term, the markets respond primarily to company earnings, worker productivity, and many other factors, with the possession of Congress or the Oval Office playing a much smaller role.

In the long term, the markets respond primarily to company earnings, worker productivity, and many other factors, with the possession of Congress or the Oval Office playing a much smaller role.

Our system of government was designed with checks and balances of power. The executive, legislative, and judicial branches each limit the power of the other. No one office acts alone, and the power in our country is not centralized.

We cannot discount the importance of electing capable, honest, and ethical servant leaders to our nation’s highest offices. That said, the success of the American and global economy does not depend on one man or one woman.

Regardless of policy changes proposed or made by individual officials, they will take time to produce results, either good or bad. In some cases, it may take many years and could ultimately affect the next set of representatives. While our elected leaders do have an impact, companies will adjust, adapt, and respond to the economic factors prevalent at the time regardless of who is sitting in congress.

What does wisdom suggest, knowing that the only constant is change and that enterprising entrepreneurs and businesses around the globe will continue to seek profitable ventures no matter how our 2022 mid-terms pan out?

Our investment team believes it is wise to keep a long-term view.

The months surrounding any election are full of important questions, yet nobody is certain of the answers. Even though uncertainty rules the day, the markets regularly provide opportunities for long-term growth. Sound investment policy insulates itself from the whims of the day.

What will happen within the financial markets in the next 12 days, 12 weeks, or 12 months is anybody’s guess, but we cannot lose sight of what is likely to occur in the long term.

Following the terrorist attacks of 9/11, Peter Lynch provided commentary to shareholders of Fidelity mutual funds. Mr. Lynch said at that time that “which way the next 1,000 to 2,000 points in the market [the Dow Jones Industrial Average] will go is anybody’s guess, but I believe strongly that the next 10,000, 20,000, and 40,000 points will be up.”

His point to investors at that time was that the short term is always unknowable, but that he was confident in well-run businesses over the long term. On the date of his commentary, September 20, 2001, the Dow Jones Industrial Average closed at 7,986. At the time of this writing, the Dow Jones Industrial Average stands over 31,000.2

Mr. Lynch was right in the direction of the next 10,000 points despite the Financial Crisis of 2008, which many economists consider the worst financial crisis since the Great Depression. Despite the atrocities of 9/11, despite the difficult bear market that followed, despite the Financial Crisis of 2008, despite a pandemic, the next 10,000 points continue to trend up.

The one thing we know with certainty is that at least half our nation will be disappointed on November 9. Which way the next 1,000 to 2,000 points in the market will go is anybody’s guess, but we believe as Mr. Lynch did in 2001 that the next 10,000, 20,000, and 40,000 points will be up.

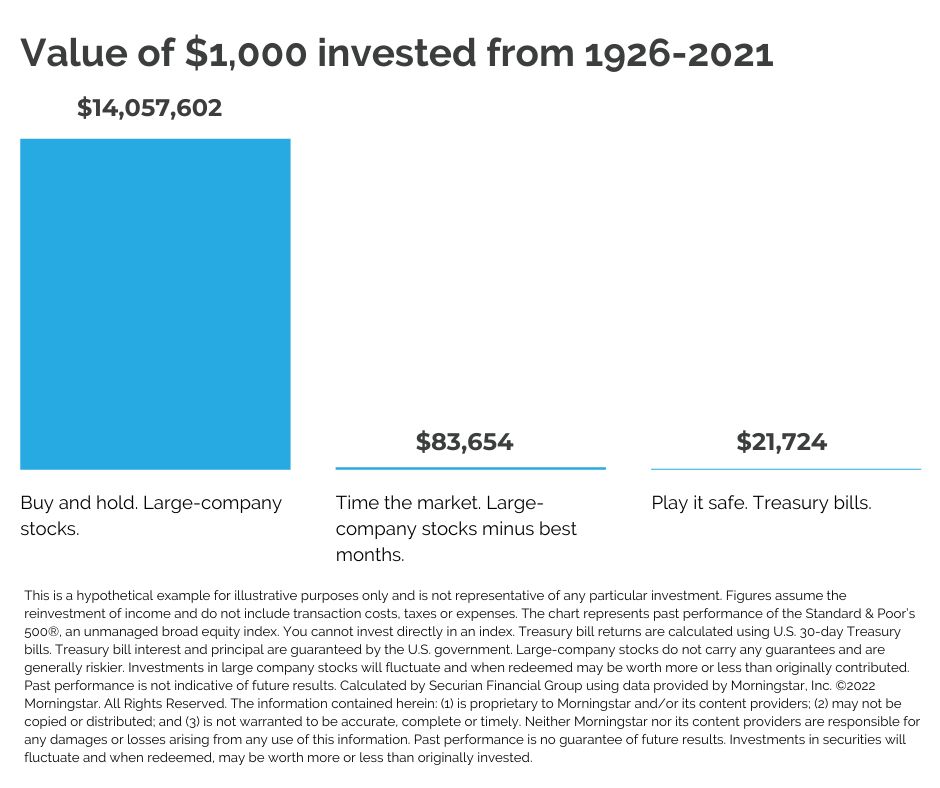

Changing investment policy based on election outcomes is ill-advised. If history has a lesson for all of us it is that consistently timing the markets is impossible. A drastic change in investment policy, based on the outcome of an election, is at its core an attempt to time the market.

If we do anything between now and the election, let it be a review of our financial plan and confirm that our portfolio optimally supports our plan over its intended time horizon. This approach is an appropriate and prudent practice with both Republican and Democratic control of congress.

Get more financial wellness tips in your inbox!

1Tepper, T. (2022, March 8). 3 ways the midterm elections could impact the stock market. Forbes. Retrieved August 31, 2022, from https://www.forbes.com/advisor/investing/midterm-elections-stock-market/

2DJIA: Dow Jones industrial average overview. MarketWatch. (n.d.). Retrieved August 31, 2022, from https://www.marketwatch.com/investing/index/djia

The DJIA is a widely followed measurement of the stock market. The average is comprised of 30 stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies. Please note an investor cannot directly invest in an index.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.