How to avoid gaps in your disability coverage that can derail your financial goals

“How much disability insurance do I need?”

Disability insurance replaces the income lost if you are too sick or injured to perform your job duties.

As a worldwide virus sweeps through our communities and workplaces, reminding us all that our bodies are more fragile than we imagine, “How much insurance coverage do I need?” is the question on everyone’s mind.

Related: Will disability insurance support you in a Coronavirus quarantine?

But while our chance of disability from coronavirus may be top-of-mind, the disability risk isn’t new, and it won’t go away when this present crisis passes. According to a 2020 study, disability will keep one in four working Americans from work for a year or more before they turn 65.1

1 in 4 working Americans will be unable to work for a year or more because of a disabling condition before they reach 65.

Maleh, J., & Bosley, T. (2020, June). Disability and Death Probability Tables for Insured Workers Born in 2000, Table A.

The truth is short- and long-term disability claims aren’t rare, and claims may include ailments you wouldn’t expect, including cancer, pregnancy, musculoskeletal disorders, and mental illness.

This leads us all to ask:

What would happen if my partner or I was ill or injured, unable to work? Would we have the money to pay the bills?

Hopefully, your answer includes disability insurance, which would help sustain you and your loved ones through the short-term and lasting ailments that keep you out of work.

Many employers will provide some disability coverage, especially for short-term disability. However, many professionals find themselves in want of additional coverage, especially those in high-income positions such as doctors, nurses, dentists, veterinarians, and attorneys and those who don’t have an employer’s group benefits to rely on such as small business owners and entrepreneurs.

This is where insurance calculators come in.

In many cases, these online tools do the math on your expenses and how much coverage you need to make sure you can cover base expenses, such as food and housing.

Unfortunately, buying disability insurance this way can lead to detrimental gaps in coverage.

What your disability insurance calculator is missing:

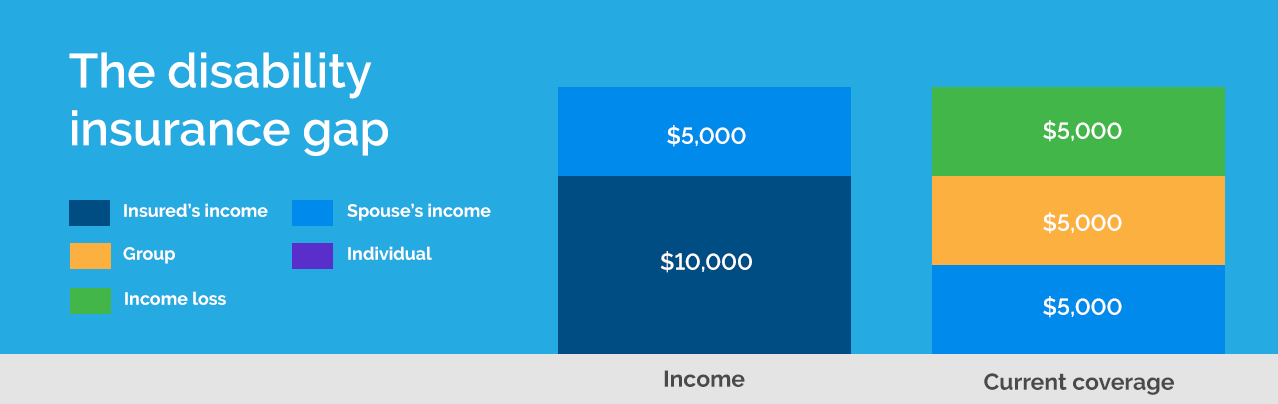

Say, for example. you make $120,000 a year after taxes and your spouse takes home $60,000 annually. You spend approximately $10,000 on expenses each month and the rest goes toward retirement and other savings goals.

Your group disability coverage from work is $5,000 a month and your spouse contributes that remaining $5,000 with their take-home pay. According to the calculator, you’re good to go!

Except that you’re missing $5,000 a month that would have been going to your savings goals.

If you consider an average 9.2% return in the markets2 and the average three-year long-term disability claim,2 you aren’t just missing out on $60,000 lost income annually, but you may be out over $26,000 in investment interest over those three years.

Disability insurance shouldn’t be a standalone, one-size-fits-all product any more than you’re a one-dimensional person boiled down to your demographic details and the digits and decimals connected to those details. Still many financial firms sell coverage from this perspective, turning your potential future into a numbers game.

At North Star, we do things differently.

Disability insurance is a key element to the whole-person financial strategy.

When you consider your finances as a tool to reach your goals, empower your life, and support your values, the insurance shopping process goes differently.

From this perspective, your risk management strategy—disability insurance, life insurance, long-term care, and home and auto—builds a protective system around your long-term savings and investment goals.

Now, you aren’t just protecting your mortgage money and grocery bill. Instead, your disability insurance is insuring the costs of birth or adoption, your loved ones’ college education, medical and nursing care for your parents as they age, and your own satisfying retirement and lasting legacy.

Calculators can be useful, but they don’t show the whole picture.

When a North Star disability specialist or financial advisor assesses your insurance needs, they look at your whole financial picture, including the money you’re bringing in and what would be lost if disability occurred.

Our goal isn’t simply to ensure your financial survival but to help you continue to thrive and reach the goals you’ve set for yourself and your family, no matter what life brings your way.

Wondering if you have gaps in your disability coverage that could derail your financial goals? Schedule a free, no-obligation consultation with a disability specialist today.

It only takes two minutes to schedule, and 15 minutes to talk to an expert who can help kickstart this process for you. It takes longer than a basic calculator, but we think your financial future is worth it.

Get more financial wellness tips in your inbox!

1Maleh, J., & Bosley, T. (2020, June). Disability and Death Probability Tables for Insured Workers Born in 2000, Table A.

3Scheid, B. (2020, July 15). S&P 500 returns to halve in coming decade. Goldman Sachs. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/s-p-500-returns-to-halve-in-coming-decade-8211-goldman-sachs-59439981.

3Council for Disability Awareness. (2018, June 15). Financial Impact of Disability. Retrieved January 08, 2021, from https://disabilitycanhappen.org/financial-impact/

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.