How to use annuities for retirement investing

Saving for retirement and investing more money for the future is a persistent financial goal for many Americans.1

However, confidence in the future is wavering1 as volatility in the markets and record inflation make even steady investors wonder if they have made the right choices to balance their risk and opportunity to achieve the future lifestyle that they’ve imagined for themselves and their families.

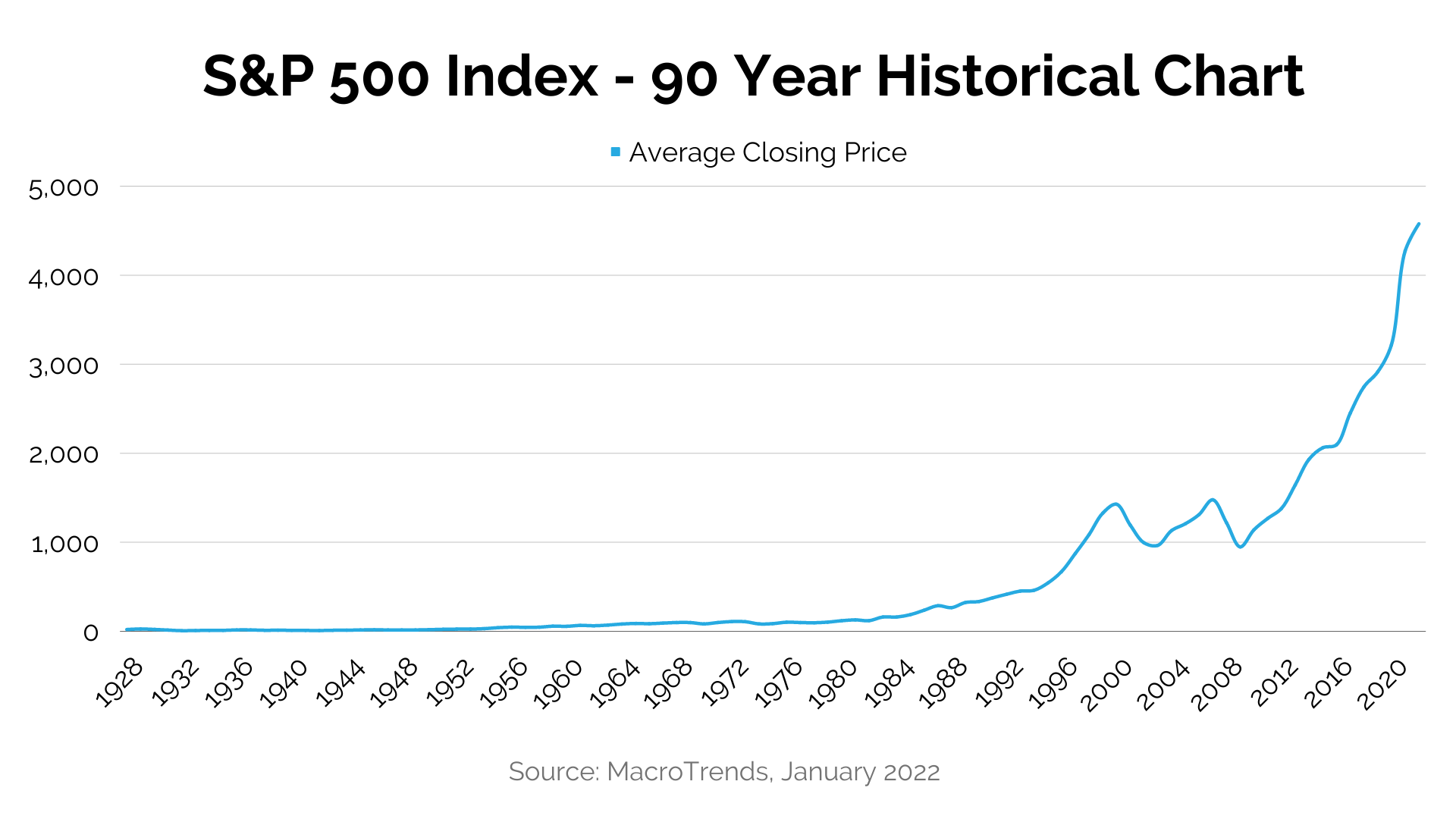

On a positive note, although the markets seem erratic, if the last 100 years tell us anything, it’s that investors who are in the right vehicles for their time horizon can expect things to balance out by the time they need their money.

Still, exploring all your options for a lifelong income is worthwhile to bolster your confidence and diversify your options to max out your future potential, and annuities can be a valuable addition to many retirement portfolios.

Learn about our investment approach

What is an annuity?

Annuities are long-term, tax-deferred investment vehicles that earn interest and provide a guaranteed stream of payments over a predetermined amount of time.

An annuity is often used to fund retirement and takes a variety of forms to align with different financial goals and risk tolerance. You can also customize your annuity with certain add-ons and riders at an additional cost to make them even more suitable for your investing goals.

At a glance, an annuity can be defined by the following features:

- A long-term, tax-deferred investment

- Providing protection for income, legacy, and spousal needs

- Issued by an insurance company

- Purchased through a financial professional

- Flexible based on your retirement and investment needs

Types of annuities

All annuities provide long-term, tax-deferred income and offer some customization. However, annuities are also split into four general categories off the bat based on their risk and reward potential:

Immediate

Immediate

With an immediate annuity, also referred to as a single payment immediate annuity (SPIA), you can convert a lump sum into an ongoing, guaranteed stream of income. Payments begin within the first year.

The lump sum payment may come from a personal savings account, 401(k), or IRA and will pay out in the amount you choose each month for a set duration.

This guaranteed income takes some of the guesswork out of withdrawals from your 401(k) or IRA. Often, people use the immediate annuity income for regular living expenses like groceries, insurance, and utilities and reserve funds in other retirement accounts for non-essential spending, like vacations and travel.

Variable

Variable

Variable annuities offer a wide range of investment choices tied to the stock market with different levels of risk and growth potential depending on the choices you make.

You receive potential for long-term growth based on the ups and downs of the market, with payments beginning at retirement age and having the option to continue for the rest of your life.

As with a 401(k) or a traditional IRA, earnings from a variable annuity are tax-deferred, meaning they aren’t taxed while you’re contributing to the annuity, allowing for greater growth potential, but are subject to income tax. If you are expecting to be in a lower tax bracket during retirement, this feature may be an advantage to you.

Fixed

Fixed

Fixed annuities have the lowest risk of all the options, but they also offer less potential for growth. You can begin taking your monthly payments at your retirement age and then for the rest of your life.

Instead of participating in the market, a fixed annuity grows at a set interest rate and guarantees your principal investment, but you don’t have any possibility for more growth if the markets do well.

The set earnings from a fixed annuity are tax-deferred, which means they aren’t taxed until you withdraw and are subject to income tax. For those who expect to be in a lower tax bracket during retirement, this feature can be a tax advantage.

Fixed index

Fixed index

Fixed index annuities were designed to balance the strengths and weaknesses of variable and fixed annuities.

With a fixed index or indexed annuity, your interest is a combination of minimum guaranteed interest rate and the performance of an index or indexes such as the S&P 500 or the Dow Jones Industrial.

This unique hybrid design can offer protection against stock market losses while taking advantage of the market’s gains.

| Type | Interest | Risk | Reward | Other benefits |

|---|---|---|---|---|

| Immediate for immediate income |

Preset and guaranteed | Low | Predictable |

|

| Variable for flexible income |

Tied to an investment portfolio | Higher | Potentially higher or lower |

|

| Fixed for guaranteed income |

Preset/guaranteed | Low | Predictable |

|

| Fixed Index for growth potential |

Preset minimum.

Can change according to index like the stock market |

Medium | Won’t sink below a set level |

|

Available riders on annuities

In addition to the types of annuities, at an additional cost you can also add in riders as optional enhancements to your contract. Riders allow you to tailor your annuity contract for what’s most important to you:

Guaranteed minimum living benefits: Guarantees the level of benefits received, no matter how the annuity’s portfolio or index performs. The goal of this rider is to offset risks inherent in variable and fixed index annuities in which the payout amounts can rise or fall depending on the markets.

Guaranteed minimum death benefits: If the annuity owner dies during the accumulation phase, the guaranteed minimum death benefits rider allows for a new payment recipient to be named for the duration of annuitization.

Long-term care rider: Covers the cost of long-term care by increasing your payment should you require it. Typically, this would be in the form of a monthly payout that’s a multiple of your normal benefit.

Someone turning 65 years old has a nearly 70% chance of needing long-term care services in their remaining years.

Disability income rider: Like disability insurance, the disability income rider ensures a higher pay out if you develop a disability that results in a loss of income from another source. The increased income from your annuity would typically be limited to a set timeframe, such as a year.

Inflation protection: Also known as the cost-of-living rider, inflation protection increases the amount of your payments based on either the rate of inflation or a specified percentage noted in the annuity contract. The amount that the income can increase will often be capped.

These are just a few of the annuity riders available. For more details on what customizations may be beneficial to you and your overall retirement strategy, connect with a financial professional.

How do annuities fit into a balanced retirement strategy?

A properly diversified portfolio helps temper the impact of volatile market swings.

For retirement-minded investors, the decade of 1999 through 2009 was a tough time to invest in the U.S. stock market. For the disciplined “buy and hold” investor, many gains obtained through market appreciation were wiped out in the corrections in the early part of the decade and in 2008.

Annuities offer guarantees not available through other investments. They can help weather downcycles and stay invested with confidence, putting you on the path to achieving your future goals.

Is an annuity a good investment for me?

Keeping in mind that annuities are technically insurance policies, not high-growth investment vehicles, you can evaluate if an annuity would fit into your overall financial strategy and retirement plan.

| Advantages | Disadvantages |

|---|---|

|

|

Along with a consultation with a financial professional, the extended pros and cons list for annuities below can provide some additional insight on if this vehicle is right for you:

Advantages of annuities

An alternative way to saveIf you’ve maxed out your 401(k) or IRA, an annuity can provide an additional form of tax-advantaged investing. Likewise, if you started saving for retirement later in life, an annuity can provide an opportunity to catch up and increase your balance when you don’t have the advantage of time and compound interest. |

Lifetime incomeAn annuity can provide you income for as long as you live through annuitization, which converts your assets into an income stream at no extra cost, or via an optional lifetime benefit rider available for an additional cost. Annuitization is a one-time process of taking your annuity account and turning it into regular payments that will last for the rest of your life. The annuitized payments continue, regardless of how long you live, even if the total payments exceed the original account value. |

FlexibilityThe main benefit of an annuity is how it can be customized based on your needs and preferences. With the choice of immediate or deferred annuities, you experience flexible timing on the investment, allowing you to contribute a lump sum early or add money over time. You also have flexibility in the vehicle itself—immediate, variable, fixed, and fixed indexed annuities—and the option to add riders at an additional cost based on what matters most to you. |

Tax-deferred potentialLike a Traditional IRA and 401(k), your contributions, interest, and capital gains in an annuity grow tax-free, and you pay taxes on the withdrawals during retirement when you’re likely to be in a lower tax bracket. This allows you to build value over time, using compound interest to boost your principal over time. |

Legacy planningAnnuities provide the opportunity to preserve wealth for the next generation in a tax-efficient manner. Most annuities will pay out a minimum of what you contributed through a premium as a death benefit. However, you may also use enhanced death benefit riders to increase the amount paid to loved ones after your passing. |

Spousal opportunitiesWith the addition of spousal protection, you can protect and preserve assets for a surviving spouse through the continuation of the annuity payment contract or with a lump-sum payout of a death benefit. |

Disadvantages of annuities

Modest growthAnnuities are valuable because of their predictable growth, not their aggressive growth. Although the rate of your annuity will differ based on the type of contract, money invested, index interest rate (if variable or fixed indexed), and the length of the contract, today’s annuity rates typically fall between 2% and 3%.2 |

Limited capital appreciationUnless you opt for a variable annuity, you will not see significant increases to your monthly payment from annuity even when the markets do well. This is an advantage for reliability on a short time horizon, but if you are looking to maximize growth over a longer time period, you may be disappointed with what an annuity offers. |

Restricted access to fundsWith an annuity, you are paying a premium, not making an investment contribution. This means the funds in your annuity contract are not accessible to you until the agreed-upon date, and then payments will be distributed on a predetermined schedule. While there are some options for cashing out or selling future payments, neither of these options make the funds immediately available and they can come with fees. If you make a withdrawal within the first five to seven years and you typically will be hit with surrender charges of up to 7% of your investment or more. |

Fees and commissionsAnnuities can typically charge higher fees than equity investments, including an initial commission. If you purchase a variable annuity, ongoing investment management and other fees often amount to 2% to 3% a year. However, the annuity also offers death benefit protection and guarantees not provided by other investment products. |

Conclusion

Are annuities a good investment? As with any financial question, the answer is, “It depends.”

Every investment and insurance vehicle has its advantages and disadvantages, the key is to find the solutions that offer you the benefits you’re looking for with drawbacks you can manage.

With annuities, the main pros are that they provide predictable income for life, making you less reliant on the highs and lows of the markets for your future cash flow. Additionally, annuities are incredibly flexible, with riders that allow you to customize based on your needs when it comes to health, legacy, and financial possibility.

Overall, annuities prove to be a viable option for many investors seeking to diversify their retirement portfolios. Even if they aren’t a fit for your holistic financial strategy, with the proper guidance and support, you are likely to find a solution that will work for you and your future.

Get more financial wellness tips in your inbox!

Meet the North Star Investment team

|

|

Steven VacinekInvestment Consultant |

|

|

1Bennett, K. (2021, December 20). Survey: 2 in 3 see no boost in personal finances in 2022. Bankrate. Retrieved January 31, 2022, from https://www.bankrate.com/surveys/personal-financial-outlook-survey-2022/

2Silvestrini, E. (2022, January 7). Annuity Rates. Annuity.org. Retrieved January 24, 2022, from https://www.annuity.org/annuities/rates/

An annuity is intended to be a long-term, tax-deferred retirement vehicle. Earnings are taxable as ordinary income when distributed, and if withdrawn before age 59½, may be subject to a 10% federal tax penalty. If the annuity will fund an IRA or other tax qualified plan, the tax deferral feature offers no additional value. Qualified distributions from a Roth IRA are generally excluded from gross income, but taxes and penalties may apply to nonqualified distributions. There are charges and expenses associated with annuities, such as deferred sales charges (surrender charges) for early withdrawals.

Variable annuities have additional expenses such as mortality and expense risk, administrative charges, investment management fees and rider fees. The variable sub-accounts of annuities are subject to market fluctuation, investment risk and loss of principal

All guarantees are subject to the financial strength and claims paying ability of the issuing insurance company and the guarantees have no bearing on the variable investment performance. The variable investment performance can lose value.

The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S.

The DJIA is a widely followed measurement of the stock market. The average is comprised of 30 stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies. Please note an investor cannot directly invest in an index.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.