Kayla Nikula, CPFA®

Associate Partner

Educating and empowering you to make the right financial decisions for you and your future.

I help high-achieving singles and families answer the question, “What’s it all for?”

Because when you know the why driving your spending and investing choices, you can make smarter decisions that set you up for a fulfilling and confident financial future.

Whether you are making a good income but feel like you’re still living paycheck to paycheck, or you have a cash flow surplus but aren’t sure how to wisely invest.

My educational financial planning approach helps take you from questioning your financial viability to feeling clear on your path toward success.

|

|

|

| Start with a brief virtual or in-person meeting to find out if we are a fit to work together. This consultation is complimentary with no obligation to keep working together if it doesn’t make sense for your life. | Next, we will work together to create a thorough but simple financial standing summary to answer the question, “Am I okay?” | Follow a personalized investing plan designed for your current needs and future goals. Our team will manage the invested assets to maximize your returns over the long haul. |

Our process

After the initial consultation to determine if my team is a good match for you and what you’re looking for, we will launch into our client onboarding process.

During the first year working together, we will have three to four meetings to lay the groundwork for your investment strategy and financial plan, and in subsequent years we meet annually or as often as requested by you.

I work with the other members of The Haunty Team to design financial strategies that emphasize education and transparency. I am prepared to answer the “why” behind everything I recommend to you, serving as your dedicated guide while you pursue your financial goals.

STEP 1: Data gathering

Where are you currently at?

First, I will take a comprehensive look at your current financial situation from your cash flow to employee benefits to current investment activity. Once this process is complete, our team will compile everything we’ve gathered into a simple snapshot of where you stand financially.

![]()

STEP 2: Goal identification

What is all the money for?

Next, we will discuss how you want to use your financial resources to support your current lifestyle and provide for your future goals. This meeting is intended to give you freedom—whether it is through permission to spend or by increasing your savings rate to increase your choices for the future. Either way, the action steps are focused on you and your financial well-being.

![]()

STEP 3: Recommendations and implementation

What do you need to do?

Using your goals as a guide, I will prepare a written financial plan featuring my specific recommendations for you. This plan isn’t pages of jargon, but a step-by-step guide for reaching your goals.

What I present is by no means the final copy of this plan, and we can discuss together if any adjustments are needed to make it the perfect fit for you without sacrificing your financial goals.

![]()

STEP 4: Accountability and execution

What changes do you need to make?

Throughout the execution of each step of your financial plan, life will, of course, continue to happen. Therefore, changes to your plan will likely be needed over time. I will work closely with you to make sure you remain on track while adjusting for any changes to your situation.

Financial services

Jump to: Investment management | Financial planning | Insurance recommendations

Investment management

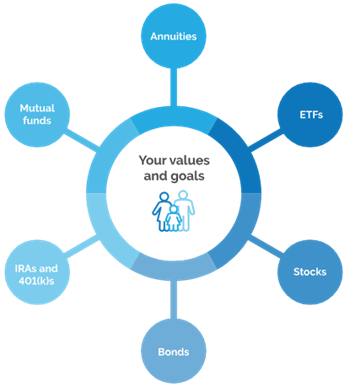

Investing is the cornerstone of any wealth-building strategy, and a properly diversified portfolio helps temper the impact of volatile market swings while maximizing returns over the long term.

Investing is the cornerstone of any wealth-building strategy, and a properly diversified portfolio helps temper the impact of volatile market swings while maximizing returns over the long term.

As an independent advisor in an open architecture platform, I design portfolios from a wide range of solutions to meet your advanced investing needs. With the support of the North Star Investment team, we are well-versed in custom-designed portfolios pulling from any bond, any mutual fund, or any ETF that fits your goals.

We address growth, diversification, and fee and tax costs of each asset selection to help you build sustainable wealth.

Comprehensive financial planning

The reason finances are complex is because they are interconnected. A financial professional can’t make a recommendation in one area of your financial life without it touching every other area.

This is why financial planning is so important to overall financial success. I am a strong advocate of “the plan dictating the products.” In other words, there is no one-size-fits-all investment portfolio, but a tailored approach is required for all clients.

Retirement planning

Are you ready for retirement? Regardless of where you are on the path toward retirement, I can assist you with implementing strategies to maximize your earning potential. Through techniques like tax-efficient investments and wealth accumulation, I will help you reach your retirement goals on your timeline.

Saving for education and college

With education costs on the rise, many families are looking for options for to pay for education through flexible, tax-advantaged solutions. As such, with your goals as a guide, I work with you to design a financial strategy to help ensure you are well set to fund your family’s education goals.

Insurance recommendations

Life insurance

You can provide long-lasting security and wealth opportunities for your family through life insurance. We help you determine the level and style of coverage you need to protect your family against the unknown. Then, as your plan progresses, we will reassess your needs.

Disability insurance

Your income is the driving force behind your financial goals. Therefore, it is crucial to have protection in place in the event of sudden income loss from a disability or other event.

As such, I work with you to identify the best types of protection to suit your current income and projected financial needs.

SERVICE LEVELS & FEES |

About

Growing up in a family with special needs, I saw the impact that a comprehensive financial strategy can have on a family and its future generations.

Growing up in a family with special needs, I saw the impact that a comprehensive financial strategy can have on a family and its future generations.

Because of this, I was motivated to study personal finance at the University of Wisconsin—Madison. Taking a behavioral approach to the financial process, I am a strong proponent of teaching the foundations of financial wellness to help my clients build long-term wealth.

Outside of my practice, I enjoy spending time with my husband, Dan, and our two small children on our farm near Mount Horeb, WI. I also enjoy supporting my alma mater’s football, basketball, and hockey teams (the Badgers) on game days, traveling up north, and visiting supper clubs across the state.

The Haunty Team

I work alongside Senior Partner Thomas Haunty, CFP®, RHU, REBC, ChFC, AIF® in a multi-generational financial advising practice known as The Haunty Team. We are joined by advisors Stacey Washa and Max Dowdy as we deliver advice-based wealth management services to clients around the nation.

Investment advisor representative of Cetera Advisor Networks, LLC. Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.

Investment management

Investment management