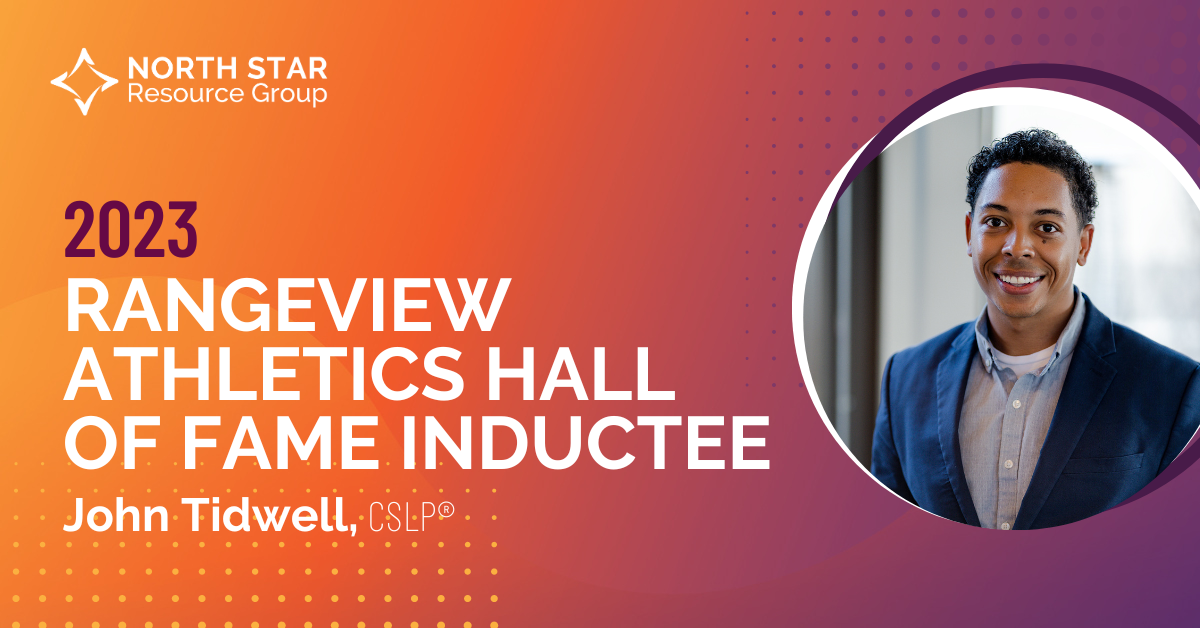

John Tidwell, CSLP®

Financial Advisor

Helping medical professionals organize and optimize their financial lives

As a tax accountant early in my career, I saw the impact finances can have on your financial freedom.

Today, providing financial guidance allows me to help my clients reach their goals on a larger scale through holistic financial strategies.

As medical and dental professionals, you have all the discipline needed to be successful, I simply offer guidance to help you make the most of your opportunities.

Through good habits and sound financial strategies, you can begin the path to financial independence. Let’s get started.

SCHEDULE A FREE, NO-OBLIGATION CONSULTATION

Outside of helping motivated professionals reach their financial goals, I am also passionate about being active and getting outdoors. My wife, Miranda, and I love spending time outside together with our daughter and son, traveling, fishing, and walking our dog, Huxley.

Qualifications

- Double major in accounting and business administration with a minor in finance from the University of Sioux Falls

- FINRA Series 7 and Series 66 registered

- Life, accident, and health insurance licensed

- Certified Student Loan Professional, CSLP®

Services

Experience confidence in your financial strategies

Insurance & Risk Management → |

|

|

Insurance and risk management

Disability insurance

No one expects disability to happen to them, but if it does, disability insurance protects if you lose your most important asset: your ability to work.

With an occupation disability insurance policy, you can protect your income in the event of short-term or long-term disability.

Life insurance

You can provide long-lasting security for your family through life insurance. I can help you determine the level of coverage you need to fortify your family against the unknowns.

Investment management

Comprehensive retirement planning

Prepare to retire with confidence. I can help coordinate your contributions and savings vehicles at every stage of your career and create a contribution strategy that will help you experience the retirement you dreamed of.

Tax-efficient investment strategies

Invest for the future, without any surprise tax bills. As we develop your portfolio, we’ll carefully balance your growth potential and the taxes and fees as we make each selection, providing insight into your choices and what they mean for long-term net returns.

Student loan guidance

Create an actionable plan for your debt and begin building true wealth. As a Certified Student Loan Professional, I understand the repayment and forgiveness options available and can help you identify the right opportunities to pursue.

Team

I work in partnership with other financial professionals and specialists to offer additional expertise to your situation. Coaching our clients with our combined knowledge and expertise, we are focused on cultivating long-term relationships based on transparency and sound financial strategies.

Speaking engagements

With a passion for financial education, I regularly speak in medical and dental schools and residency programs, as well as at industry events throughout the nation.

My Financial Strategies for Medical Professionals presentation is customized to your program and runs 45 to 60 minutes, with time for audience Q&A. In the session, I cover popular topics, including:

- Student loan management (Public Service Loan Forgiveness [PSLF], forbearance, refinancing, etc.)

- Retirement investing overview (Roth IRAs, SEPs, 401(k)s, 403(b)s, and 457s)

- Asset protection strategies

- Private disability insurance considerations and the importance of “true” own occupation coverage

- Contract review tips (malpractice insurance, sign-on bonus, noncompete, and more)

Past speaking engagements:

- SNMA (Student National Medical Association)

- Creighton University Dental School

- University of Nebraska Medical Center Dental School

- University of South Dakota residency programs

- University of North Dakota residency programs

- The Mayo Clinic residency programs

- Sanford Hospital

- Avera Hospital

- Marshfield Clinic

- Gundersen Health

- Maine Medical Center

Investment advisor representative of Cetera Advisor Networks, LLC. Securities offered through Cetera Advisor Networks LLC (doing insurance business in CA as CFGAN Insurance Agency LLC, CA Insurance Lic # 0644976), member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. CA Insurance License #4159807.