5 ways a financial plan can change your financial life

Money is the top stressor in America—even for the highest earners.1

Many people making hundreds of thousands a year still experience money as a pain point, because without a plan, even a high income can feel chaotic.

This is why I encourage my clients to use a values-based financial planning framework to design and implement money strategies around their one-of-a-kind lives.

When you have the right systems and habits in place, you can…

✓ Feel in control of your money.

✓ Help avoid costly mistakes.

✓ Experience true financial peace and freedom.

These are what I believe to be the top benefits of financial planning, but they are also just the tip of the iceberg:

1. Financial planners increase confidence.

A Schwab survey found that 65% of people with a written financial plan say they felt financially stable, while only 40% of those without a plan felt the same level of comfort.2

A written financial plan and recommendations provide you with a measurable goal to work toward. The ability to track progress allows you to make progress, reducing doubt and uncertainty in your life.

2. Financial planners can lead clients to better habits.

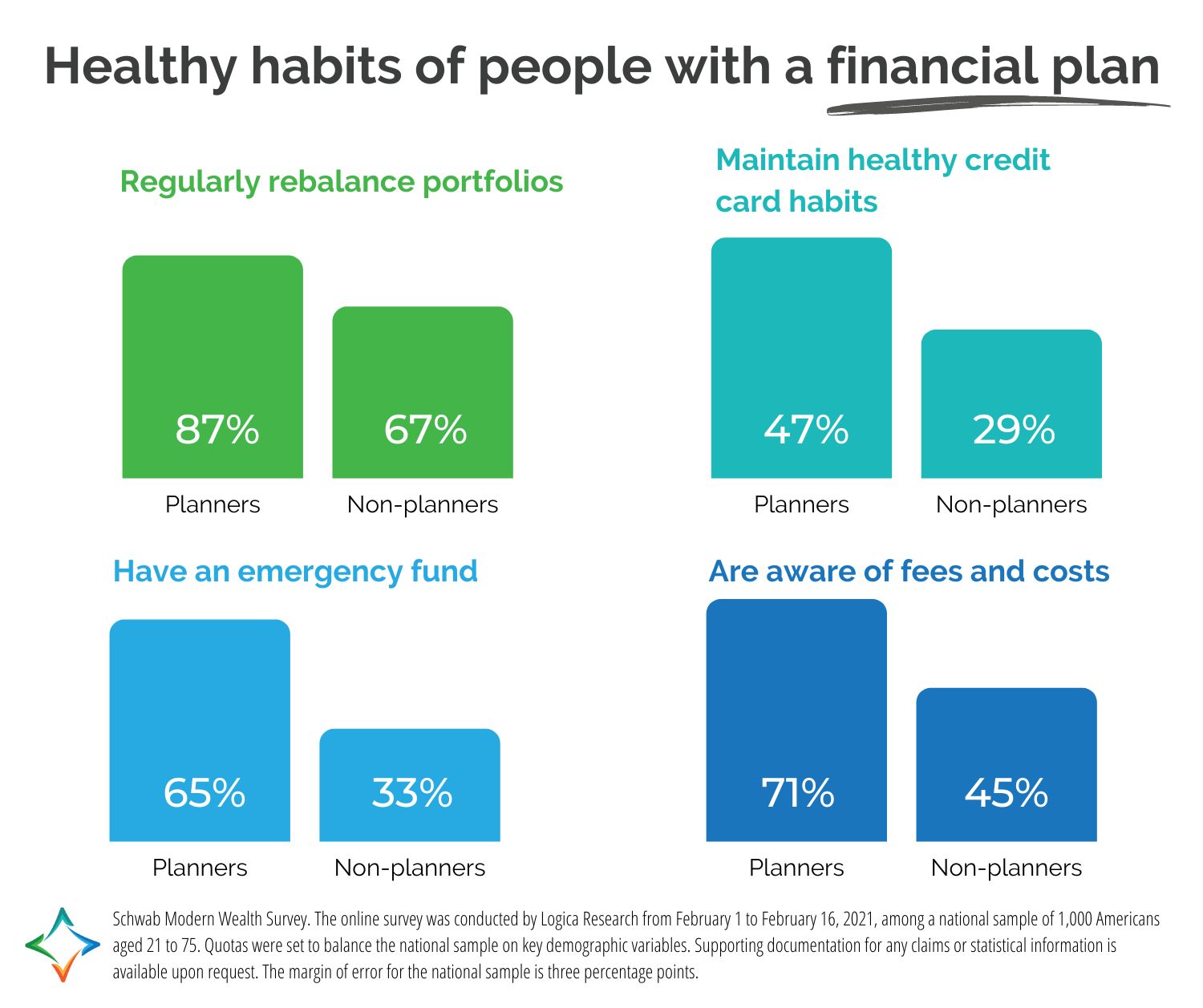

Research also shows that planning supports sound money habits as well.

There are good investment and insurance strategies as well as healthy money habits. Financial planning can help with both.

3. Financial planners help separate a client’s emotions from their money.

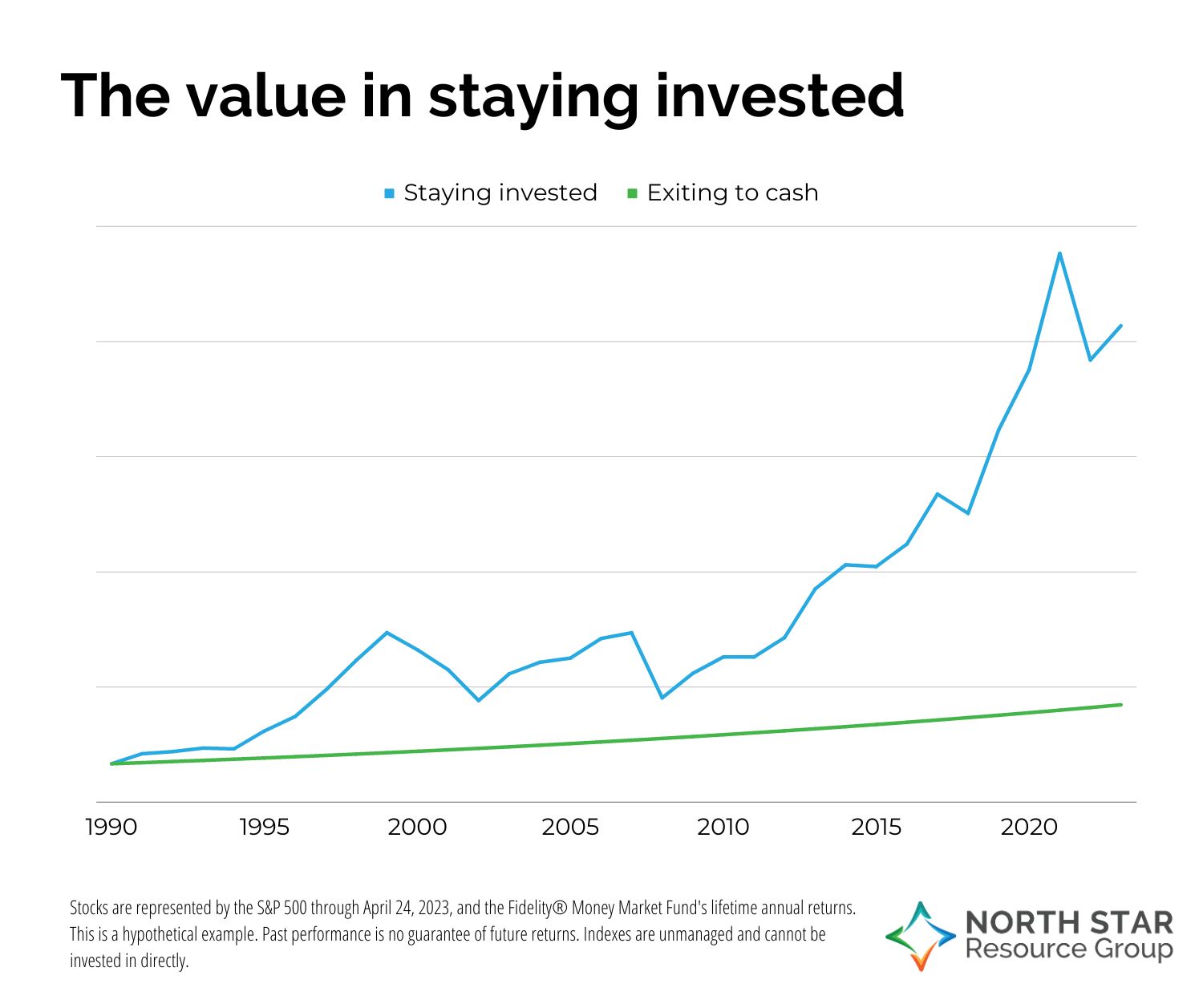

Financial planners steer clients away from the impulse to chase returns or flee for cover in volatile markets. Individual financial success is not driven by market performance, but by the behavior of individual investors.

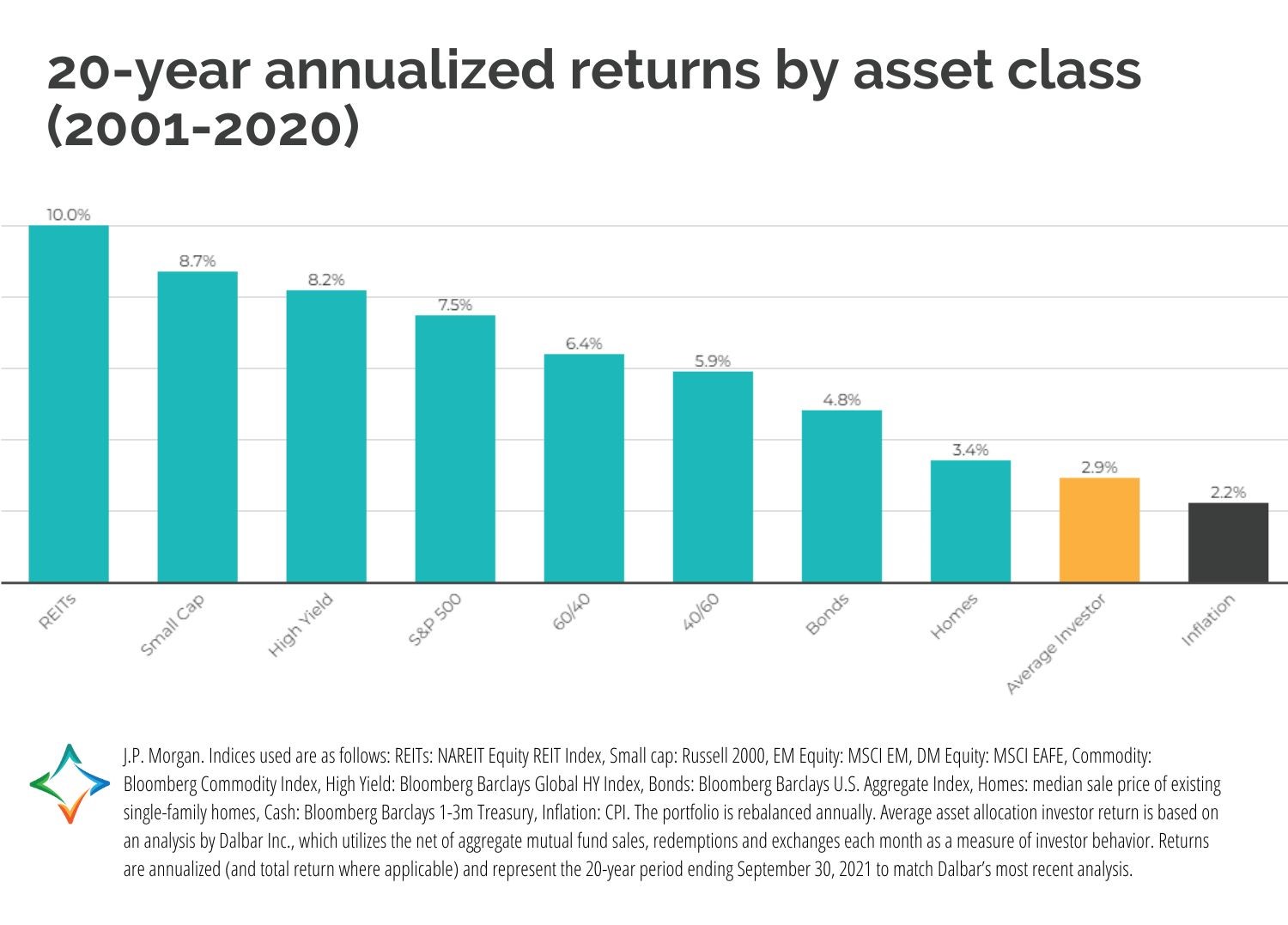

Over the last 20 years, the average investor return was 4.6% less than the S&P 500. This is because the average investor doesn’t stay invested. Instead, they try to time the market and end up missing out on returns they would have received if they simply stayed put.

4. Financial planners capitalize on opportunities and reduce losses.

Financial planners have the necessary background and knowledge of the latest laws and market offerings to identify current strengths and weaknesses in a client’s finances that they may not recognize.

Left alone, some investors make choices that impair their return or put their assets, their family, or themselves at risk. A planner can help ground emotion and contextualize buzzword headlines so you can stick with your well-thought-out strategies centered on goals and long-term performance.

5. Financial planners act as accountability partners.

A written financial plan is only as valuable as the paper it is written on. The real value is in the advice and the implementation of that advice.

Winston Churchill once said, “I never worry about action, but only inaction.”

You need a personal trainer for your finances, with regular assessments of where you are, a plan of execution to get them where they want to be, and accountability that works for you and your life.

Conclusion

A financial planner’s value does not often show up in monthly statements. The value of a financial planner can be added up over a client’s lifetime and over the long haul.

We are sure that this advice plays a significant role in our client’s success. The real value a financial planner brings to their client is peace of mind, long-term prosperity, financial freedom, and confidence that they are doing the right thing.

5671661/DOFU 5-2023

1Robinhood, (October 2022). The Financial Wellness Survey.

2Schwab Modern Wealth Survey. The online survey was conducted by Logica Research from February 1 to February 16, 2021, among a national sample of 1,000 Americans aged 21 to 75. Quotas were set to balance the national sample on key demographic variables. Supporting documentation for any claims or statistical information is available upon request. The margin of error for the national sample is three percentage points.