5 strategies for staying the course for physician investors

2022 was a challenging year for financial markets, one of the 10 worst years since 19301, and it left many investors wary of what the future held.

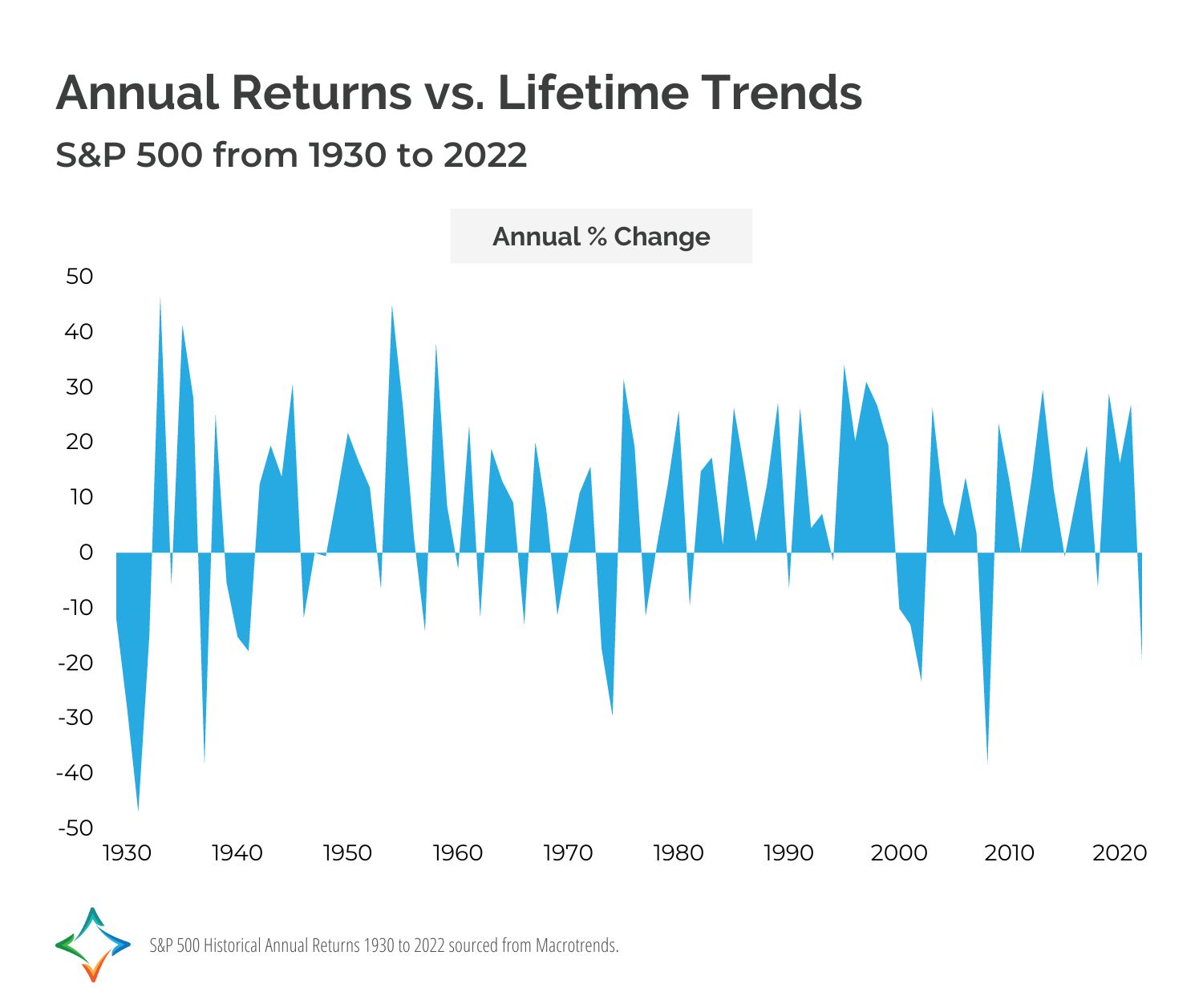

Our brains are wired to assume that big losses will be followed by further losses, just as we assume big gains will be followed by more gains. However, historical data shows that this isn’t always the case.

Looking back at the S&P 500’s worst years in the past, the subsequent year’s returns were a mixed bag.

| Worst Year | Next Year | |

|---|---|---|

| 1930 | -24.9% | -43.3% |

| 1931 | -43.3% | -8.2% |

| 1937 | -35% | 31.1% |

| 1941 | -11.6% | 20.3% |

| 1957 | -10.8% | 43.4% |

| 1973 | -14.7% | -26.5% |

| 1974 | -26.5% | 37.2% |

| 2001 | -11.9% | -22.1% |

| 2002 | -22.1% | 28.7% |

| 2008 | -37% | 26.5% |

Year-to-year trends are hard to track in the markets—especially when you account for the multitude of factors that affect returns on your investments.

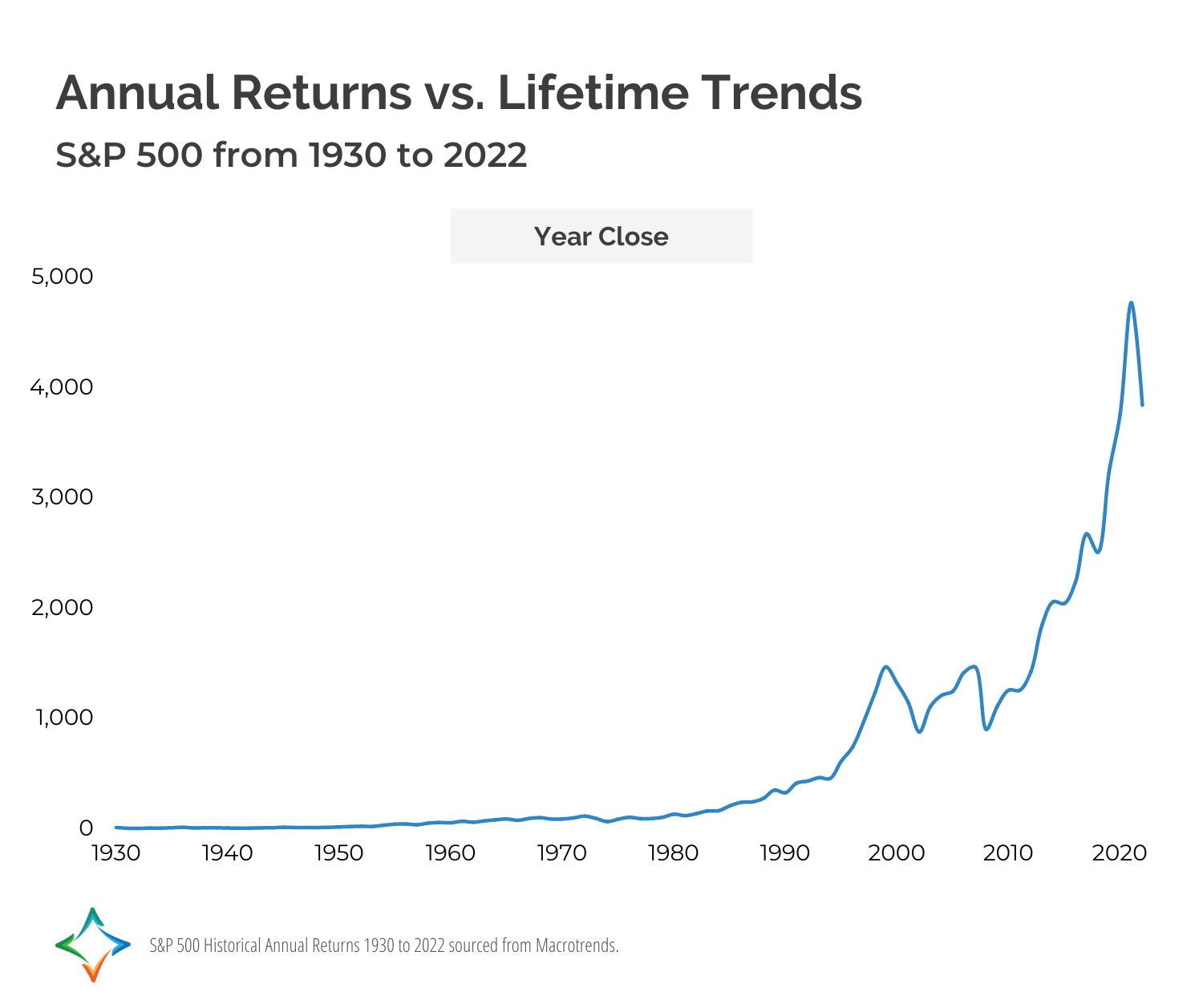

People devote their jobs to finding patterns in the data points with varying results. However, one pattern that is clear in historical data is an overall upward trend in the markets.

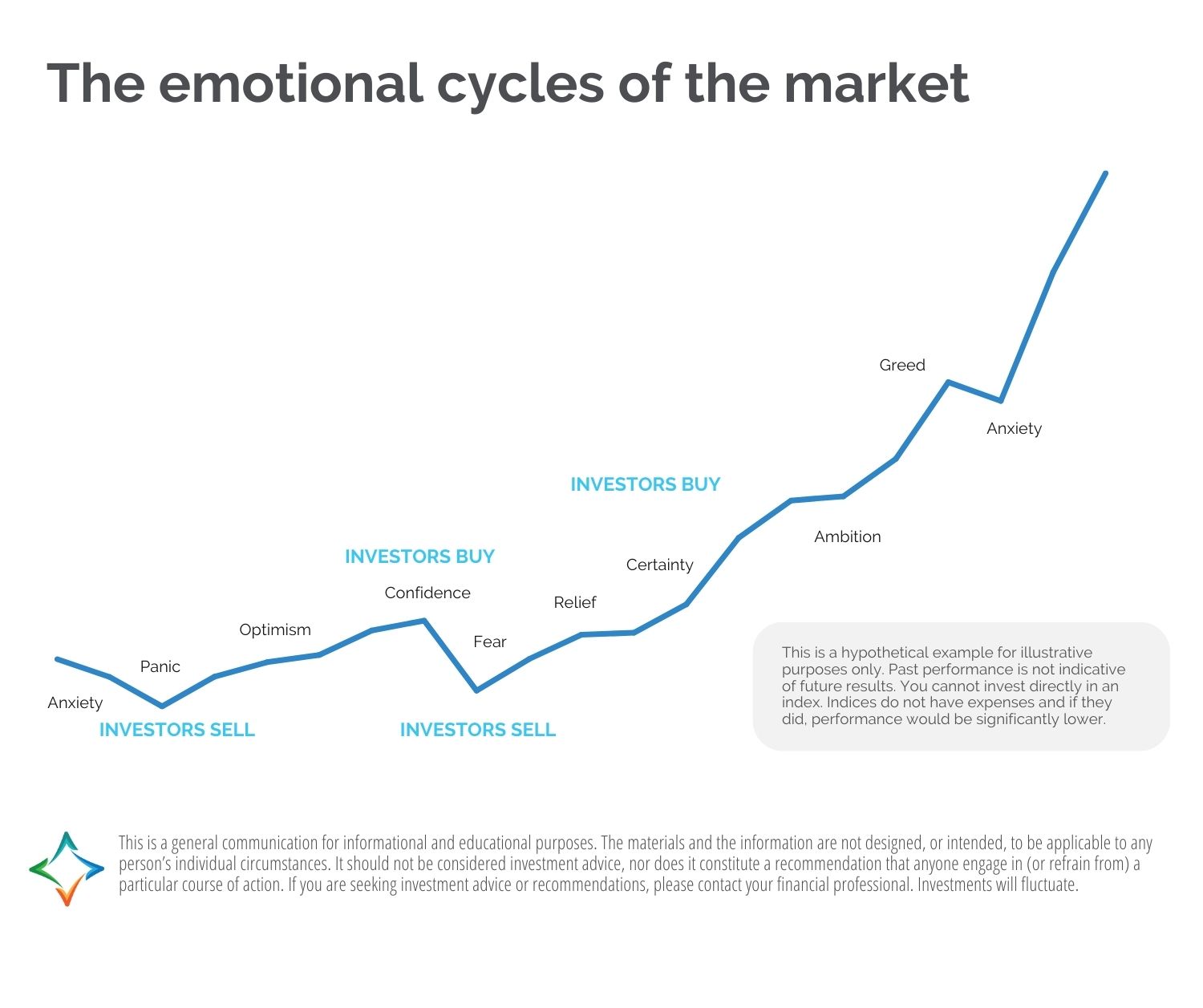

Our emotions tend to amplify the current market sentiment, leading us to believe that stocks will continue falling when they are down and rise indefinitely when they are up. However, having a long-term investment plan and sticking with it is crucial.

Regardless of annual outcomes, staying the course as an investor proves to be a wise move in the long term.

Staying the course means going against our emotions at times and thinking for the long term rather than succumbing to short-term market fluctuations. It means preparing for different market and economic conditions instead of trying to predict them. It also means recognizing that doing nothing can be the best course of action, especially if you have already mapped out your financial plan and you have a safe place to go for dollars when needed,

Not making drastic change when everything seems to be shifting around you is difficult. In most arenas, action is what gets results, not sitting still.

Thankfully, doctors understand this better than most. Just as a patient rarely sees a change in their lab results overnight, it often takes consistency of healthy habits over time to get healthy. Once the body has what it needs to recover, the patient needs to let it do the work to heal, without trying to muscle through.

A similar thing happens with investing. Once you have a financial plan, all the pieces are in place for an overall upward trajectory, regardless of short-term results. Even when the investor isn’t making big shifts in allocation, the plan and portfolio are doing work for them to build and protect and wealth.

Keeping in mind these five strategies for investment success are helpful as market changes tempt us to change our habits:

1. Embrace long-term thinking

As a physician, you often have a more complex financial situation than the average investor. With this, it’s important to have a long-term perspective when it comes to your investments and how these balance with your debt repayment strategies and income protection.

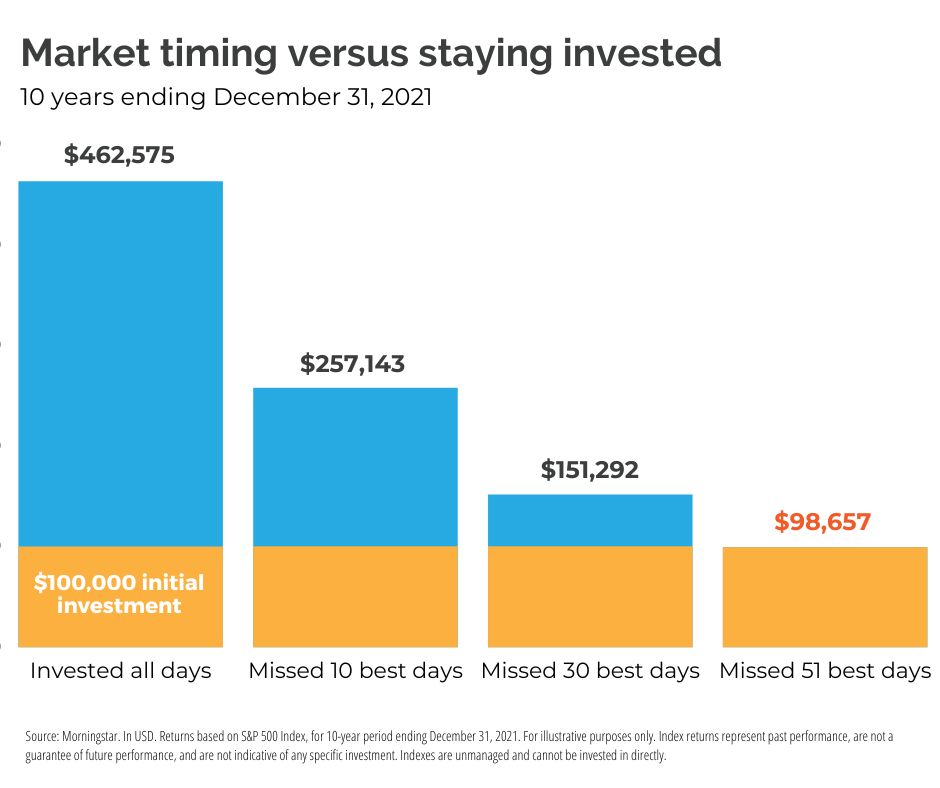

Do not base your investment decisions on short-term market fluctuations or attempt to time the market. Instead, make sure to stick to your financial plan centered long-term financial goals.

2. Control your emotions

Market volatility can trigger emotional responses, making it tempting to make impulsive investment decisions. Recognize that emotions can cloud judgment and lead to poor outcomes. Stay disciplined and avoid making hasty changes to your investment strategy based on short-term market movements.

3. Have a solid financial strategy built on your unique goals

Using a values-based financial planning framework, you can design an investment strategy that accounts for your goals, risk tolerance, and long-term goals for your life and money.

Your investment strategy should be based on sound principles and consider diversification, asset allocation, and a long-term perspective. To your plan even during periods of market uncertainty, consider working with a trusted professional who can help ground your decisions when emotions are high.

4. Avoid frequent portfolio changes

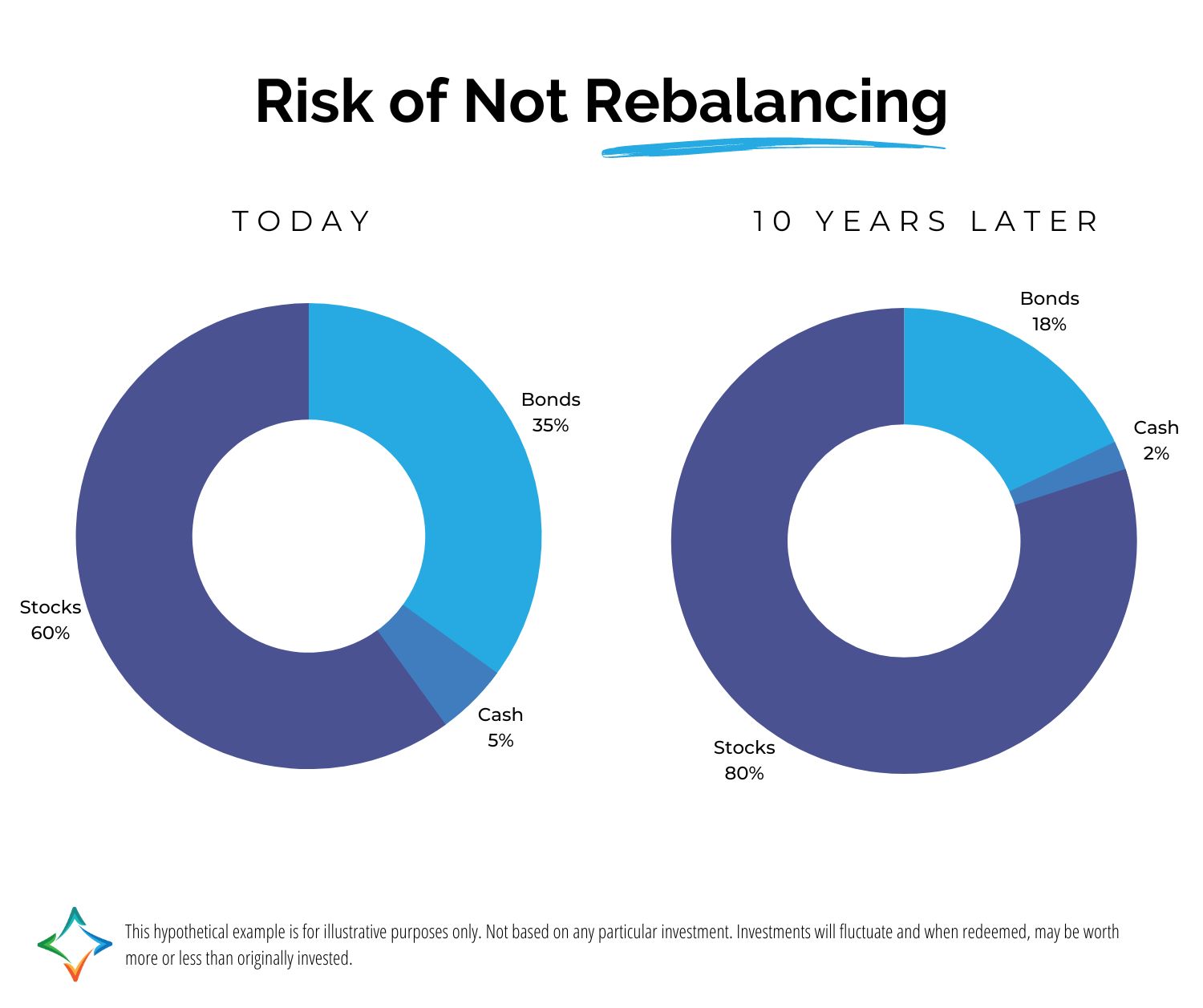

Constantly tinkering with your investment portfolio in response to market news or trends can be detrimental to your long-term returns. Resist the urge to make frequent changes and instead focus on a well-diversified portfolio that suits your investment objectives.

Remember, sticking to a strategy doesn’t mean you never make changes to your portfolio allocation. Annual rebalancing helps you stick to your investing strategy even as accounts grow at varying rates.

Additionally, as you approach retirement and decumulation, your risk tolerance will shift to make sure you have money available to use as income when you need it.

5. Trust in the power of patience

Investing is a long-term journey, and patience is a virtue. Avoid trying to time the market or chase short-term gains, as this usually leads to losses overall.

Trust that over time, markets tend to rise and generate positive returns. Stay committed to your investment plan and have faith in the potential growth of your portfolio over the long run.

In closing…

The difficulty of predicting market movements and the importance of staying the course as a physician investor is highlighted by the historical trends in the market.

Our emotions often lead us to make poor decisions based on short-term market fluctuations, but having a long-term investment plan and resisting the temptation to make frequent changes to your portfolio can be key.

Often putting in more effort or trying harder in investing doesn’t necessarily lead to better results. Less or nothing at all is often the best approach for most physician investors after a specialized comprehensive plan is carefully put in place.

P.S. Staying the course doesn’t mean ignoring all current events! While a financial plan is based on your long-term life and wealth goals, which are rooted in your values that are unchanging, breakthroughs in legislation are times you may want to update how you implement your strategy to leverage new tools or policies.

The SECURE 2.0 Act changes announced late 2022 is a great example of a piece of legislation that had some positive implications for physicians looking to maximize their retirement potential. You can learn more about it in my article “SECURE 2.0 Act: How it affects retirement planning for physicians.”

1Melgar, L., Lynch, D. J., & Shapiro, L. (2022, December 30). See just how bad a year it was for your retirement account – and why. The Washington Post. https://www.washingtonpost.com/business/interactive/2022/stock-market-sp500-down-this-year/