SECURE 2.0 Act: How it affects retirement planning for physicians

During the 2022 holiday season, Congress passed SECURE 2.0 Act while President Biden signed it into law just before the new year. This new legislation, which follows and builds on the Setting Every Community Up for Retirement Enhancement (SECURE) Act of December 2019, is designed to encourage Americans to save more for retirement, improve access to retirement savings options, and add flexibility for current savers.

While the provisions in the act will take some time to go into effect, understanding the changes, especially those that relate to you, can help you prepare for the necessary shifts in your own retirement strategy.

Table of contents

- Qualified student loan payments are treated as employee retirement contributions for employer-matching purposes

- Larger catch-up contributions

- Delayed required minimum distributions

- The option of rolling unused 529 funds into a Roth

- Flexibility for employers wishing to offer matching Roth contributions

- Long-term part-time workers qualify for retirement plans more easily

Retirement match for paying down student loans

2024, BASED ON ELIGIBILITY

Starting in 2024, employers will be able to “match” employee student loan payments with matching payments to a retirement account.

This is most certainly the biggest difference-maker for physicians.

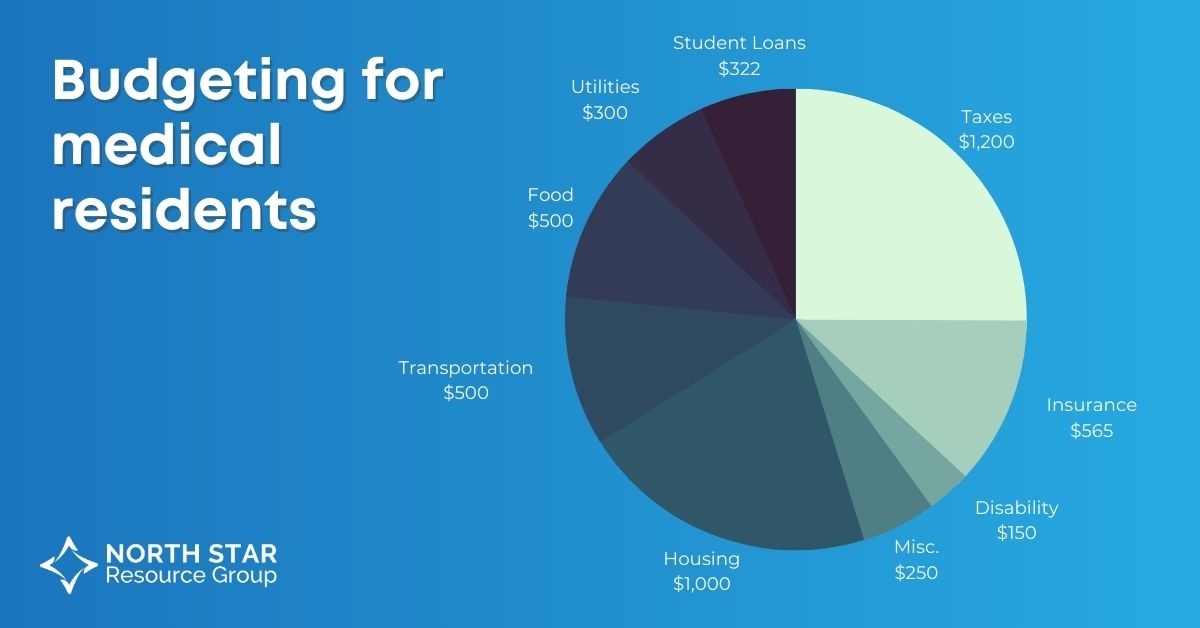

For decades, medical professionals have had to choose between paying off their student loans or preparing for retirement, especially in residency when your income is lowest.

Yes, a salary in the medical field increases drastically once training is complete, and even those who didn’t save early on can catch up later in their career. However, this strategy does mean you were missing out on two key areas to earn “free” retirement money: Employer matched funds and compound interest.

With this legislation, student loan payments will count toward employer match, meaning you can hit your retirement goals more efficiently, putting less pressure on your future self to max out your accounts.

What does this mean for you?

While this change does not come into effect for another year, you should reevaluate your retirement and loan repayment strategies now to ensure you are allocating your income in the best way possible for your future.

I will be working with my clients to check if their employer will be offering this match benefit to their residents and attending physicians, and then using financial planning software to determine what changes to retirement contributions and student loan repayment amounts mean for future wealth-building potential.

Larger catch-up contributions

2025

Starting in 2025, maximum limits for contributions to employer plans will rise to allow them to catch up for years in the past that they perhaps couldn’t contribute as much.

Additionally, these catch-up contributions will be tied to inflation starting in 2024, allowing retirement savers to keep up with rising costs of living—a welcome shift following the inflation rates of the last two years.

However, for high earners, these catch-up contributions will need to be made in Roth accounts.

The age-old question of Roth or Traditional is typically answered by, “When will your income be the highest?” Plus, those taxes may very well be at a lower rate than they would be during your peak earning years.

Since most attending and in-practice physicians fall into this high-income category (over $144,000 a year), they can’t fund a regular Roth IRA. Instead, if advisable, we do a backdoor Roth IRA contribution or fund a “Roth Alternative” strategy if they have too much in a previous employer IRA account.

Both strategies are designed to prepare you well for retirement while minimizing your tax burden now and on distribution.

Backdoor Roth conversions allow you to move your nondeductible traditional IRA contribution to a Roth IRA, regardless of your income level. If done correctly, a backdoor Roth conversion would not have additional tax consequences.

What does this mean for you?

If you are looking to max out your retirement contributions before retirement, follow up on contribution limits at your annual financial planning review. If you are my client, we already have this on the agenda.

Along with updating your estimated contributions before your retirement date, we will also factor in growth and taxes during distribution, both of which will be impacted due to the new Roth rule.

Delayed required minimum distributions

JANUARY 2023

Beginning this year, anyone 73 or older will be required to make minimum distributions from their retirement account. This is a shift from age 72 in 2022, and the age will continue to increase, all the way to age 75 starting in 2033.

A required minimum distribution (RMD) is the amount of money that must be withdrawn from an employer-sponsored retirement plan, traditional IRA, SEP, or SIMPLE individual retirement account (IRA) by owners and qualified retirement plan participants of retirement age.

Account owners can delay taking their first RMD until April 1 following the later of the calendar year they reach age 73 or, in a workplace retirement plan, retire. RMDs are taxable income and may be subject to penalties if not taken.

However, the penalty for not taking an RMD will decrease from 50% to 25% moving forward and could be reduced even further to 10% if the account owner withdraws the RMD late and submits an amended tax return.

Finally, beginning in 2024, RMDs from employer-sponsored Roth accounts will no longer be required.

What does this mean for you?

Raising the age for RMDs allows more flexibility for allowing dollars to grow tax-deferred. However, taking more significant distributions later in life will also mean greater tax liabilities.

As with any retirement strategy, tax-efficient growth and distribution should be considered. A tax-diverse portfolio will continue to be an advantage for investors and a financial advisor will be essential to make the most of large retirement balances.

Read More: How to Balance Your Retirement Strategy to Maximize Growth and Minimize Taxes

New rollover options 529 Plans

2024

529s have long been one of the best options for tax-efficient college savings. They offer potential state tax deductions or credits for contributions, tax-free growth on investment earnings, and no federal taxes on withdrawals used for qualifying education expenses.

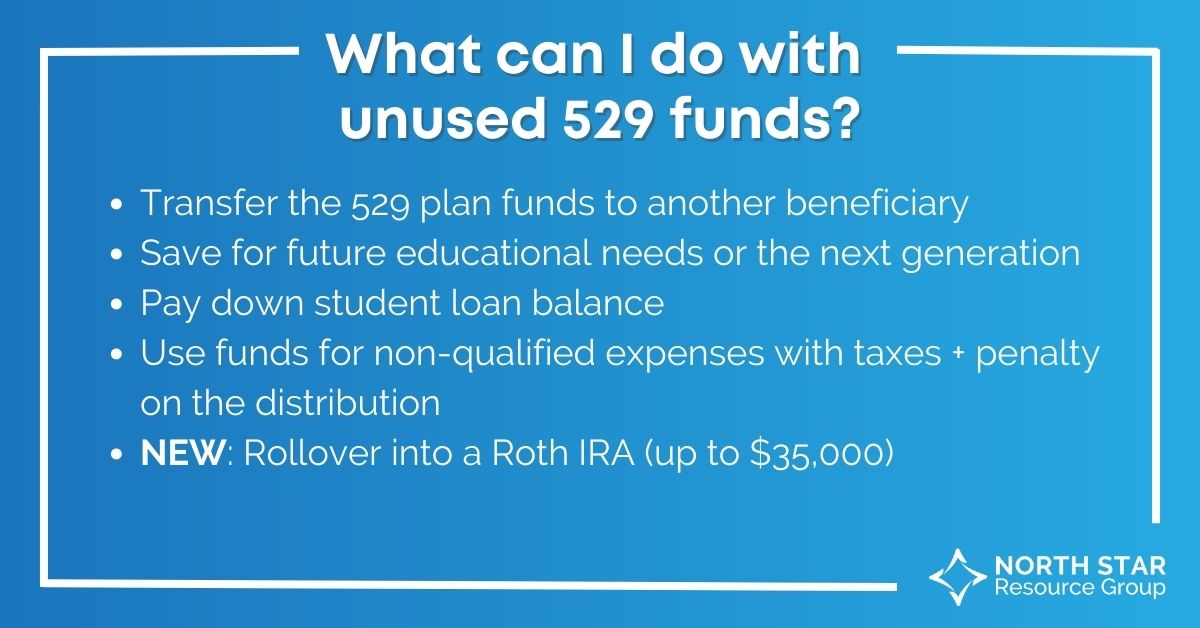

The main concern has been with if the child chooses not to attend college. Before Secure 2.0, you could use the balance for trade or vocational school, transfer to another family member, or withdraw for nonqualifying expenses with a federal and state tax plus 10% penalty on the earnings portion of the withdrawal.

Now, as soon as the dollars in the 529 plan are 15 years old, they can be transferred tax-free into a Roth IRA for the beneficiary with a lifetime limit of $35,000.

Important to note is that you must count the rollover toward the usual annual IRA contribution limit ($6,500 in 2023), meaning the rollover would need to occur over a number of years. Still, this allows you to receive a tax advantage on those funds earmarked for the future, whatever that future may hold.

What does this mean for you?

For those clients who are starting to save for loved ones’ futures, the drawbacks to a 529 are now exceptionally minimal. Since even the rollover is tax-free, you are receiving all the tax benefits of a 529 with fewer drawbacks for any funds up to $35,000.

If you are starting the path toward saving for college or are interested in moving earmarked funds into a 529, contact me to get started. Likewise, if you have a loved one who chose to forego formal education (including trade or vocational school), and has unused 529 funds, let’s talk about the potential for a Roth conversion.

Matching Roth contributions

2024

Historically, if a company wished to offer vested matching contributions to employees’ retirement accounts, those contributions could only be invested into a traditional IRA with pre-tax dollars.

Now, when employers offer Roth account options to their employees, they will also be able to provide matching contributions to those accounts.

It may take some time for payroll and plan providers to catch up to these changes, but the difference offers a welcome new option to help employee savings grow tax-free.

What does this mean for you?

If your employer wishes to offer this option, you will have an additional choice regarding retirement contributions. The choice between Traditional or Roth contributions will continue to rely on your tax strategies now and for future distributions.

Long-term part-time workers qualify more easily

2024

Under current law, employees with at least 1,000 hours of service in a 12-month period or 500 service hours in a three-consecutive-year period must be eligible to participate in the employer’s qualified retirement plan. SECURE 2.0 reduces that three-year rule to two years for plan years beginning after December 31, 2024.

What does this mean for you?

With burnout in the medical field at an all-time high following COVID, work-life balance is a real concern. While most will continue to work well over 40 hours a week, this new provision means solid retirement plan options could still be available for those who choose to cut back.

As with any significant change to your workload or income, being able to project out what a decision could mean for your financial future can alleviate much of the uncertainty and anxiety associated with the decisions. Having a solid financial plan to start with makes it possible to see how these “what-ifs” may or may not affect long-term goals.

The bottom line

As with any new tax or financial legislation, the possibilities and questions are many and only multiplied when you consider applying the changes to your own situation. Sitting down with a financial advisor to walk through how each of these changes can affect your individual strategy can be extremely helpful for feeling like you are on the right track and making the most of new opportunities.

Whether you are just starting residency or are a practicing physician nearing retirement or anywhere in between, if you have questions about how the SECURE 2.0 Act changes come into play in your financial story, don’t hesitate to reach out. The first meeting with me is always free and with no obligations. I am here to help!

– James

|

Download our free, no-obligation Retirement Checklist!

|

5483057/DOFU 3-2023