What Has Happened in the Markets During Election Years?

Elections and volatility are coming….

Elections are divisive and unsettling. It can sometimes feel like the world and our futures hang in the balance.

No wonder most investors feel they should do something.

“If the other party wins, my portfolio is going to tank! I’m just going to get out of the market until this blows over.”

Is that a good strategy?

Capital Group, owner of American Funds, is an investing giant who’s been in the business since 1934. They analyzed investor behavior and stock market outcomes over the last 90 years across 23 election cycles, and here’s what they found.

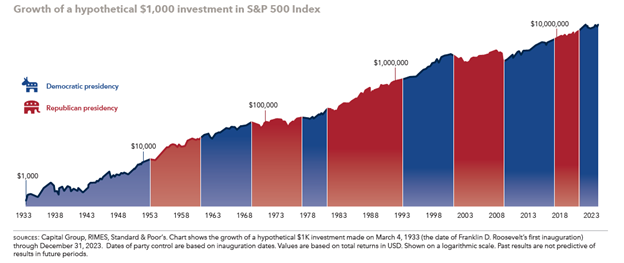

Which party has been better for investors?

This is the question people seem to love. They want to know that their side is better.

Historically, though, the truth is that it hasn’t mattered who won when it comes to long-term investment returns.

It’s never been a question of when to invest, but how long you stay invested. $1000 invested in the S&P 500 when FDR took office in 1933 would have grown to about $21 million today. Since then, there have been eight Democratic and seven Republican presidents.

So what usually happens during election years?

Volatility.

Markets don’t like uncertainty, and the primary season of an election year brings about lots of it, as candidates each argue their case for new policies and solutions to the issues of the moment.

The up and down swings can be uncomfortable, but it may be useful to view that volatility as an opportunity, rather than something to fear. This can be an opportunity to buy great companies at fair prices.

After each party has selected their candidate, we see markets typically resume their long-term upward trajectory. The patient investor is rewarded for their steadfastness.

Which mistake do investors often make in election years?

Candidates are incentivized to fearmonger and exaggerate about what might happen if the other party gets elected. Feeling anxious about an election is completely normal.

But allowing those feelings to dictate long-term investment decisions isn’t wise.

Historically, though, we’ve seen investors do exactly that.

Here’s the strategy you’ve probably heard someone say or thought of yourself: “Let’s just wait this year out—it’s going to be crazy. Once things settle after the election, I’ll invest my money.”

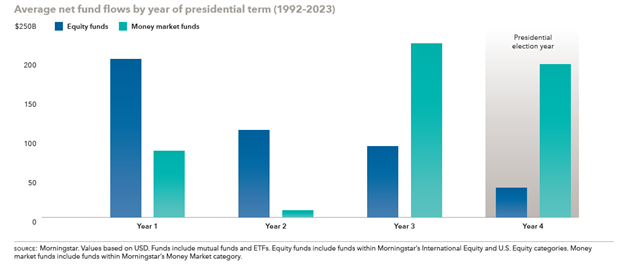

This seems pretty reasonable, and as you can see below, that has been the most common behavior observed during election years.

The dark blue line shows the average amount of money invested in stock funds. The green line shows the amount invested in relatively safe money market funds.

What this chart shows is that every four years, as we enter a new presidential election cycle and as we get closer to that election, investors invest less in stocks and instead place their money in cash to wait it out.

So what have been the best ways to invest in an election year?

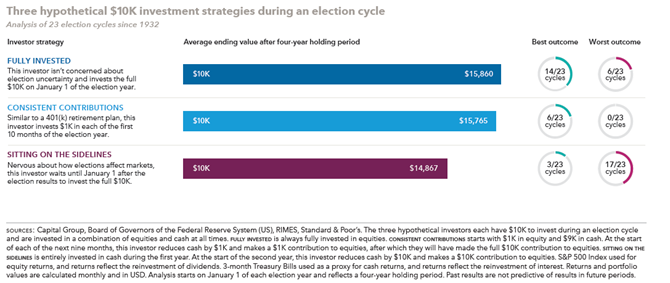

Since 1932, there have been 23 election cycles and the “wait and see” approach barely ever beat out simply staying invested.

To see this, let’s imagine three different investors.

One simply keeps their money invested. The elections are stressful enough as it is, so they decide to leave their portfolio untouched and go about their life.

The second person invests a constant amount each month as the year goes on. They hope to naturally take advantage of whatever market conditions present themselves.

The third says this time is different. They hold their money as cash until the election is over. They invest their money on January 1st of the following year once things have settled.

As you can see below, out of the three strategies, sitting on the sidelines has performed worst in 17 of the 23 election cycles. It was the best strategy 3 of the 23 election cycles. Being fully invested or investing over the course of the year usually resulted in the best outcomes.

The bottom line is that allowing politics and emotion to dictate when and how you invest is almost never a good strategy.

Instead, we must focus on defining and planning for our long-term goals.

Building a diversified portfolio of great companies that give us the best chance to fund those goals.

Holding on to and adding to those holdings for decades.

Tuning out the noise in the meantime, whether it’s an election or a hot new stock.

Sticking to the plan and spending the time we save with our family and friends instead of sitting in front of a computer screen trying to time the market.

Calvin McKenney is a Financial Advisor offering securities through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. 10261 YELLOW CIRCLE DRIVE, MINNETONKA, MN 55343. 952.908.2500

This material attached being provided by Registered Representative Calvin McKenney and written by Capital Group, a non-affiliate of Cetera Advisor Networks LLC.

All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful. Past performance is not an indication or guarantee of future results.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

The views stated in this letter are not necessarily the opinion of Cetera Advisor Networks LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.