Invest the Opposite of Everyone Else

However your friends are investing, consider doing the opposite.

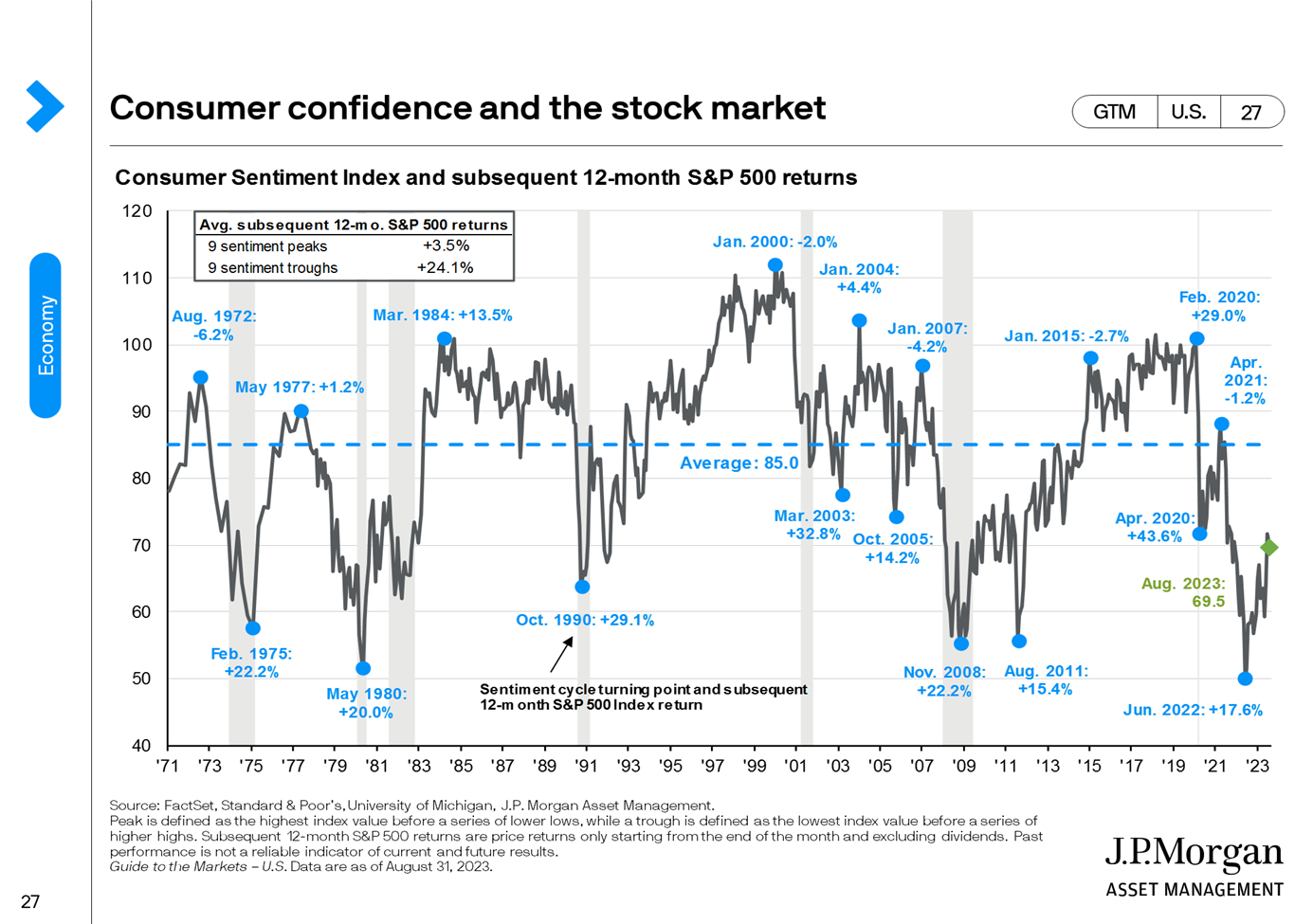

The graph below shows the weird inverse world of how everyone feels about the economy and how to invest in it.

What you’re seeing is the relationship between consumer sentiment and the subsequent year of stock market returns as measured by the S&P500.

Consumer sentiment is represented by the University of Michigan Consumer Sentiment Index. This is a 50-question telephone survey of about 500 or more people. Essentially it gauges how people are feeling about the economy right now.

The interesting thing is that the better people are feeling about the economy, the worse the stock market has performed over the next 12 months.

And the reverse? Yup – the worse we felt about the economy, the better the stock market performed in the next year.

What’s important is to visualize how this plays out in our everyday investment lives.

During euphoric periods in the market, everything can seem to be going up in value. Everyone around you may seem to be taking huge risks and getting rich quickly.

So what might this drive you to do? Search for the most speculative and risky investments and buy them to get on the hype train.

What happens next? Often, that speculative bubble comes crashing down, and you can be left holding the bag.

What about on the way down, when everyone around you is talking about the next recession or depression coming?

Your friend just read an article on CNBC that told him to move his money to gold because the U.S. is about to lose its reserve currency status!

What do you do?

Well, it may seem rational to flee to safety. Consider waiting this one out until things get better.

What could end up happening? The market starts going up. But you don’t buy in, because you’ve convinced yourself the economy and market are going to come crashing down. But wait, the market is still going up.

Oh boy, now you feel like you’re missing out. You hop back into the market, but not after missing the first 20% of its gain.

These are hypothetical examples, but they illustrate one of the main problems investors face and that a good financial advisor should help you avoid.

Instead of following the crowd, we stay focused on our goals and the plan we’ve built to get there. We focus on buying good companies and holding them for the long term.

If the market goes up – great! We stay the course and don’t fall for any get-rich-quick schemes because we know the reliable way to build wealth is slowly.

And if the market goes down – great! It’s an opportunity for us to buy those same companies we love at cheaper prices.

All the while we can stop the constant whipsawing from following the crowd through its erratic ups and downs and being left off more stressed and worse off as a result.

The S&P 500 is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The situations depicted are hypothetical only, and do not represent the actual performance of any particular investments or strategy. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful.

The views stated are not necessarily the opinion of Cetera and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

Investors should consider their financial ability to continue to purchase through periods of low price levels.