Hyperinflation of 1000 Percent

“Hyperinflation of 1000% is coming soon.”

“We’re headed for another Great Depression.”

“The market is going to collapse in the next year.”

Did I catch your attention?

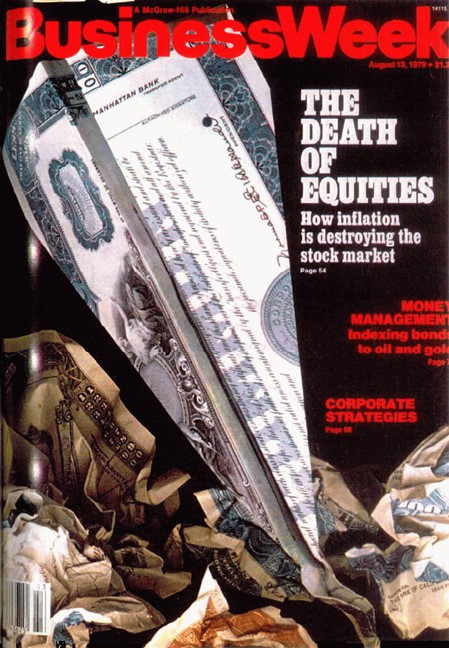

As the journalism axiom goes, if it bleeds it leads. Our brains are wired to pay attention to potential danger, and the news preys on that to keep us clicking.

Here’s a couple facts that explain the problem most investors face. There is a never-ending amount of negative headlines from serious people published in reputable newspapers about the economy and market in the news.

Pair that with the fact that the market has had intra-year declines of an average 14% every single year.1 Meaning at some point, your portfolio would have been down 14% from its most recent high.

Can you see the problem? If you just saw some Harvard economist on CNBC say we’re headed to a Great Depression hellscape you’re going to listen. Then imagine if a month later your portfolio drops 14%.

What might you do?

Panic and sell.

Meaning you’ve just locked in your losses and taken yourself out of whatever market recovery may come next.

This isn’t to say that bad things don’t happen in the economy. They do. Recessions happen. Pandemics happen. Banks fail. Inflation flares up. There are always problems to fix.

It’s completely natural to feel anxious during these times – that is okay.

The difference is what to pay attention to and what to do about it.

You’re probably reading this on a device that would be science fiction to someone 30 years ago.

In 1950, 24.7% of children globally died before their 5th birthday. Today that number is down to 3.8%.2

Artificial intelligence is successfully passing the Bar Exam.

The average life expectancy was 47 in the year 1900. Today many are starting businesses, running marathons, or establishing families at 47.3

You can have your DNA analyzed for a couple hundred bucks without leaving your house.

In 1905, a Vermont Doctor and his chauffeur were the first to successfully drive a car across the country from San Francisco to New York. It took them 63 days. Today you can fly cross-country in a matter of hours for a few hundred dollars all while enjoying a movie.4

We’d argue that you pay attention to the preponderance of history. That, throughout its ups and downs, the United States and its largest corporations persevere, innovate, and thrive. Investing money alongside that progress has been a great way to build personal wealth.

So the next time you read some click-bait article maybe you’ll laugh, or maybe you’ll feel stressed. But you’ll also remember to think carefully before making any decisions based on those gut feelings.

1“Annual Returns and Intra-Year Declines.” Welcome, am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/guide-to-the-markets-slides-us/equities/gtm-annualreturns/. Accessed 6 Nov. 2023.

2United Nations Inter-agency Group for Child Mortality Estimation (2023); Gapminder based on UN IGME & UN WPP (2020)

3PPI, Wharton. “Mortality in the United States: Past, Present, and Future.” Penn Wharton Budget Model, Penn Wharton Budget Model, 19 Dec. 2018, budgetmodel.wharton.upenn.edu/issues/2016/1/25/mortality-in-the-united-states-past-present-and-future.

4Posted April 26, 2018 by Ben Carlson. “50 Ways the World Is Getting Better.” A Wealth of Common Sense, 18 Jan. 2019, awealthofcommonsense.com/2018/04/50-ways-the-world-is-getting-better/.

The views stated are not necessarily the opinion of Cetera and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice, Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.