Broadening our Perspective to Avoid Financial Pitfalls

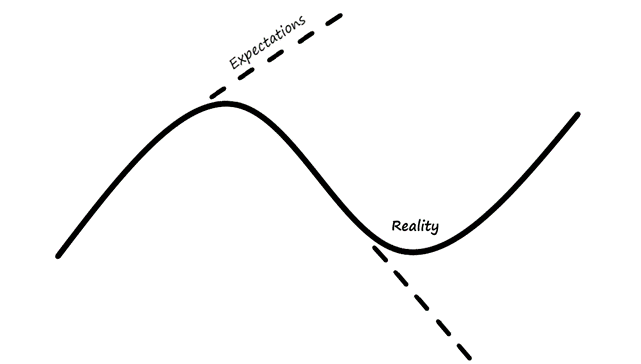

An all too human problem we all face is taking a recent phenomenon and projecting it indefinitely into the future.

An all too human problem we all face is taking a recent phenomenon and projecting it indefinitely into the future.

The Minnesota Vikings win a few games in a row and all of a sudden, I find myself visualizing the “real” possibility of a Super Bowl run.

With a news cycle that continues to get faster and faster, our memories of the recent past have only gotten shorter and shorter. Our ability to recall a problem that came and went 10 years ago is almost impossible, as our attention is being whipsawed by whatever crisis or fad is trending on Twitter.

When things are going horrible and the news is filled with stories about layoffs and your portfolio is down, it’s easy to think this will go on forever. “I lost X percent this year; if this goes on for much longer, I won’t have any money left!”

The same applies when times are good. If you’ve received a bonus and a salary increase every year for the last five years, it can be easy to begin spending next year’s salary before you’ve even received it. If a surprise occurs like say, instead of a bonus, you’re laid off, you can find yourself in a very unpleasant position.

This is what psychologists call recency bias, which means overemphasizing the importance of recent experience when estimating the probability of future events.

Luckily for you, there’s a cure!

All it takes is to broaden our definition of the recent past and to expand the amount of experiences worth considering.

When you’re feeling like you’ll never stop receiving pay increases or bonuses, it’s worth stepping back and thinking about the times when you, a family member or a friend were unexpectedly laid off. We all have these stories, and they can remind us how quickly and unexpectedly things can change.

When your investment portfolio declines by 20% in a year and it feels like the world is collapsing around you, it may be helpful to know the context. A quick Google search would tell you that, since 1953, the stock market has declined by 20% or more once every six years.1

This isn’t to say you shouldn’t be excited or anxious about the future. Bonuses are great and down markets are not.

But expanding the lens through which we make our financial decisions can provide more context, and may give us a better chance of not falling into the same traps again and again.

And it may be the catalyst for us to adequately prepare for whatever the next surprise life has for us.

1“What Past Stock Market Declines Can Teach US.” Capital Group, www.capitalgroup.com/individual/planning/market-fluctuations/past-market-declines.html. Accessed 4 Dec. 2023.

*The opinions contained in this material are those of the author, and not a recommendation or solicitation to buy or sell investment products. This information is from sources believed to be reliable, but Cetera advisor Networks LLC cannot guarantee or represent that it is accurate or complete.

**Investment advisor representative of Cetera Advisor Networks, LLC. Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.