Should you invest in large or small cap stocks?

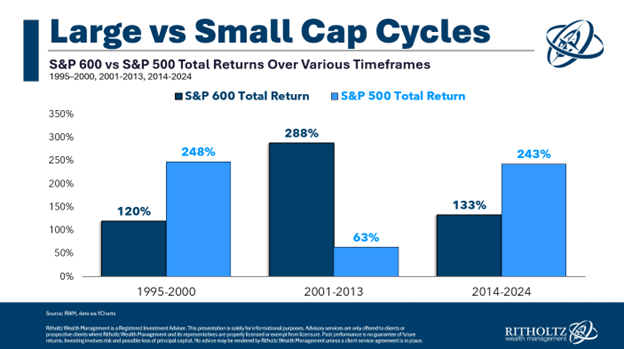

Since 2014, large-cap stocks have outperformed small-caps by 110%.

You may be wondering, “What is a large or small-cap stock? What does this have to do with my portfolio? Which should I invest in?”

“Cap” is short for “market capitalization,” or the market value of a company. This is found by multiplying the number of shares outstanding by the current market value of one share.

As defined by S&P, a large-cap company is one that has a market cap of $18 billion or greater. This is commonly tracked by the S&P 500 index. A small-cap company is defined as having a market cap of $7 billion or less (can you guess where a mid-cap company falls?).

S&P has an index to track a basket of these smaller companies called the S&P 600.

Large-cap companies are led by behemoths, some of which are valued at over $3 trillion as of writing this. Some of the largest holdings in the S&P500 are Microsoft, Nvidia, and Apple.

Small-cap companies are a mixed bag of names you may know, like Abercrombie, SPS, and Robert Half, and many you’ve never heard of.

The return of the stock market has been dominated by these tech giants as of recently.

Many question owning anything else but these giant companies. They dominate their respective industries and continue to expand their empires.

“____ sector of the market has gone up the most over ____ period of time, let’s just buy that!”

But despite this recent outperformance, what would you guess the performance of large and small caps has been since the creation of the S&P 600 small cap index in 1994 through May of 2024?

S&P500: 10.7%

S&P600: 10.7%

So, despite cycles of outperformance, both indexes have ended with about the same return. To me, this reinforces the importance of diversification and rebalancing.

Accurately predicting and timing winners and losers is hard. So, owning many different companies, large and small, can be prudent. This puts you in a position to profit from whoever the future winners are. But not too hurt by any one company or sector doing especially poorly.

Rebalancing is the ongoing process of incorporating investing wisdom into your portfolio. That wisdom is that the companies dominating today may not dominate tomorrow. And the losers of today may be the winners of tomorrow.

So we periodically take profits from our winners to buy shares of the losers. Buy low, sell high as they say.

Like what you read? Join my newsletter to get a small dose of personal finance concepts delivered to your inbox twice a month!

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing. Past Performance does not guarantee future results.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Calvin McKenney is a Financial Advisor offering securities through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. 10261 YELLOW CIRCLE DRIVE, MINNETONKA, MN 55343. 952.908.2500