Emotional Investing: The Herd is Often Wrong

Do you remember how frantic it felt to invest in 2020 and 2021?

Millions of people couldn’t download one of those trading apps fast enough.

The stock market was going up, your friend was getting “rich” trading stocks, the market pundits were elated with talks of a bright future, and you sure didn’t want to be left behind.

How do you feel about investing now?

The stock market is going down, your once “rich from stock trading” friends are now complaining about their 401(k) balance, the market pundits now prophesize about economic ruin from inflation and war. Now all you want to do is stop the pain and get as far away from investing as possible.

“Maybe sitting in cash for a while would ease the pain…”

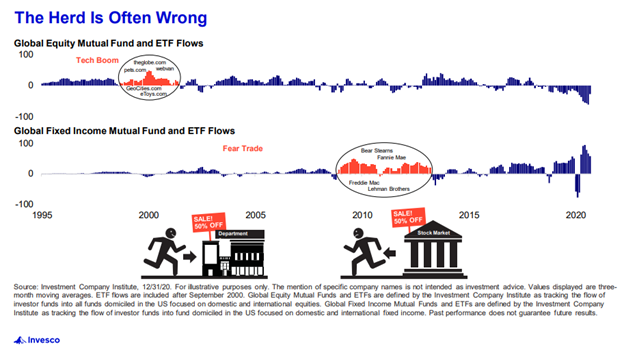

This sort of behavior is a tale as old as investing itself.

When the market is going up, fear of missing out drives us to buy as much highly appreciated stock as we can.

And when the market is going down, fear of further losses and a herd mentality makes us want to follow the rest of the crowd and stop the pain, and the easiest way to do this is to sell your investments or stop buying more.

But what have we just done? Bought high and sold low. Many investors repeat this process time and time again throughout their lives until they’re broke.

Can you imagine doing this in any other setting? You walk into Levi’s looking to buy a new pair of jeans. The salesperson says “Great! We are offering 30% off those jeans today.” And you reply “In that case, I don’t want that pair anymore. Do you have any jeans that have been marked up 50%?” That would be insane and yet we do it all the time in our investments.

There is another way to invest that avoids this up and down rollercoaster.

Take a moment to acknowledge that the past will repeat itself. There will be times of euphoria in the market when everyone seems to be getting rich quick besides you.

There will be times of market panic when it seems the world is on the brink of collapse.

And despite all that, commit yourself to tune out the headlines and invest a constant amount every month into a diversified portfolio of the world’s greatest companies.

And if you’re younger and accumulating assets, realize it’s a chance for you to own those great companies at a discount.

Millions have built wealth to fund their life’s goals with this strategy. Few have done so by trying to time the market or follow a trend that will “get you rich quick.”

Like what you read? Join my newsletter to get a small dose of personal finance concepts delivered to your inbox twice a month!

Dollar Cost Averaging does not assure a profit and does not protect against loss in declining markets. Also, since such a program involves regular investment purchases regardless of fluctuating price levels of the investment, consider your financial ability to continue purchases through periods of low price levels.

Neither asset allocation nor diversification guarantee against loss. They are methods used to manage risk.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

4784293/DOFU 6-2022