Alex Morrall, AIF®, CFP®, CPFA®

Financial Advisor

Helping you prioritize and plan for each financial goal on your horizon

Adopt healthy financial habits and thrive in life through personalized systems and strategies.

✔ Fiduciary responsibility ✔ On-call customer service ✔ Proactive support & tracking

I help you pursue your financial goals and manage money so it doesn’t control your life.

Often, when someone meets with me for the first time, they want to know if their current financial situation is aligned with their future goals, and if not, what can they do to get on track?

W H A T W E D O :

Clarify your goals and trajectory.

Clarify your goals and trajectory.

Coach on behaviors needed to reach goals.

Coach on behaviors needed to reach goals.

Personalize systems that make savings and security simple, so you can focus on your life.

Personalize systems that make savings and security simple, so you can focus on your life.

About

As your financial advisor, I serve as a counselor, coach, and project manager, pulling together every piece of your financial picture to help you get to where you want to be, when you want to be.

As your financial advisor, I serve as a counselor, coach, and project manager, pulling together every piece of your financial picture to help you get to where you want to be, when you want to be.

I take a long-term approach to financial planning, and I’ve worked with many of my clients for years, growing with them as they achieve the goals they only hoped possible in our first meeting.

This planning and service is built on a few core beliefs:

- MINDSET. Often, we carry money mindsets with us from childhood into adulthood, without an opportunity to evaluate our thinking about income, spending, and saving. I believe when your values become clear, you can establish systems to responsibly steward your resources and make progress toward what’s most important to you,

- SYSTEMS. My role is to help you construct systems to master your money and be able to do what you want in life.

- HABITS. Our financial situation dictates the decisions we make in every aspect of our life. Therefore, adopting healthy financial behaviors is a key element to thriving in life.

- SERVICE. When you have a money question and you need to phone a friend, I am here to be that friend and provide wisdom when you are facing a tough decision. When you work with me, you can expect me to care more about your financial success outside of anyone in your immediate family.

Outside of my practice, I enjoy fishing, skiing, and spending time with my wife, Sonia, and my retired sled dog, Blaze. I’m also a poet, and I even bought Sonia’s engagement ring using the prize money from a poetry contest.

I studied English at Macalester College, and I remain an avid supporter of the Macalester football program, where I was a defensive lineman in college.

Designations

CERTIFIED FINANCIAL PLANNER™ (CFP®)

CERTIFIED FINANCIAL PLANNER™ (CFP®)

To receive this designation, you must meet rigorous qualifications for advanced financial planning by meeting high education, experience, and ethical standards. As a CFP Professional, I’m able to take on the role of a fiduciary for my clients and remain committed to acting in their best interest as I deliver holistic financial planning.

Certified Plan Fiduciary Advisor (CPFA)

Certified Plan Fiduciary Advisor (CPFA)

The CPFA designation focuses on financial planning for retirement, including 401(k)s, 403(b)s, and similar plans. As a CPFA advisor, I can assist you in finding and optimizing suitable resources for planning your golden years.

Accredited Investment Fiduciary (AIF)

Accredited Investment Fiduciary (AIF)

The AIF designation is all about ethics and trust. The coursework focuses on following best practices for fiduciary service and balancing business interests against a client-first approach. The course also focuses on good documentation to avoid mismanagement of claims and conflicts of interest.

Our comprehensive financial planning process

DiscoveryIn this first meeting, I will get to know you and your family along with your priorities, fears, and aspirations. This will serve as the foundation for my financial counsel to you for years to come. At the second meeting or via email between meetings, my team will gather all the necessary financial documents to gain a full understanding of you and your family’s current financial positioning. |

PlanAfter a thorough analysis of your financial situation, I will create a plan that includes clear, actionable steps in order of priority. Then, we can discuss systems we need to establish so you can achieve each step. |

ExecuteMy team and I work with you to execute your financial plan. We will proactively reach out twice a year to catch any significant changes to your situation and adjust your plan as we work through it. As your go-to financial resource, we are also available to connect any time you have a question or significant changes occur that might impact your plan. |

See how our process integrates your personalized Asset-Map® Report.

One of the most important aspects of my process is making sure that I understand you. Helping both of us see the big picture is essential to our ongoing communication and guidance.

We build a custom Asset-Map Report for all of our clients’ households and use it throughout our interactions to make sense of priorities and intentions as well as gaps and areas of improvement.

They say a picture is worth a thousand words. We agree. We start by creating a visual experience that displays your household: who is important to you, what resources will be available—both now and in the future—to use toward your financial goals. The Asset-Map process can help us make more informed decisions about your future.

Financial services and fees

In complex financial cases, each category intersects and affects the others, requiring expertise and organization to manage your wealth efficiently.

We use cross-category strategies and vehicles to make your money work for you.

Jump to: Financial planning | Investment management | Tax planning | Estate planning | Business owner solutions | Wealth transfer | Philanthropy | Property and casualty | Medicare Supplement | Credit needs

Financial planning fees

Starting at $100/month; varies by complexity

Holistic financial planning concepts

Use advanced planning as the foundation of all your solutions, including cash flow, distribution, taxes, and legacy, all offered through flexible pricing models.

Investment management

Experienced streamlined, tax-efficient investment portfolio and put your money to work for you with growth for the long-term. We consolidate everything into one portfolio with one fee for advice and trading.

Tax planning strategies

Design a complete financial strategy that leverages efficiency and impact across the board.

Financial professionals do not provide specific tax/legal advice and information should not be considered as such. You should always consult your tax/legal advisor regarding your own tax/legal situation.

Estate planning review

Leverage advanced services to minimize taxes and maximize legacy. Our corporate trust solutions allow you to determine how assets are distributed, with researched and tax-efficient asset management.

Business owner solutions

Maximize your profitability and fortitude. Through our strategic partners, you have access to lines of credit for businesses as well as guidance on using securities as loan collateral.

Multi-generational strategies and wealth distribution

Align your goals and vision across generations. We support you through financial value conversations and provide education to ensure the continuation of ideals.

Philanthropic endeavors

Give strategically and streamline record keeping through donor-advised funds. We stay aware of current laws and alternative donation options to help maximize contributions and tax deductions.

Property and casualty insurance

Receive individualized guidance on protecting your physical assets. Our independent agents locate redundancies and vulnerabilities in your existing policies and can consult on protection for unique scenarios.

Medicare Supplement guidance and resources

Simplify your healthcare choices and make Medicare work for you. Our independent consultants establish solutions that allow you to free dollars from medical expenses.

Credit needs

Access financing options designed for your needs with jumbo mortgages, flexible lines of credit, and other customizable options.

Team

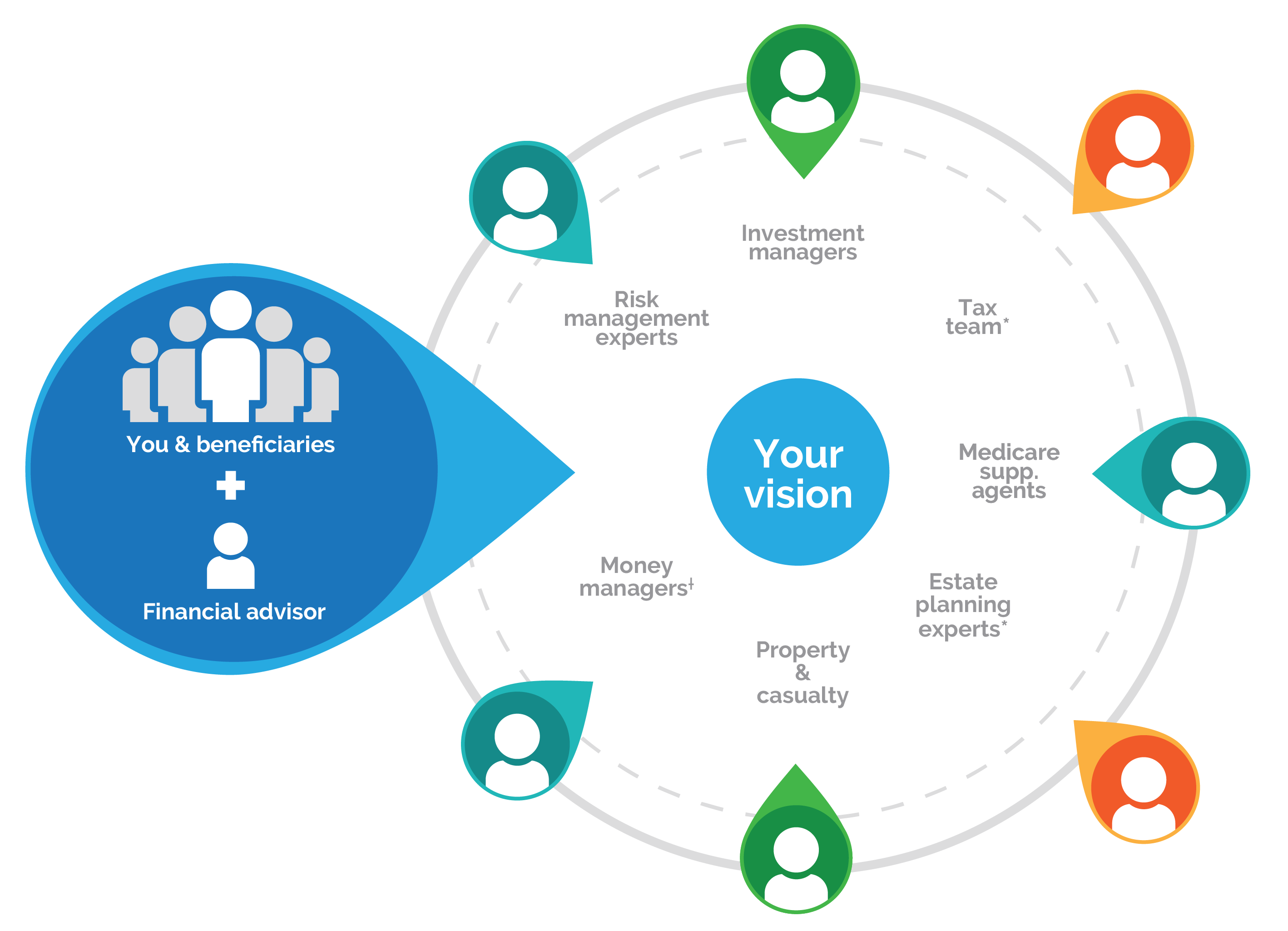

When working with me, you’re not just working with me. Rather, you’re working with a team of financial strategists who I consult with.

Serving as your financial coordinator, I work with our team of specialists to synchronize your wealth solutions to find inefficiencies and resolve them.

As an independent firm, we work around your plan, not any one product, in a true consulting relationship. With any recommendations we provide, we offer resources and education, while you hold total decision-making power.

CPA and attorney referrals

I also work hand-in-hand with a network of CPAs and attorneys whom I regularly refer to based on clients’ needs. I am also happy to collaborate with outside professionals with whom you have an existing relationship, bringing them into this strategic approach.

Investment advisor representative of Cetera Advisor Networks, LLC. Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.