My Beef With Growth Hacking

I have beef with growth hacking…

OptinMonster defines growth hacking as, “…an umbrella term for strategies focused solely on growth. It is usually used in relation to early-stage startups who need massive growth in a short time on small budgets.”

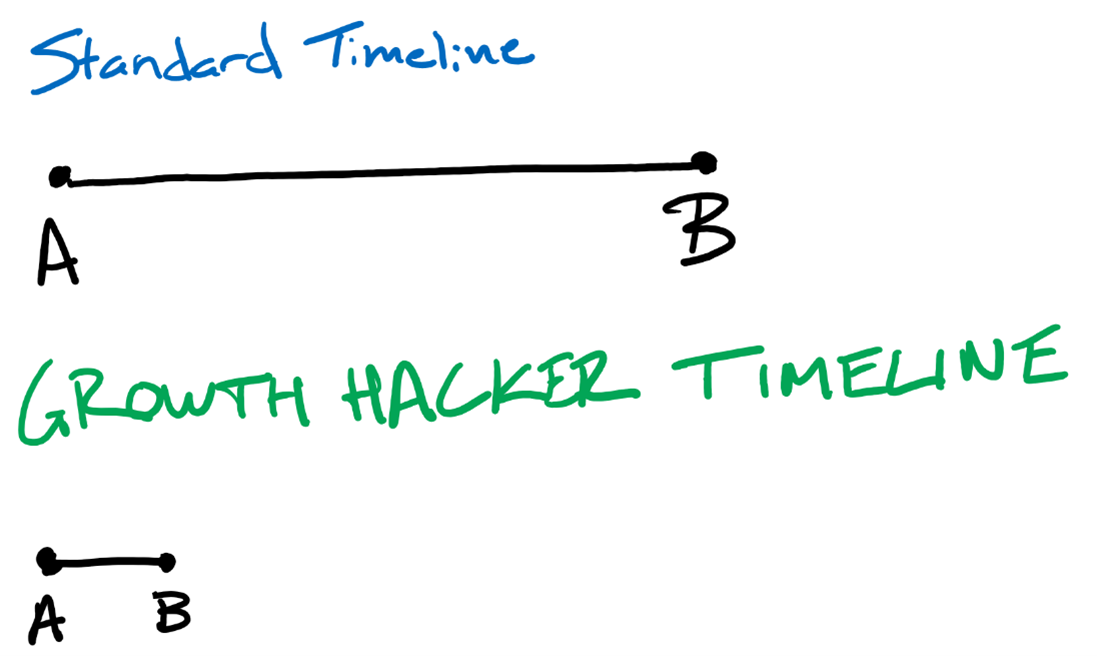

Graphic representation of growth hacking below:

This timeline doesn’t only exist in business but shows up across our “get results now” culture. We’re told we can achieve our dream body in 30 days, become an overnight success in our business or career, and achieve personal financial freedom in a few short years.

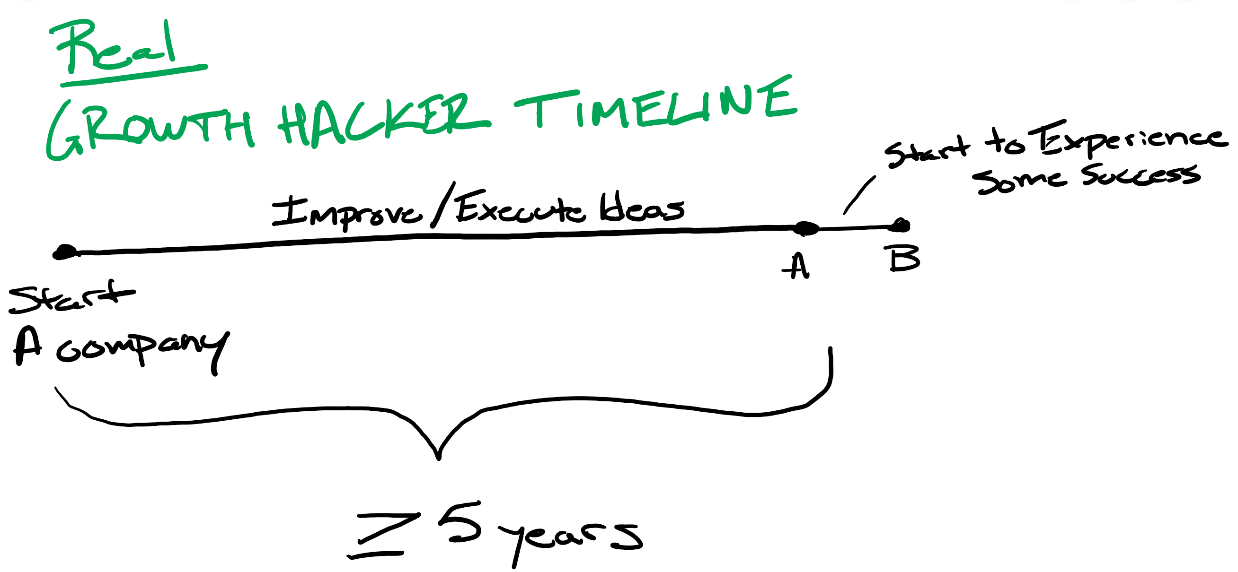

Anecdotes highlighting such myths show up across mainstream media, social media, and even in our own networks. But maybe we aren’t seeing the whole picture. Most successful growth hacking timelines probably look more like this:

Real results are derived from years of consistent action. Too often, as outsiders, we only see the first growth hacking timeline and we don’t see the years of disciplined effort it actually took to achieve the result. Time is a necessary ingredient in the achievement of growth in any area of our life: personal, professional, physical, spiritual, etc.

As someone working to improve myself and grow a business, I hear the siren song of growth hacking. It’s easy to think, “how can I find a shortcut to reach my goals?” However, I’m learning to shift my focus to the enjoyment and appreciation of the work I have the opportunity to complete on my journey. A stance of gratitude shifts my thinking from “I have to do this work” to “I get to do this work.”

I see a growth hacker mindset show up in my work as a financial advisor as well. I help my clients invest their money to progress towards their long-term goals. Overnight success is rarely achieved when investing. It takes years of disciplined investing to attain long term financial goals. Yet, human instinct naturally leans towards impatience. We want to obtain our goals right now!

Such a thought process can lead to detrimental investor behavior. Many individuals take on too much risk when the market is up and panic when the market is down. Perhaps such investor behavior helps explain JP Morgan’s September 30th, 2021 Guide to the Markets. Their slide entitled “Diversification and the average investor” shows that the 20-year annualized return of the S&P 500 as 7.5%. In the same period, the average investor achieves a measly 2.9% rate of return.

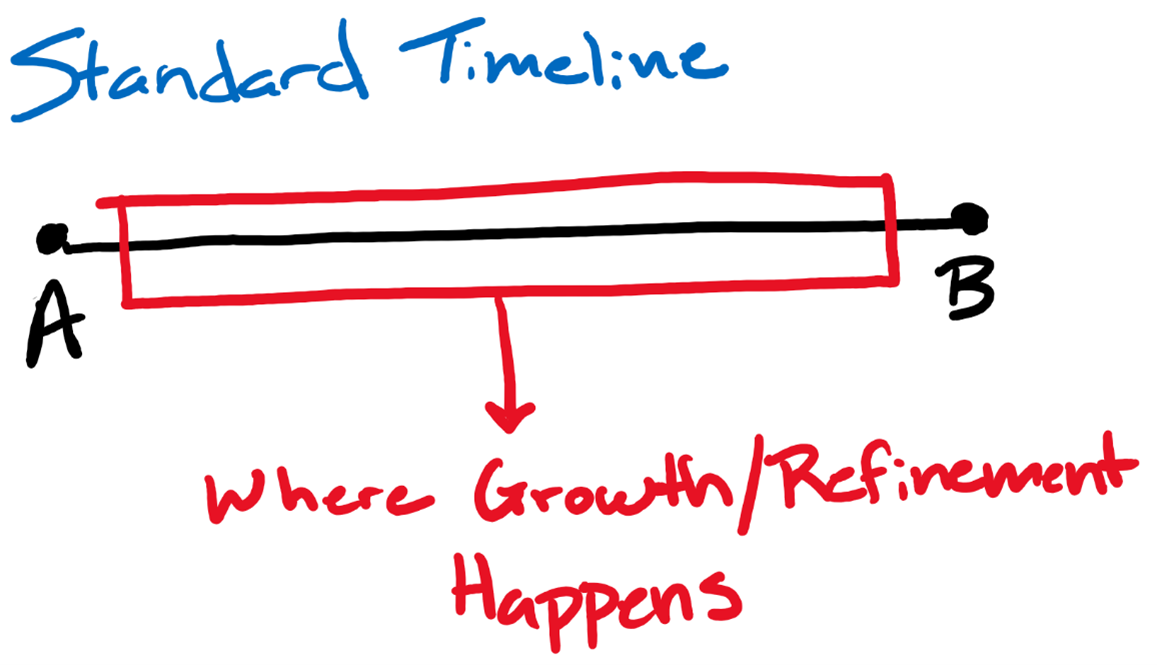

I think these results can in part be explained by investors attempting to apply the growth hacker timeline to investing. But very few people successfully hack the market and those who do are more likely lucky than skillful. With this principle in mind, the next question is why do people feel the need to apply a growth hacker mindset to their investments? I believe the answer can be found below:

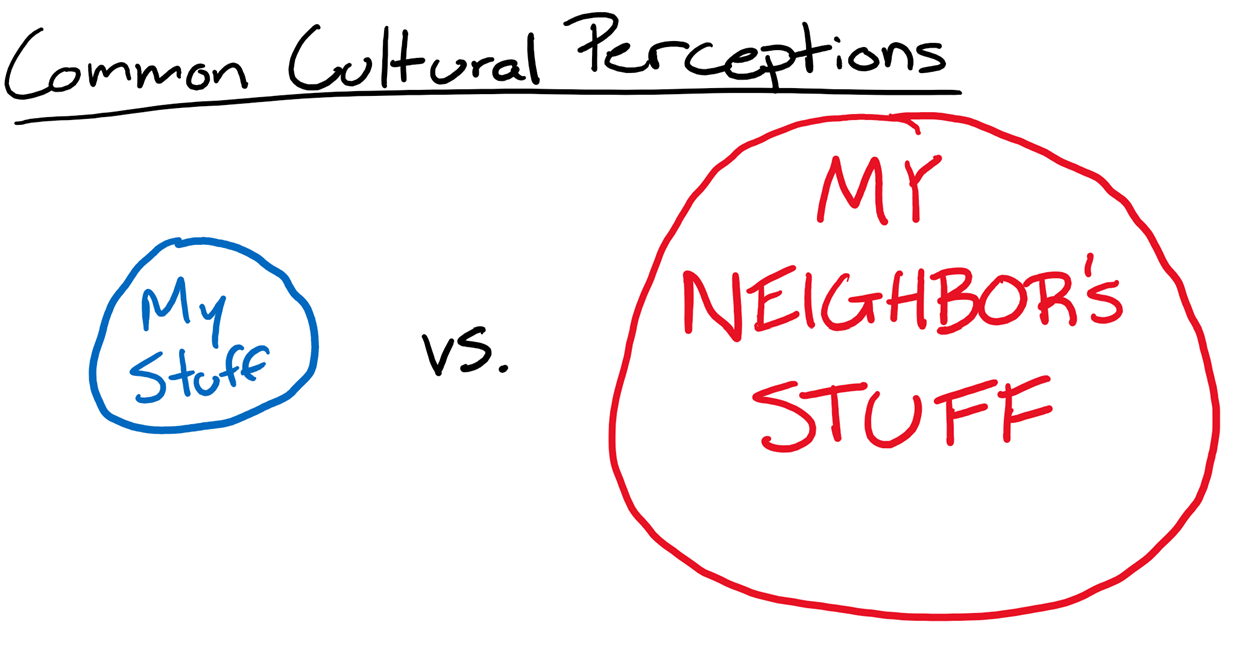

As a species, many of us live in a state of comparison. How does our life compare to our neighbors, our extended family, or our friends? When the answer is unsatisfying, individuals make impromptu purchases that don’t align with their values or take unnecessary investment risks. That statement only pertains to the financial havoc wreaked by comparing ourselves to others. Such a state of mind can also produce a feeling of inadequacy and detract from overall wellbeing.

Lifestyle comparison is a systemic issue perverting the American psyche. I believe three antidotes exist:

- Gratitude– Life is most certainly difficult. But even on the hardest days, strive to find something to be grateful for even if it’s just the sun shining or the rain falling. Through gratitude we can find contentedness in our current situation.

- Know your unique values– I often ask myself, “what do I care about most or what are my non-negotiables?” This brings my focus from what other people have and I don’t to what I care about and what I see as extraneous.

- Don’t solely focus on achievement– It’s great to have a goal to aim for. But don’t focus so much on the goal that you can’t enjoy the journey along the way. Don’t fall victim to comparing your achievements to someone else’s. We are all on our own path and must work to enjoy the trail while we walk towards our desired destination.

These are better medicine than trying to growth hack our way through life.

Do you want to experience financial well-being and start financially thriving? Book a financial well-being lab session on my calendar here:

The only cost is your time and there is no obligation.

Alex is a registered representative and investment advisor representative of Securian Financial Services, Inc. 3866521/DOFU 10-2021