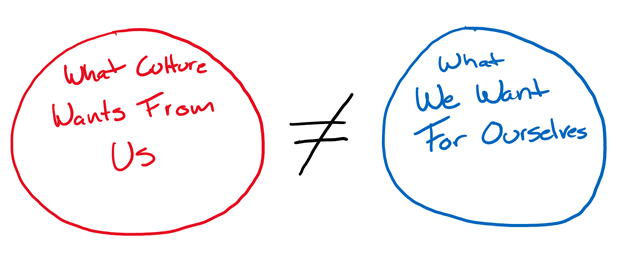

Cultural Norms vs. Personal Goals

Cultural norms vs. personal goals

People sometimes hinder their well-being by conforming to cultural norms…

Such a tension often arises in my work with clients within my financial advisory business. When I have conversations with clients surrounding their goals, they often regurgitate some form of cultural norm like, “we want to retire at 65” or they aren’t sure if they can safely share their goals because it’s outside of what our society expects. Such conformity detracts from a sense of well-being because people work towards objectives that they don’t personally value. What culture wants from us and what we want for ourselves are not equal.

But we don’t have to listen to our culture. We don’t need to live up to the norm. It doesn’t matter what your neighbor Joe, your Aunt Betty, or your old college roommate Frank thinks of your life goals. With the power vested in me as a podcaster, newly minted internet blogger, and financial advisor, I give you permission to choose your own life objectives. I hope you caught onto my sarcasm because who really gives you this permission is you. You need to let yourself choose your goals and then, you get to design your life to achieve these goals.

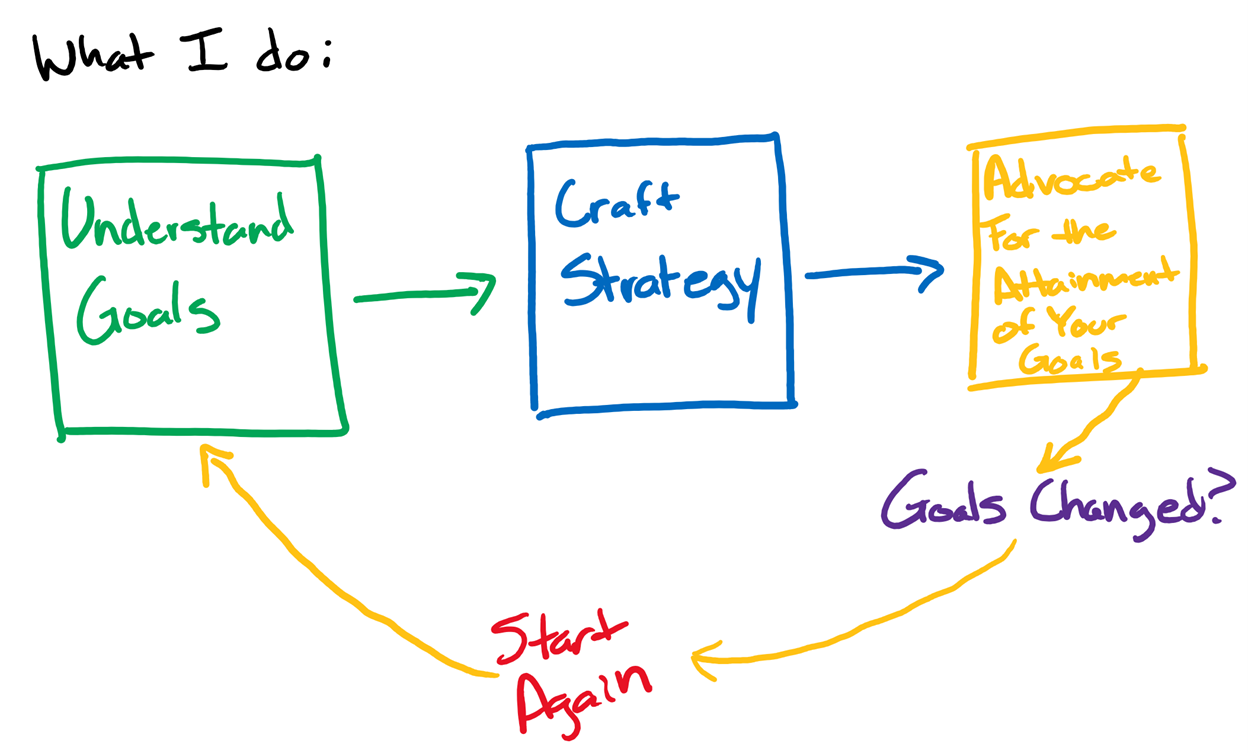

My role as a financial advisor is to do my very best to converse with my clients about their goals without judgement or bias. It’s my duty to my client to understand your objectives as well as I possibly can and craft a strategy to achieve these goals. It’s also my duty to fiercely advocate for your articulated goals if you get off track unless your objectives have shifted.

The other specter that holds people back from articulating their goals is being wrong. No one can predict the future, so there’s a good chance your goals could change, evolve, or straight up be different from what “future you” wants. Such a sentiment is normal, and at some point, you are going to be wrong about something and that’s okay. My college football coach always used to say, “Sometimes in life, just like in football, you have to call an audible.”

Just like Tom Brady reading the defense and changing the play, one of my roles as a financial advisor is to know your goals and adjust your strategy if warranted. When, not if, your goals change, we work together to make the necessary adjustments.

The final thing that keeps people from sharing their goals with me is they think they need to be financial in nature. They think they need to say something like retire at age 65 with $3 million. But my argument is most if not all life goals, have some financial componenet. Whether you want to start a family, travel the globe, or start a business; they all have a financial componenet. People often don’t want money, but want what money can do for them. Therefore, it’s my role to figure out how to leverage money to work towards your goals.

I believe that once we liberate ourselves from cultural constraints and start to pursue our own goals, it is a positive contributor to our sense of well-being. Unearthing an individual’s goals is at the heart of what I do as a financial advisor and one of the reasons that I believe my work is vital to one’s well-being.

Do you want to experience financial well-being and start financially thriving? Book a financial well-being lab session on my calendar here:

The only cost is your time and there is no obligation.

Alex is a registered representative and investment advisor representative of Securian Financial Services, Inc. 3872193/DOFU 10-2021