Navigating a Volatile Market

Exxon vs. Zoom Scenario Summarizes Historical Volatility

Q2 2022 kicked off with an inverted yield Curve, mortgage rates at 4.67%, global sanctions raining upon Russia, the 3rd and 8th largest cities in the world entering a mandatory lockdown, and the U.S. average price per gallon was at an attractive $4.30.

Three months later and we have officially entered Bear Market territory, have only 6 weeks global supply wheat supply remaining, China controls roughly 90% of the world’s antibiotic and semiconductor supply, and Elon Musk is sharing in Zoom calls with his new employees.

Over the past 12 months, investors have experienced both the pinnacles of euphoria as well as the rockiest of bottoms in broader financial markets.

For those of you that were heavily weighted in individual growth stock positions – you were Kawhi hitting the buzzer beater leading the Toronto Raptors to their first NBA title in 2021. Now you feel more like Bill Buckner in the 1986 World Series as the ball runs between your legs.

As I write this piece, we are officially in bear market territory. I mind you that this is where the players are separated from the pretenders and generational wealth is generated. The key is to be broadly diversified which gives you automatic exposure to both the winners and the laggers in the broader economy, however your winners will pick up the slack from your losers over the long run.

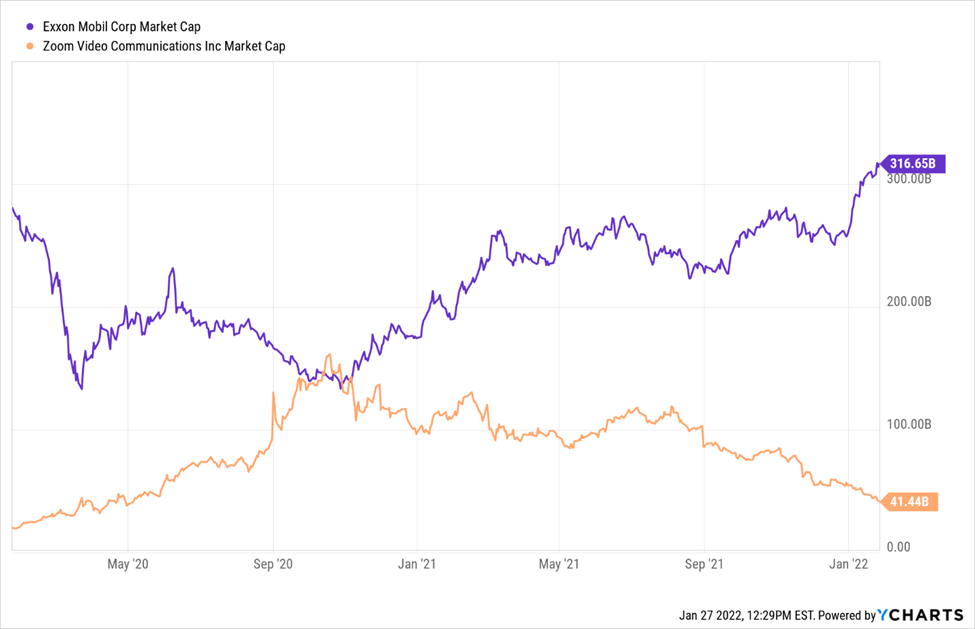

As illustrated above, in Q4 2020, ZM (orange line) had a market capitalization (indicator of public opinion and companies outstanding shares) that was 3-times the size of XOM (purple line). This was at the peak of COVID lockdowns, we had growth companies trading at all-time highs, and the National Average gasoline price was sitting at $2.18 per gallon.

Fast forward to today where XOM has a market capitalization that is 11x the size of ZM, oil is trading above $100 per barrel, and the national average for gasoline is above $5.00 per gallon.

On April 20, 2020 oil futures traded at negative prices and suppliers literally paid buyers to take delivery of these contracts due to diminishing consumer demand and storage constraints. As of today, the energy sector would be + 18.74% YTD and the technology sector down (27.05%) YTD .

This is a result of:

A massive tech selloff due to Fed’s rate intervention which is necessary to combat the spiking costs of goods and services that is been felt through all facets of the global economy.

Shanghai and Beijing (two of the top 10 most populous cities on the globe) have been on total lockdown throughout the entirety of the second quarter and are still in their reopening phases. Resulting in less global economic production.

We declared economic warfare with Russia and issued sanctions that in turn removed 9% of the global supply of oil from the equation. The consequences being diminishing U.S. energy supplier capabilities alongside increasing consumer demand and soaring fuel prices due to inflation reaching its highest level since 1981.

If you were able to accurately forecast the economy over the past 24 months, earn an income that supports your standard of living, and maintain healthy lifestyle at home- Congratulations- you should run for office. Why not? There is no stopping you. Not to mention, you’ll be able to forecast market behavior in all the years to come!

For the rest of us – a diversified portfolio and a discipline buying strategy will have to do!

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

Kirk is a registered representative and investment advisor representative of Securian Financial Services, Inc. Securities and investment advisory services offered through Securian Financial Services, Inc. Member FINRA/SIPC. North Star Consultants of Texas is independently owned and operated. 2801 Via Fortuna, suite 450 | Austin, TX 78746. 4837063/DOFU 7-2022

- April 7, 2022 mortgage rates = 4.67% https://www.cnn.com/2022/04/07/homes/us-mortgage-rates-april-7/index.html

- April 2022 U.S. Avg Gas Price = $4.30 https://thelistwire.usatoday.com/lists/average-gas-price-in-april-for-united-states/

- Bear Market territory definition (June 13, 2022): https://www.investopedia.com/terms/b/bearmarket.asp

- China controls roughly 90% of the world’s antibiotic and semiconductor supply stat (April 28, 2021) https://www.marketwatch.com/story/china-has-cornered-the-market-on-antibiotics-so-the-u-s-must-rebuild-its-manufacturing-capacity-11619640612

- Kawhi Leonard buzzer beater: https://www.youtube.com/watch?v=CROx4XvLJTk

- Bill Bucker video: https://www.youtube.com/watch?v=18caPNisP2U

- Zoom Ticker: https://finance.yahoo.com/quote/ZM?p=ZM&.tsrc=fin-srch

- Exxon Ticker: https://finance.yahoo.com/quote/XOM?p=XOM&.tsrc=fin-srch

- 2020 National Average gas price stat: https://www.usatoday.com/story/money/2021/12/08/gas-price-drop-expected-2022/6430657001/

- April 20, 2020 negative oil stat: https://www.bloomberg.com/news/articles/2020-04-20/negative-prices-for-oil-here-s-what-that-means-quicktake

- Energy Sector and Technology stat: https://csimarket.com/screening/performance.php?days=ytd&pageS=1

- Shanghai and Beijing lockdown info: https://www.republicworld.com/world-news/china/china-beijing-shanghai-return-to-lockdown-as-latest-covid-surge-ferocious-and-explosive-articleshow.html

- Inflation reaching its highest number since 1981 stat: https://www.usinflationcalculator.com/inflation/historical-inflation-rates/