Would you rather have Warren Buffet’s investment skill or his time spent investing?

I’m positive that almost everyone would choose his skill and yet I’d argue that we should instead focus on his time spent investing.

Let me explain.

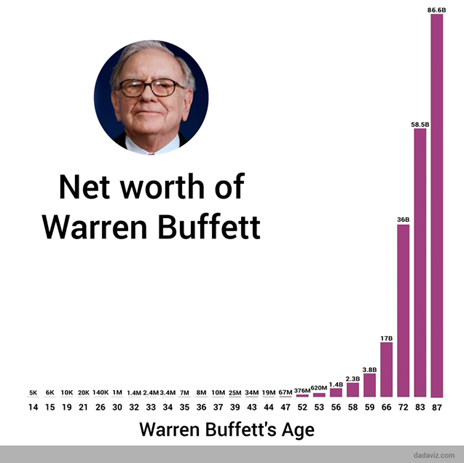

Buffet’s lifetime annual return of 20% per year is immensely impressive.1 Thousands of books, podcasts, and TikTok videos have been dedicated towards explaining how Buffet achieved that return. How does he pick the “right” stocks? How can I pick the “right” stocks or time the market to get rich?

But what if the best decision that Buffet ever made wasn’t the stocks he chose, but that he started investing at 11 years old and continued investing through his 91st birthday? 2

Now 91, Buffet is worth around $100 billion.1 Would it surprise you to learn that $99 billion of his wealth came after his 50th birthday?3

That is the power of compound interest if you let it run for long periods of time. Our brains have a hard time truly grasping that a 10% return for Buffet today results in an increase in $10 billion of wealth, but that is compound interest at the tail-end at work.

To further illustrate the value of simply time spent investing, let’s pretend Buffet was more like a normal person who spent his early life exploring his passions, traveling the world, and buying cars over his budget.

Let’s say by age 30 he began investing seriously by putting $500/mo away and he was still able to achieve those incredible returns of 20% per year. (Remember past performance is no guarantee of future results.) Let’s also say that he stopped investing and moved his money to cash at age 60 to protect it and live out his days playing golf and laying by the ocean. What would his net worth be today? Not $100 billion. It would be slightly over $12 million.5,6

Let’s also consider a hypothetical Warren Buffet who was less skilled of an investor but understood the wisdom of time spent investing. Let’s say that he too saved $500/mo of his money, but unlike the last example, he did nothing fancy and simply invested in an index that earned the average US stock market return of 10%. Crucially he did this for that same amount of time – 80 years. What would his net worth be today? Around $178 million.5,7

So let me ask you, what lesson of Buffet’s would we be wise to adopt?

Should we spend thousands of hours of our lives reading charts, studying books, and listening to CNBC to hopefully be the next Warren buffet, and more than likely, be one of the millions of investors who underperform the market by trying to beat it.4

Or should we simply commit to investing in a diversified group of companies from around the world, starting early, investing consistently throughout our lives, and staying invested well into our retirements?

One path requires thousands of hours of stress and, ultimately, good luck. The other requires skills completely in our control – patience, diligence, and steadfastness. I’d argue the latter gives us both a better chance at financial success and gives us back our time to focus on our relationships, careers, and passions. That seems like a pretty good deal to me.

Neither asset allocation nor diversification guarantee against loss. They are methods used to manage risk.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

4901720 DOFU 8/2022

- Bloomberg.com, Bloomberg, https://www.bloomberg.com/billionaires/profiles/warren-e-buffett/.

- Jr., Tom Huddleston. “How Warren Buffett Made His Billions and Became the ‘Oracle of Omaha’.” CNBC, CNBC, 30 Aug. 2020, https://www.cnbc.com/2020/08/30/how-warren-buffett-made-billions-became-oracle-of-omaha.html.

- Housel, Morgan. “Here’s the Most Overlooked Fact about How Warren Buffett Amassed His Fortune, Says Money Expert.” CNBC, CNBC, 8 Sept. 2020, https://www.cnbc.com/2020/09/08/billionaire-warren-buffett-most-overlooked-fact-about-how-he-got-so-rich.html.

- Coleman, Murray. “Dalbar QAIB 2022: Investors Are Still Their Own Worst Enemies.” Index Fund Advisors, Inc. – Fiduciary Wealth Services, Dimensional Funds, Index Fund Advisors, Inc., 4 Apr. 2022, https://www.ifa.com/articles/dalbar_2016_qaib_investors_still_their_worst_enemy.

- https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

- The calculation of slightly over $12 million was produced on the Investor.gov website’s Compound Interest Calculator: Initial Investment of $0.00, Monthly Contribution of $500.00, Length of Time of 30 Years, Estimated Interest Rate of 20%, Interest rate variance range of 0%, Compounded Daily.

- The calculation of around $178 million was produced on the Investor.gov website’s Compound Interest Calculator: Initial Investment of $0.00, Monthly Contribution of $500.00, Length of Time of 80 Years, Estimated Interest Rate of 10%, Interest rate variance range of 0%, Compounded Daily.