Midterm Elections – Don’t Let Politics Affect Your Wallet

Ahhh it’s that time of year again… the leaves are turning, pumpkin spice lattes are back, and our TV’s are blanketed in black and white ads with narrators telling us if “so and so politician” gets elected the economy and our country is going to explode in a million pieces.

Don’t you just love the fall?

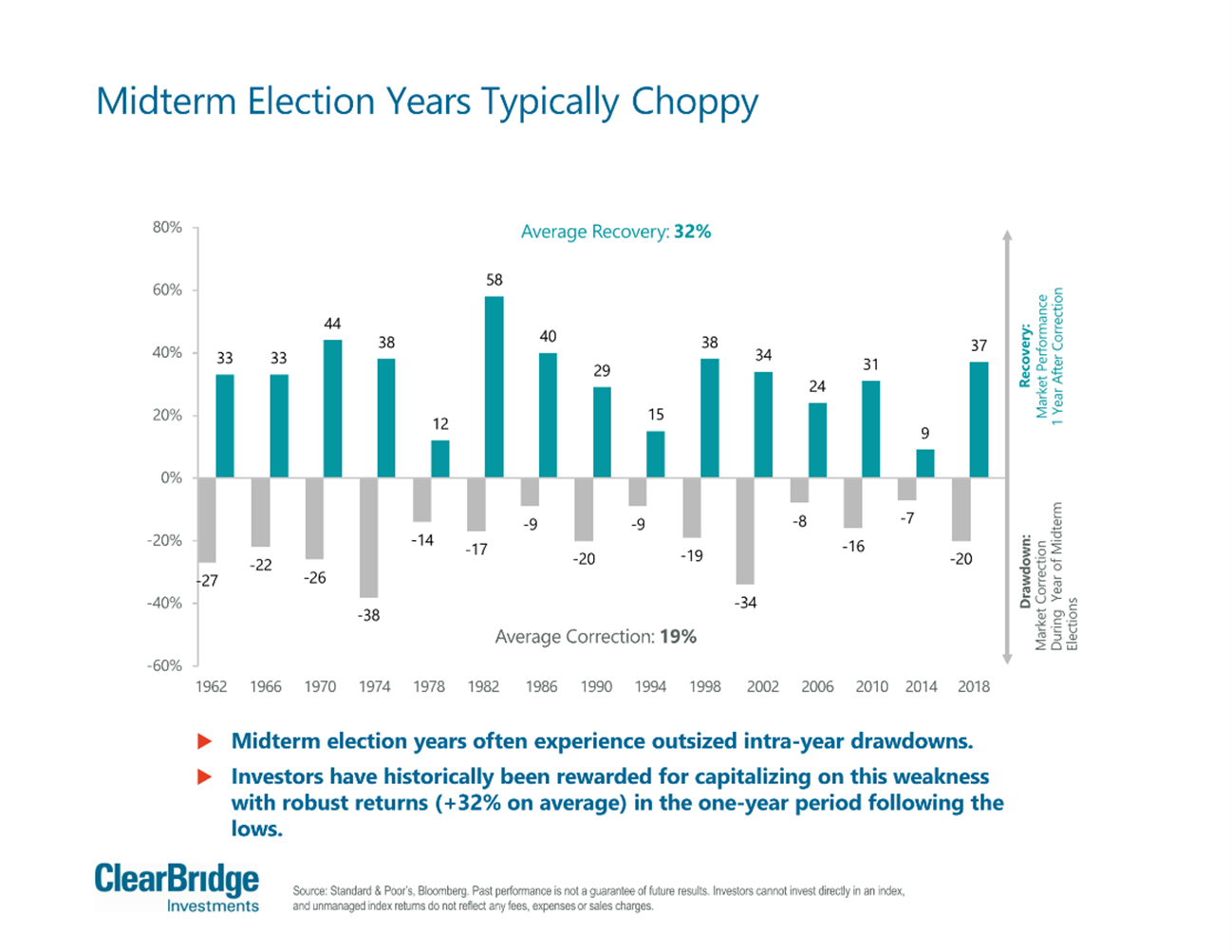

No wonder why the market has historically experienced substantial volatility during midterm election years. In fact, since 1950 the market has dropped an average of 19% at some point throughout an election year (see figure 2).

Elections are unsettling. We are bombarded with those ads telling us the world is going to end. Tax laws may change. Government policy may look completely different. Subsidies may come or may be taken away.

So the markets have historically mirrored that anxiety with lots of short-term volatility.

But what has happened after the elections is interesting.

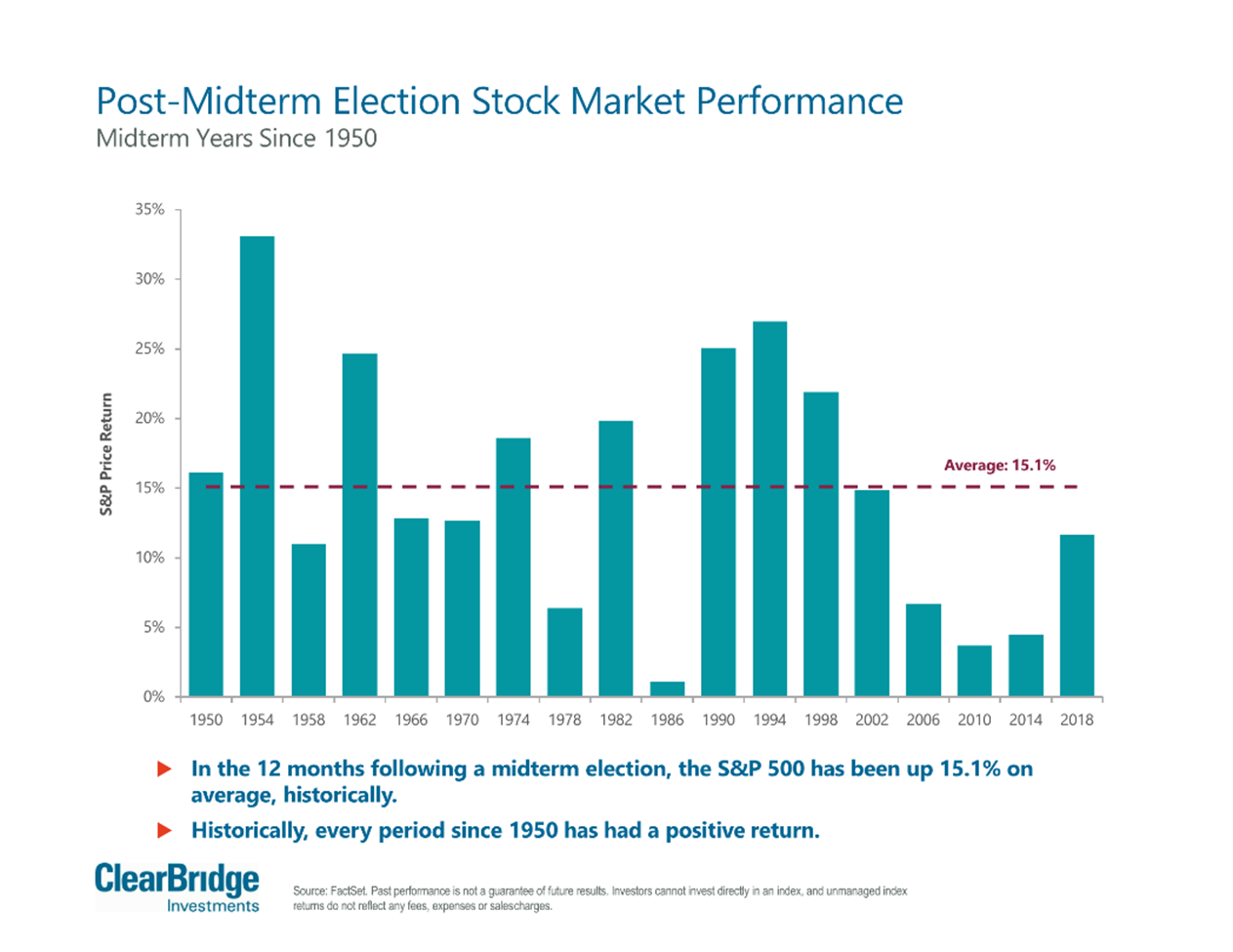

Since 1950, every year following a midterm has resulted in a positive return. On average, the market was up 15.1% in the year following a midterm election (see figure 1).

As we always disclose, past performance is no indication of future results. The point isn’t to expect a positive return, but that what we’ve seen so far this year is actually the norm, not the exception.

Often our feelings around what to do with our investments in response to current events contradict what has historically been a good thing to do with our money. Midterm election years are choppy and chaotic, but we can be rewarded after the election once the country and markets regain some stability.

We’d be wise to accept that volatility and uncertainty are the norm, and that we can’t predict when the markets may go up or down. Instead, we may simply consider dollar-cost averaging purchases of a diversified group of the most recognizable companies in the world. And more importantly, holding onto them through periods of volatility.

Statistics like these are why your financial advisor may seem abnormally calm in chaotic times. We’ve been here before and we’ll be here again.

Figure 1

Figure 2

Neither asset allocation nor diversification guarantee against loss. They are methods used to manage risk.

Dollar Cost Averaging does not assure a profit and does not protect against loss in declining markets. Also, since such a program involves regular investment purchases regardless of fluctuating price levels of the investment, consider your financial ability to continue purchases through periods of low price levels.

Get new ideas in your inbox once a month

Sign-up to receive a small dose of a financial concept monthly.

Join my email community

The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. Please note an investor cannot invest directly in an index.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. 5007481/DOFU 11-2022