How Some Online Trading Platforms are Nudging us Towards Bad Financial Habits

“Online trading platforms have democratized investing.” Sure, and fast food has democratized food. That doesn’t mean that it’s been good for our health.

Let’s go over how some of these commission-free trading platforms make money and the difference between a speculator and an investor.

A speculator gambles that a stock will go up in value over the short run because of momentum, a positive news story, better than expected profits or a hunch that they’re about to release an innovative new product. Although they may disagree, speculators success mostly comes down to good luck.

Although past performance is no guarantee of future results, investors thoughtfully put their money into strategies that have historically have been sustainable and reliable over the long run. This usually means investing in a broad range of well-established companies from many different industries with name recognition, sound business models, track record of profits, and innovative products. The simplest ways investors do this is through diversified stock mutual funds or index funds. The success of an investor relies on their patience, diligence, and steadfastness.

So how do online trading platforms fit into this?

Some trading platform’s business models are based on selling users orders (their stock or option trades) to “market makers” who then execute these trades. The problem here? They’re incentivized to make their apps as addictive as possible to keep users on the platform speculating. No wonder their apps feels like many social media apps, they’re using many of the same psychological triggers to keep users hooked. The result? Some of the users of these apps report using them as often as Instagram or WhatsApp.

So why is this worrisome?

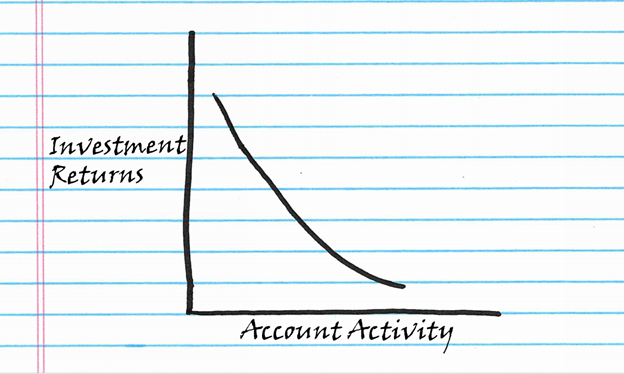

According to studies done by UC Berkely and Davis professors, the more trades that are made in a portfolio, the lower the returns. One’s real-world returns, and the likelihood they can fund their life’s goals, come down to being patient and investing for the long-term. Some online trading apps nudge users to behave in the opposite way, pushing them to think short-term.

This isn’t to say speculating is necessarily a bad thing in small doses, it’s fun in the same way going to a casino is fun. The problem is when we confuse investing and speculating as the same thing.

A prudent person goes to the casino with a $100 limit, once they’ve lost that they leave. They would never think to liquidate their 401(k) or savings to gamble.

Yet this happens all the time in our portfolios when we blur the lines between our long-term investments and speculating.

To achieve our long-term goals, we need to be able to differentiate our investments from speculation. Our investments should be thoughtful, diversified, and left mostly untouched for long-periods of time. That can never be confused with the next hot cryptocurrency or stock these apps are nudging us to buy.

Sources

The Latest Trend in Mobile Gaming: Stock-Trading Apps

Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors

Neither asset allocation nor diversification guarantee against loss. They are methods used to manage risk.

Cal is a registered representative and investment advisor representative of Securian Financial Services, Inc. 3717081/DOFU 9-2021