4 powerful tips for paying off student loans while juggling other priorities

Young professionals today are increasingly juggling both student loan debt and other competing financial priorities.

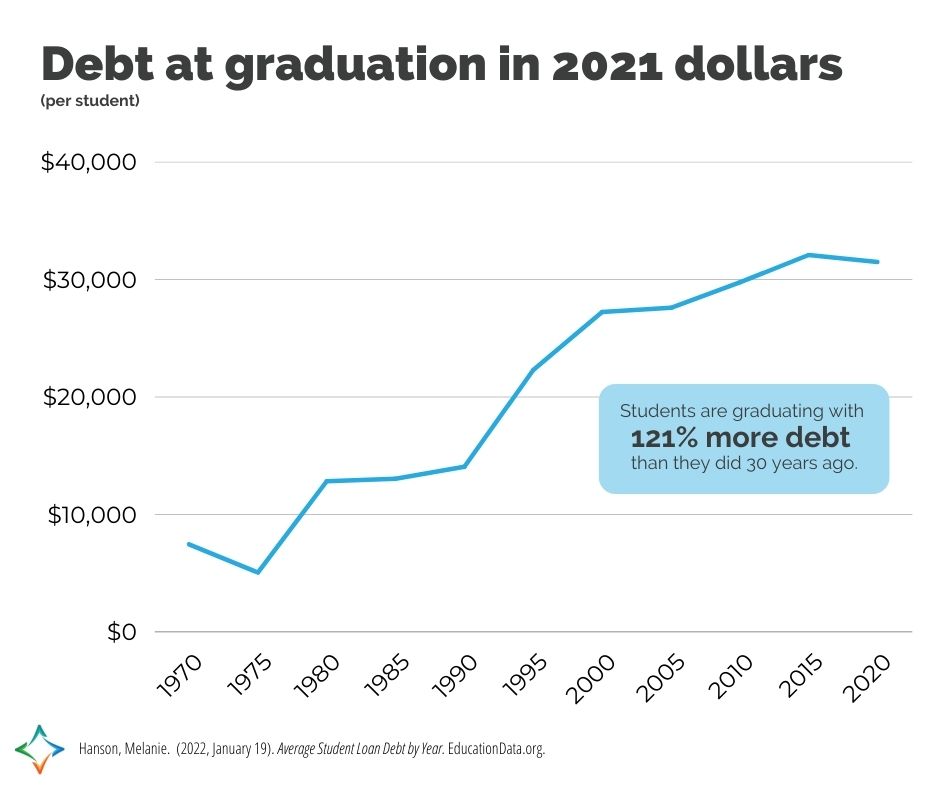

Millennials today are saddled with more student loan debt than previous generations.1 The average millennial owes $126,993, and nearly one in 10 say it will take them over 10 years to pay off their non-mortgage debt.1 6% of respondents said they may never pay it off.1

millennials predict they will still be paying off non-mortgage debt in 10 years.

With the rising cost of tuition and other education-related expenses, it’s more common than not for graduates to leave school with at least a small amount of borrowed money to pay back.

For borrowers ages 20-30, the average monthly student loan payment is a whopping $4602—or over $5,520 per year. Those who either heavily relied on borrowed funds to get through school or who are dealing with debt from both undergrad and grad school can feel particularly burdened with the prospect of paying off their debts.

An overall lack of financial literacy across the country can explain why the majority of millennials feel less than equipped to deal with their debt. Many adults graduate both high school and college without taking a proper course in financial literacy. In fact, only eight states guarantee standalone Personal Finance courses for all high schoolers—what the nonprofit Next Gen Personal Finance defines as the Gold Standard.3

The lack of formal education then causes adults to begin their careers with little more than self-taught or learned knowledge of how to manage their money.

While this is an issue on its own, it can be particularly problematic when young professionals are dealing with juggling their student loans amidst their other financial priorities.

Life doesn’t stop while paying off student loans—those dealing with debts may also be saving for a wedding, a down payment on a home, going back to school, preparing to welcome a child, getting a head start on retirement savings, and much more.

It can seem like your financial priorities are always going head to head or that it’s impossible to stretch your paycheck to fit all your priorities. However, it is possible to get to a point where you’re making actual progress, rather than just treading water:

1. Cover the basics of your financial strategy.

Even if you feel as though you don’t have any room to contribute money to things other than your essentials and your student loans, it’s important to cover the basics.

As soon as you’re able, start contributing to a retirement fund.

If your employer offers a retirement plan such as a 401(k) or 403(b) that you can opt into, start contributing to this right away and automate your contributions if possible. If your employer offers a match, it’s wise to contribute at least that much. Even putting away just a little each month starting when you’re 22- or 23-year-old can make an incredible difference 30 or 40 years down the line.

Next, start an emergency savings fund.

Arguably, when you have the least amount of money is when you’ll likely need an emergency savings fund the most. If your car needs an unexpected repair or you unexpectedly get laid off, this fund can help you both cover the cost and prevent you from taking on further debt.

To start, determine your average monthly expenses, including both regular and discretionary expenses. Then, multiply that number by the number of months you plan to save for—the recommended number is three to six months. Once you have your number, get started on saving.

While saving up to that number likely won’t be an overnight venture, having even some money saved up for unexpected expenses can help to not totally derail your financial picture should you need to use it.

2. Prioritize your debts according to interest rate.

Once you’ve covered the basics, it’s time to think critically about how to take control and pay down your debt. If you have multiple forms of debt, such as multiple student loans, car loans, or credit card debt, it can be helpful to organize these according to which has the highest interest rate. Prioritizing paying on the highest-interest debts first can save you money by allowing you to pay less in interest charges overall.

3. Develop a simple strategy.

Now that you know the order in which you’ll tackle your debts, create a simple strategy to follow through on. Develop a few basic guidelines for yourself:

- Always pay on time.

- Always pay at least the minimum payment.

Vowing to never miss a payment can save you money in late fees. The easiest way to do this? Automate your payments, if possible. While it may require reminders set for yourself near the due dates of your monthly payments, automating your payments is the most foolproof way to ensure your payment is received on time, without fail.

Another rule you could implement is to be intentional with any money received outside of your regular paycheck. For example, putting any bonuses, gift money, tax refunds, etc. toward your student loan debt is a great habit to get into.

While it may not seem like the most rewarding way to spend that money initially, if it could shave off even an extra month or two of minimum payments down the road, it will be worthwhile.

On the other hand, if you have another big financial goal that you’re working toward simultaneously while paying off your loans, you could decide to put this money toward that goal instead to give it a boost. It all comes down to what works best for you.

4. Consider other options if necessary.

If you feel as though you’re struggling to just stay afloat with your loan payments, consider a different repayment plan or refinancing options if you can.

If you find that your payments are not affordable for your income, you may want to consider other repayment options that provide more flexibility, such as income-driven repayment plans. Depending on your occupation, you may be eligible for other repayment options as well.

Refinancing is when another bank or lender offers you a better interest rate for you to transfer the remaining balance due on your loan there. It could mean both a lower interest rate and lower monthly payments for you. If you have a good credit score and a high balance remaining on your loans, it may be a process that’s worth looking into.

Student loan repayment should fit into a long-term financial wellness strategy

While paying off your loans should without question be a priority, it also shouldn’t prevent you from living your life and spending or saving money on other things. Sticking to a comprehensive budget can be a lifesaver for diligently monitoring where your money is going at this point, especially if things are tight.

A financial professional can also be a great resource to let you know your options, determine how to balance multiple goals at once, and keep your priorities in check.

Dealing with student loan debt in a timely manner can be a stressful experience where very often there appears to be no end in sight. However, it’s important to keep in mind that with the right strategy and mindset in place, there will be a day when you see the magical number “$0.00” next to “balance due” on your loans. Keep your head down, focus on your priorities, and seek additional help or resources if you need to. You’re not in this alone!

Interested in discussing this topic further with a financial professional? With 160+ associates licensed in every state, there is likely a North Star financial professional near you.

Get more financial wellness tips in your inbox!

1Dunaway-Seale, Jaime. Millennials Are More Than $100,000 in Debt. (2022, July). Real Estate Witch.

2Hanson, Melanie. Average Student Loan Payment. (2022, March). EducationData.org.

3NGPF’s 2022 State of Financial Education Report. (2022). Retrieved September 13, 2022.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.